Ethereum (ETH) Plummets: Key Support Levels And Market Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum (ETH) Plummets: Key Support Levels and Market Analysis

Ethereum (ETH), the world's second-largest cryptocurrency by market capitalization, experienced a significant price drop today, sending shockwaves through the crypto market. This sudden plummet has left many investors wondering about the future of ETH and what key support levels to watch. This article delves into the market analysis surrounding this downturn, examining potential causes and exploring what the future might hold for Ethereum.

What Caused the Ethereum Price Drop?

The exact reasons behind today's ETH price drop are multifaceted and still being debated within the crypto community. However, several factors likely contributed to the downturn:

-

Overall Market Sentiment: A prevailing bearish sentiment across the broader cryptocurrency market has undoubtedly played a significant role. Bitcoin's recent price fluctuations often influence altcoins like Ethereum, creating a ripple effect.

-

Regulatory Uncertainty: Ongoing regulatory scrutiny of the cryptocurrency industry globally continues to exert pressure on prices. Concerns about stricter regulations and potential legal challenges contribute to investor hesitancy.

-

Macroeconomic Factors: Global macroeconomic conditions, including inflation rates and interest rate hikes, are impacting investor risk appetite. A flight to safety often leads to investors withdrawing from riskier assets, including cryptocurrencies.

-

Technical Analysis: Technical indicators, such as moving averages and relative strength index (RSI), may have suggested a potential correction for ETH, leading to sell-offs by some traders. A break below key support levels could trigger further downward pressure.

Key Support Levels to Watch:

Traders and investors are keenly observing several key support levels for ETH:

-

$1,800: This level represents a significant psychological support barrier. A break below this level could trigger further selling and lead to a more substantial price decline.

-

$1,600: A break below $1,600 would signal a more bearish outlook and could potentially lead to further downward momentum towards the next support level.

-

$1,400: This is a crucial long-term support level. A sustained break below $1,400 could suggest a more prolonged bear market for Ethereum.

Market Analysis and Future Outlook:

The current situation is undeniably challenging for Ethereum investors. However, it’s important to remember that the cryptocurrency market is inherently volatile. Past price drops have been followed by significant rebounds.

Several factors could influence the future price of ETH:

-

Ethereum's Development: Continued progress on Ethereum's scaling solutions, such as sharding, and the growing adoption of decentralized applications (dApps) on the Ethereum network remain positive long-term indicators.

-

Institutional Adoption: Increased institutional investment in ETH could provide strong support and drive future price appreciation.

-

Market Recovery: A broader market recovery in the cryptocurrency space could significantly impact Ethereum's price.

Conclusion:

The recent plummet in Ethereum's price presents a complex situation. While the current market sentiment is bearish, the long-term prospects for Ethereum remain positive, driven by its robust underlying technology and growing ecosystem. Investors should carefully monitor key support levels, keep abreast of market developments, and consider their risk tolerance before making any investment decisions. This analysis is for informational purposes only and should not be construed as financial advice. Always conduct your own thorough research before investing in cryptocurrencies.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum (ETH) Plummets: Key Support Levels And Market Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

