ETH Price Analysis: Trapped In Descending Channel, But $3K Remains A Possibility

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

ETH Price Analysis: Trapped in Descending Channel, but $3K Remains a Possibility

The Ethereum (ETH) price continues to grapple with bearish pressure, currently trapped within a descending channel pattern. While the immediate outlook appears bleak, analysts are pointing to potential catalysts that could propel ETH towards the coveted $3,000 mark. Understanding the current market dynamics and potential future price movements is crucial for both seasoned and novice investors.

Current Market Situation: A Technical Perspective

The ETH/USD pair has been consolidating within a descending channel for several weeks, a clear sign of bearish momentum. This pattern indicates a sustained period of selling pressure, with lower highs and lower lows. Key support levels are being tested repeatedly, leading to heightened volatility. Technical indicators like the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are showing mixed signals, suggesting a battle between buyers and sellers is underway.

Factors Affecting ETH Price:

Several factors contribute to the current price action:

- Macroeconomic Uncertainty: Global economic headwinds, including inflation concerns and rising interest rates, continue to impact the broader cryptocurrency market, creating uncertainty and risk aversion among investors.

- Regulatory Scrutiny: Ongoing regulatory scrutiny of the cryptocurrency industry adds another layer of uncertainty. News and developments in this space directly influence investor sentiment and, consequently, price action.

- Network Activity: Ethereum's network activity, including transaction volume and gas fees, remains relatively strong, suggesting underlying demand for the network's services. This could potentially act as a floor for ETH price.

- Development Updates: Continued development and upgrades on the Ethereum network, such as the progress towards sharding, could positively impact long-term price prospects. Positive news on this front often boosts investor confidence.

The Potential for a $3,000 ETH Price:

Despite the current bearish technical setup, the possibility of ETH reaching $3,000 remains on the table. Several scenarios could trigger a significant price upswing:

- Market Sentiment Shift: A positive shift in overall market sentiment, driven by positive macroeconomic news or regulatory clarity, could lead to a significant price surge across the crypto market, including ETH.

- Increased Institutional Adoption: Growing adoption of ETH by institutional investors could increase demand and push prices higher. Large-scale institutional buying often fuels significant price rallies.

- Technological Breakthroughs: Successful implementation of major upgrades to the Ethereum network could spark renewed investor interest and drive substantial price appreciation.

Trading Strategies and Risk Management:

Navigating the current market requires a cautious approach and well-defined risk management strategies. Traders should consider:

- Stop-Loss Orders: Implementing stop-loss orders to limit potential losses is crucial in a volatile market.

- Diversification: Diversifying your portfolio across different cryptocurrencies and asset classes helps mitigate risk.

- Fundamental Analysis: Supplementing technical analysis with fundamental analysis provides a more holistic view of the market.

Conclusion:

While ETH's price is currently confined within a descending channel, the potential for a rally towards $3,000 is not entirely ruled out. A combination of favorable macroeconomic conditions, increased institutional adoption, and successful technological developments could trigger a significant price upswing. However, traders need to remain vigilant, employ sound risk management techniques, and carefully analyze market dynamics before making any investment decisions. The cryptocurrency market remains highly volatile, and investors should proceed with caution.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on ETH Price Analysis: Trapped In Descending Channel, But $3K Remains A Possibility. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tiko Lenovos Ai Powered Emotional Companion A Look At Its Capabilities

Mar 04, 2025

Tiko Lenovos Ai Powered Emotional Companion A Look At Its Capabilities

Mar 04, 2025 -

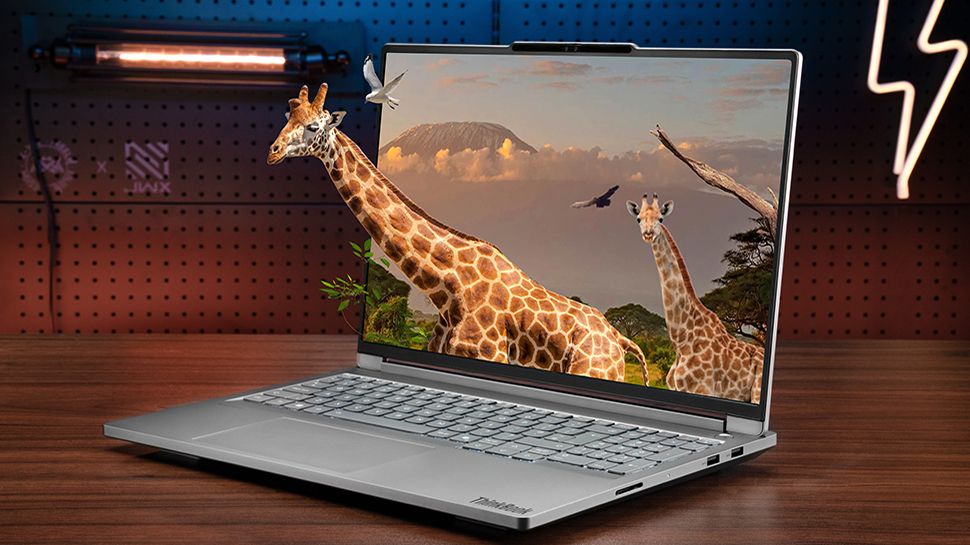

Glasses Free 3 D Laptop Lenovos Think Book 3 D Reviewed

Mar 04, 2025

Glasses Free 3 D Laptop Lenovos Think Book 3 D Reviewed

Mar 04, 2025 -

Barcelonas Mwc 2025 In Depth Analysis Of The Tech Showcases

Mar 04, 2025

Barcelonas Mwc 2025 In Depth Analysis Of The Tech Showcases

Mar 04, 2025 -

Essential Science Addressing Challenges In War Affected Areas

Mar 04, 2025

Essential Science Addressing Challenges In War Affected Areas

Mar 04, 2025 -

Best Speakers Headphones And Music Gear For 2024 A Comprehensive Guide

Mar 04, 2025

Best Speakers Headphones And Music Gear For 2024 A Comprehensive Guide

Mar 04, 2025