Ethereum Price Analysis: Could $3000 Be The Next Target?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Price Analysis: Could $3000 Be the Next Target?

Ethereum (ETH), the world's second-largest cryptocurrency by market capitalization, has shown significant price fluctuations recently. While volatility remains a key characteristic of the crypto market, analysts are increasingly debating whether a surge towards $3000 is on the horizon. This analysis delves into the current market conditions, technical indicators, and potential catalysts that could propel ETH to this ambitious price target.

Recent Price Action and Market Sentiment:

Ethereum's price has experienced a rollercoaster ride in the past few months. Following a period of consolidation, a recent bullish surge has reignited investor optimism. This upward momentum is fueled by several factors, including increasing institutional adoption, the growing popularity of decentralized finance (DeFi) applications built on the Ethereum network, and anticipation surrounding upcoming network upgrades. However, bearish sentiment persists among some analysts, citing concerns about macroeconomic factors and regulatory uncertainty.

Technical Analysis: Chart Patterns and Indicators:

Technical analysis provides valuable insights into potential price movements. Looking at the ETH/USD chart, several key indicators suggest a potential move towards $3000.

- Breaking Resistance Levels: Ethereum has successfully broken through several key resistance levels, suggesting strong buying pressure. The successful breach of these levels often signals further upward momentum.

- Relative Strength Index (RSI): The RSI, a momentum indicator, is currently showing signs of bullish strength, although it's crucial to monitor for signs of overbought conditions.

- Moving Averages: The convergence of various moving averages, such as the 50-day and 200-day moving averages, often indicates a strong trend. A bullish crossover of these averages could further support the $3000 price target.

Fundamental Factors Driving Potential Growth:

Beyond technical indicators, fundamental factors significantly influence Ethereum's price trajectory.

- Ethereum 2.0 and Upgrades: The ongoing development and rollout of Ethereum 2.0, with its transition to a proof-of-stake consensus mechanism, are expected to improve scalability, security, and energy efficiency. This upgrade is a major catalyst for potential price appreciation.

- DeFi Ecosystem Expansion: The explosive growth of the DeFi ecosystem on Ethereum continues to attract significant investment and user activity. As more DeFi applications are built and adopted, demand for ETH is likely to increase.

- NFT Market Boom: Non-Fungible Tokens (NFTs) built on the Ethereum blockchain have experienced a phenomenal surge in popularity. This burgeoning market contributes significantly to Ethereum's network usage and transaction fees, further bolstering its price.

- Institutional Adoption: Growing institutional interest in Ethereum, with large firms allocating capital to ETH, adds further weight to the bullish narrative.

Challenges and Risks:

Despite the positive outlook, several challenges could hinder Ethereum's ascent to $3000.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies poses a significant risk. Unfavorable regulations could dampen investor sentiment and negatively impact price.

- Market Volatility: The cryptocurrency market is inherently volatile. Unexpected market events or negative news could trigger sharp price corrections.

- Competition from Other Blockchains: Emerging competitors with faster transaction speeds and lower fees could potentially divert some activity away from Ethereum.

Conclusion: Potential for $3000, but Proceed with Caution:

While the confluence of technical and fundamental factors suggests a potential move towards $3000 for Ethereum, investors should proceed with caution. The cryptocurrency market is highly speculative, and significant price fluctuations are to be expected. It's crucial to conduct thorough research, diversify your portfolio, and only invest what you can afford to lose. The $3000 target remains a possibility, but it’s not a guaranteed outcome. Continuous monitoring of market conditions and technical indicators is essential for informed decision-making.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Price Analysis: Could $3000 Be The Next Target?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Get The Latest Ireland Vs West Indies Live Cricket Scores

May 26, 2025

Get The Latest Ireland Vs West Indies Live Cricket Scores

May 26, 2025 -

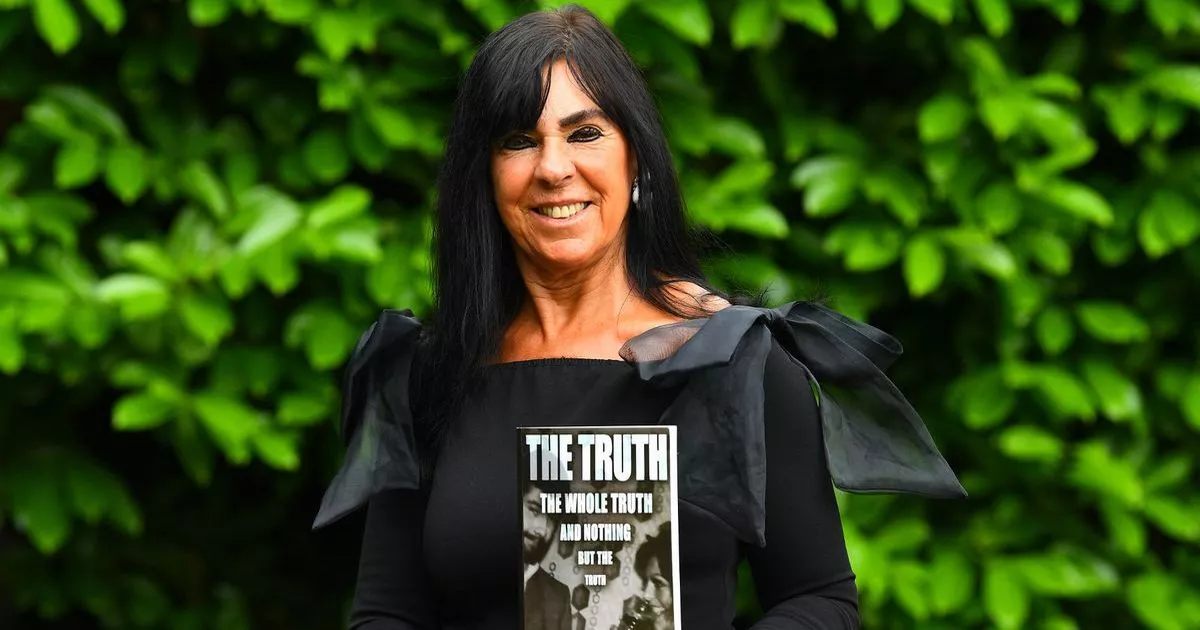

The Challenges Of Being Married To A High Profile Prisoner In The Uk

May 26, 2025

The Challenges Of Being Married To A High Profile Prisoner In The Uk

May 26, 2025 -

Who To Watch Emerging Talent At The 2025 Roland Garros Grand Slam

May 26, 2025

Who To Watch Emerging Talent At The 2025 Roland Garros Grand Slam

May 26, 2025 -

Watch The 2025 Indy 500 Complete Guide To Live Streaming Tv Broadcast And Race Day Details

May 26, 2025

Watch The 2025 Indy 500 Complete Guide To Live Streaming Tv Broadcast And Race Day Details

May 26, 2025 -

Chanskys Notebook Packmans Legacy In Chanskys Work

May 26, 2025

Chanskys Notebook Packmans Legacy In Chanskys Work

May 26, 2025