Ethereum Price Analysis: Factors Influencing ETH's Potential $3000 Surge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Price Analysis: Factors Influencing ETH's Potential $3000 Surge

Ethereum (ETH), the world's second-largest cryptocurrency, has shown signs of renewed strength, sparking speculation about a potential price surge towards $3000. While predicting the future of cryptocurrency markets remains inherently challenging, several key factors could contribute to such a significant price increase. Understanding these factors is crucial for both seasoned investors and those new to the crypto space.

The Allure of $3000: A Realistic Target?

Reaching $3000 for ETH represents a substantial climb from its current price. However, several converging trends suggest this target is not entirely unrealistic. This article will delve into the key factors driving this potential upswing.

1. The Ethereum Merge and its Lasting Impact:

The successful transition to a proof-of-stake (PoS) consensus mechanism, often dubbed "The Merge," was a monumental event for Ethereum. This upgrade significantly reduced energy consumption and paved the way for enhanced scalability and transaction efficiency. The resulting positive sentiment and increased network security have contributed to ETH's price resilience. This improved efficiency is a major draw for institutional investors looking for environmentally friendly and scalable blockchain solutions.

2. Deflationary Pressure and Staking Rewards:

The shift to PoS introduced a deflationary mechanism, meaning fewer ETH are being created. This scarcity, combined with the attractive staking rewards offered to validators, further incentivizes holding ETH, thus potentially pushing up prices. Staking rewards are a significant factor contributing to ETH's long-term price appreciation.

3. Growing DeFi Ecosystem and NFT Market:

Ethereum remains the dominant platform for decentralized finance (DeFi) applications and non-fungible tokens (NFTs). The continued growth and innovation within these ecosystems directly fuels demand for ETH, as it's the primary currency for transactions and fees. The ever-expanding DeFi and NFT marketplaces create a robust and dynamic demand for ETH.

4. Institutional Adoption and Investment:

Major institutional investors are increasingly allocating capital to Ethereum, recognizing its potential as a long-term store of value and a foundational technology for the decentralized web. This growing institutional interest provides substantial price support and reduces volatility. Institutional adoption signifies growing confidence and legitimacy in the Ethereum network.

5. Technological Advancements and Future Upgrades:

Ethereum developers are continually working on enhancing the network's scalability and functionality. Future upgrades, such as sharding, promise to further improve transaction speeds and reduce costs, attracting even more users and developers. Continuous improvements in technology solidify Ethereum's position as a leading blockchain platform.

Potential Headwinds:

While the outlook appears bullish, it's essential to acknowledge potential headwinds. Broader macroeconomic conditions, regulatory uncertainty, and competition from other layer-1 blockchains could all impact ETH's price trajectory.

Conclusion: Navigating the Ethereum Landscape

The potential for an Ethereum price surge to $3000 hinges on the interplay of several factors, from technological advancements to wider market sentiment. While a definitive prediction is impossible, understanding the underlying dynamics discussed above allows for a more informed assessment of ETH's future price movement. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions. Remember, the cryptocurrency market is highly volatile, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Price Analysis: Factors Influencing ETH's Potential $3000 Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Did Kamala Harris Confront Anderson Cooper After Biden Debate Original Sin Offers Insights

May 25, 2025

Did Kamala Harris Confront Anderson Cooper After Biden Debate Original Sin Offers Insights