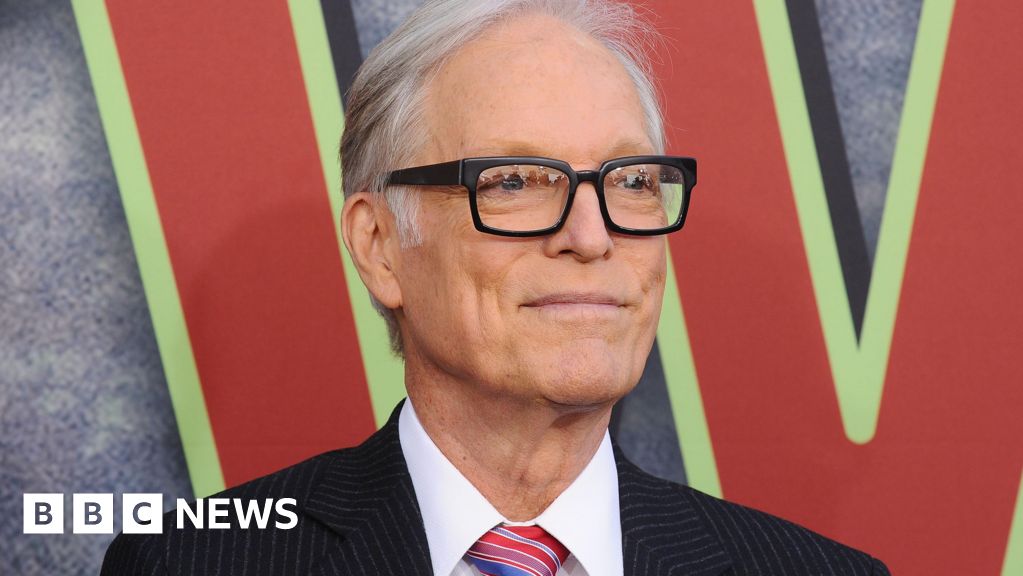

Hollywood Icon Richard Chamberlain Dies His Impact On Dr Kildare And Shogun

Mar 30, 2025

Hollywood Icon Richard Chamberlain Dies His Impact On Dr Kildare And Shogun

Mar 30, 2025 -

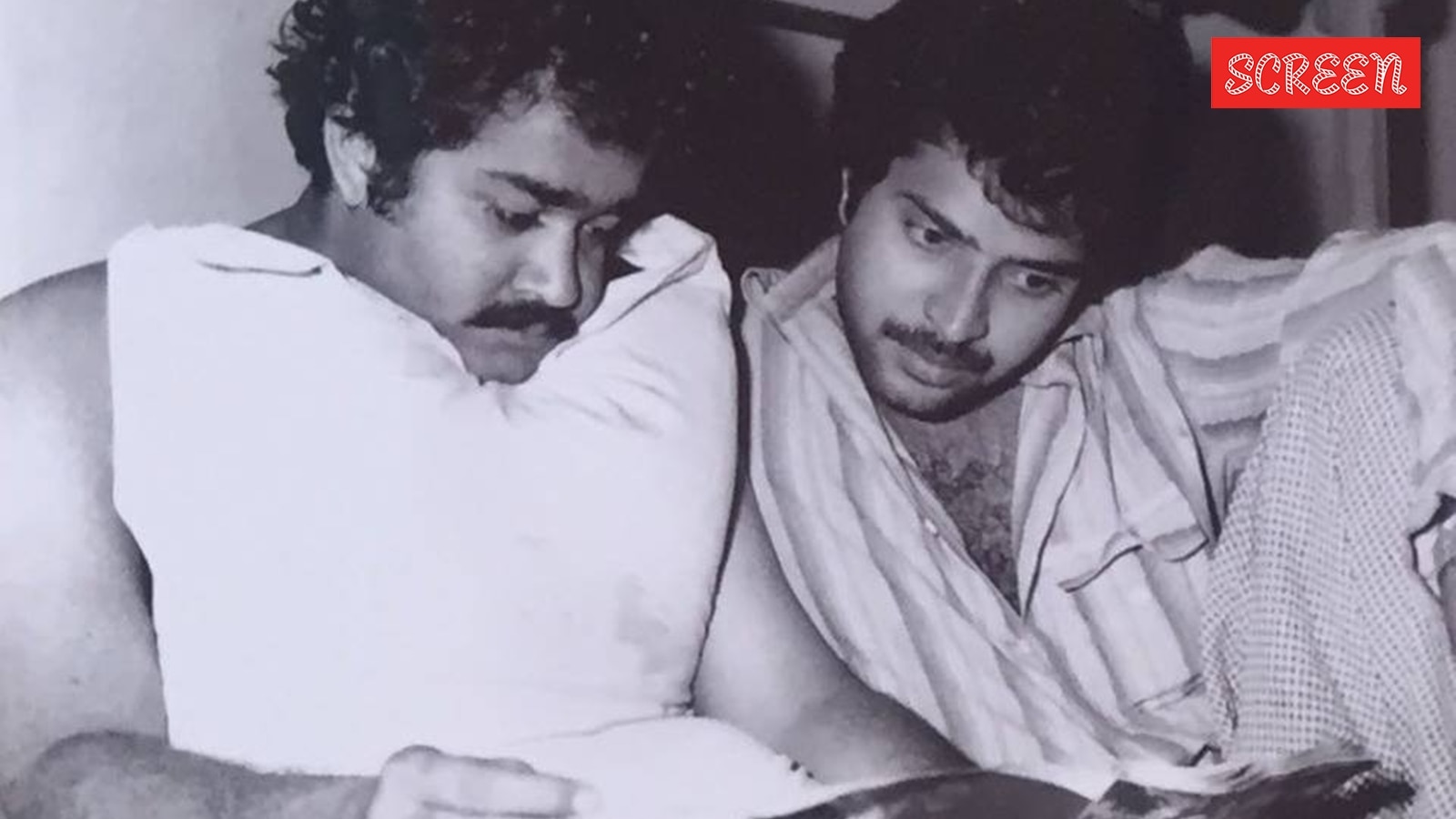

Mohanlals Unique Connection With Mammootty A Prithviraj Sukumaran Revelation

Mar 30, 2025

Mohanlals Unique Connection With Mammootty A Prithviraj Sukumaran Revelation

Mar 30, 2025 -

No Cable No Problem Free Live Stream New York Yankees Vs Milwaukee Brewers 3 29 25

Mar 30, 2025

No Cable No Problem Free Live Stream New York Yankees Vs Milwaukee Brewers 3 29 25

Mar 30, 2025 -

15 Million Funding Fuels Yutoris Ai Chief Of Staff Agents

Mar 30, 2025

15 Million Funding Fuels Yutoris Ai Chief Of Staff Agents

Mar 30, 2025 -

Leeds Uniteds Increased Danger Piroes Assessment

Mar 30, 2025

Leeds Uniteds Increased Danger Piroes Assessment

Mar 30, 2025