May 25, 2025 -

Sunday Crossword And Puzzle Answers May 25 2025

May 25, 2025

Sunday Crossword And Puzzle Answers May 25 2025

May 25, 2025 -

Fresh Lawsuit Aims To Cancel Brockwell Park Summer Festivals

May 25, 2025

Fresh Lawsuit Aims To Cancel Brockwell Park Summer Festivals

May 25, 2025 -

Sunderlands Championship Hopes Dented Player Injured Two Minutes In

May 25, 2025

Sunderlands Championship Hopes Dented Player Injured Two Minutes In

May 25, 2025 -

Who To Watch Promising Debutants At The 2025 Roland Garros Grand Slam

May 25, 2025

Who To Watch Promising Debutants At The 2025 Roland Garros Grand Slam

May 25, 2025

Latest Posts

-

Atletico De Madrid Vs Girona Resultado En Directo Y Estadisticas

May 26, 2025

Atletico De Madrid Vs Girona Resultado En Directo Y Estadisticas

May 26, 2025 -

Sabalenkas Roland Garros Determination A Daily Motivational Quote

May 26, 2025

Sabalenkas Roland Garros Determination A Daily Motivational Quote

May 26, 2025 -

Eala Mboko Valentova And More Anticipated Debuts At Roland Garros 2025

May 26, 2025

Eala Mboko Valentova And More Anticipated Debuts At Roland Garros 2025

May 26, 2025 -

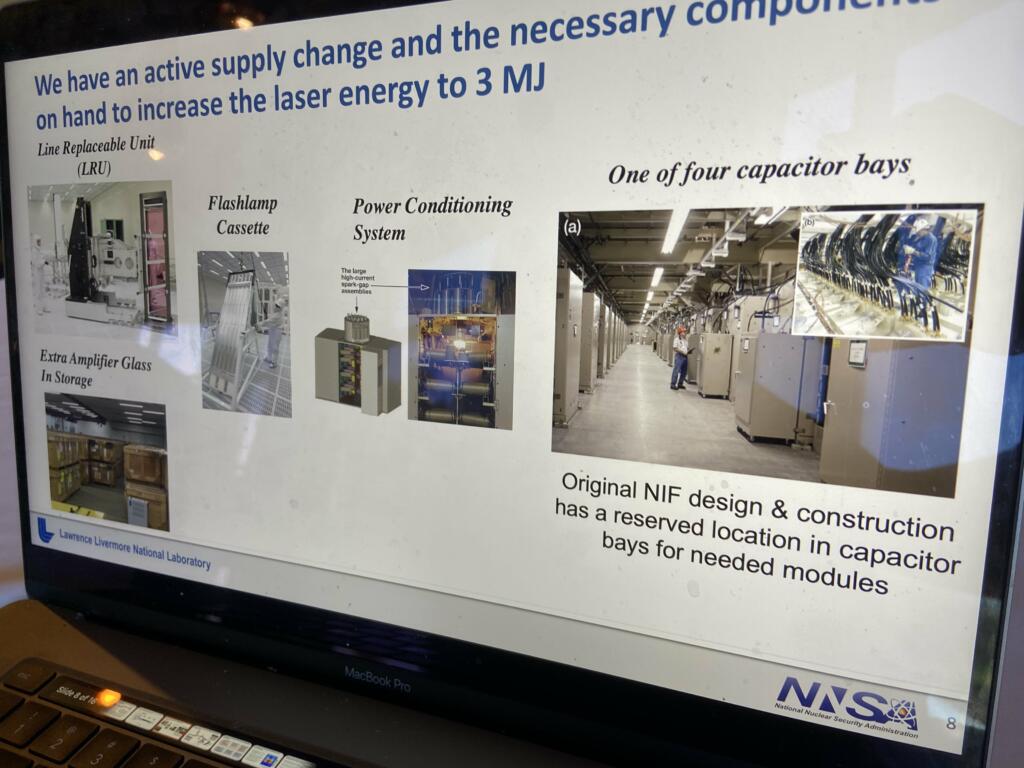

Laser Fusion Technology Inches Closer To Commercial Viability

May 26, 2025

Laser Fusion Technology Inches Closer To Commercial Viability

May 26, 2025 -

Formula 1 Live 2025 Monaco Grand Prix Updates News And Race Report

May 26, 2025

Formula 1 Live 2025 Monaco Grand Prix Updates News And Race Report

May 26, 2025