Ethereum Price Prediction: Can ETH Hit $3,000?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum Price Prediction: Can ETH Hit $3,000?

Ethereum (ETH), the world's second-largest cryptocurrency, has experienced a rollercoaster ride in recent years. After reaching an all-time high above $4,800 in November 2021, the price has fluctuated significantly. But with ongoing developments and increasing adoption, many investors are wondering: can ETH hit $3,000 again? This article delves into the factors that could influence Ethereum's price and offers a balanced perspective on potential future price movements.

Factors Influencing Ethereum's Price:

Several key factors contribute to the volatility and potential future price of ETH. Understanding these factors is crucial for any investor trying to gauge the likelihood of ETH reaching $3,000.

-

The Merge and Network Upgrades: The successful transition to a proof-of-stake consensus mechanism (The Merge) was a monumental event for Ethereum. This significantly reduced energy consumption and paved the way for further scalability improvements. Future upgrades like sharding are expected to enhance transaction speed and reduce fees, boosting network efficiency and potentially driving up demand.

-

Deflationary Properties: The shift to proof-of-stake has introduced a deflationary element to ETH. This means that the supply of ETH is decreasing, potentially increasing its scarcity and value over time. This deflationary pressure could contribute to price appreciation.

-

Decentralized Finance (DeFi) Growth: Ethereum remains the dominant platform for decentralized finance (DeFi) applications. The continued growth and innovation within the DeFi ecosystem, with new protocols and applications constantly emerging, fuels demand for ETH, as it's the underlying currency for many transactions.

-

NFT Market Dynamics: Non-Fungible Tokens (NFTs) built on the Ethereum blockchain continue to attract significant attention and investment. The overall health and growth of the NFT market directly impact the demand and price of ETH.

-

Macroeconomic Conditions: Like other assets, Ethereum's price is susceptible to macroeconomic factors such as inflation, interest rates, and global economic uncertainty. Bearish macroeconomic conditions can lead to investors moving away from riskier assets like cryptocurrencies, potentially depressing ETH's price.

-

Regulatory Landscape: The regulatory environment surrounding cryptocurrencies plays a crucial role. Clear and supportive regulations could boost investor confidence and potentially drive up the price, while overly restrictive regulations could dampen enthusiasm.

ETH Reaching $3,000: A Realistic Prediction?

Predicting the future price of any cryptocurrency is inherently speculative. While there's no guarantee ETH will reach $3,000, several factors suggest it's a plausible scenario:

- Continued technological advancements: The ongoing development and upgrades to the Ethereum network are crucial for its long-term success and price appreciation.

- Growing institutional adoption: Increased adoption by institutional investors lends credibility and stability to the cryptocurrency market, potentially driving up prices.

- Increased mainstream awareness: Wider public awareness and understanding of cryptocurrencies could lead to increased demand.

However, potential challenges exist:

- Market volatility: The cryptocurrency market remains highly volatile, susceptible to sudden price swings driven by various factors.

- Competition from other blockchains: Emerging competitors pose challenges to Ethereum's dominance in the blockchain space.

- Uncertain regulatory environment: The evolving regulatory landscape presents both opportunities and risks.

Conclusion:

Whether Ethereum will hit $3,000 is uncertain. However, the ongoing network improvements, growth of DeFi and NFTs, and potential for increased institutional adoption suggest it's a realistic possibility. Investors should conduct thorough research, understand the risks involved, and diversify their portfolios before making any investment decisions. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum Price Prediction: Can ETH Hit $3,000?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Unknown Terrain To Detailed Map The Impact Of Martian Mapping

Mar 04, 2025

From Unknown Terrain To Detailed Map The Impact Of Martian Mapping

Mar 04, 2025 -

Altcoin Predictions 3 Cryptos To Watch For Potential March 2025 Gains

Mar 04, 2025

Altcoin Predictions 3 Cryptos To Watch For Potential March 2025 Gains

Mar 04, 2025 -

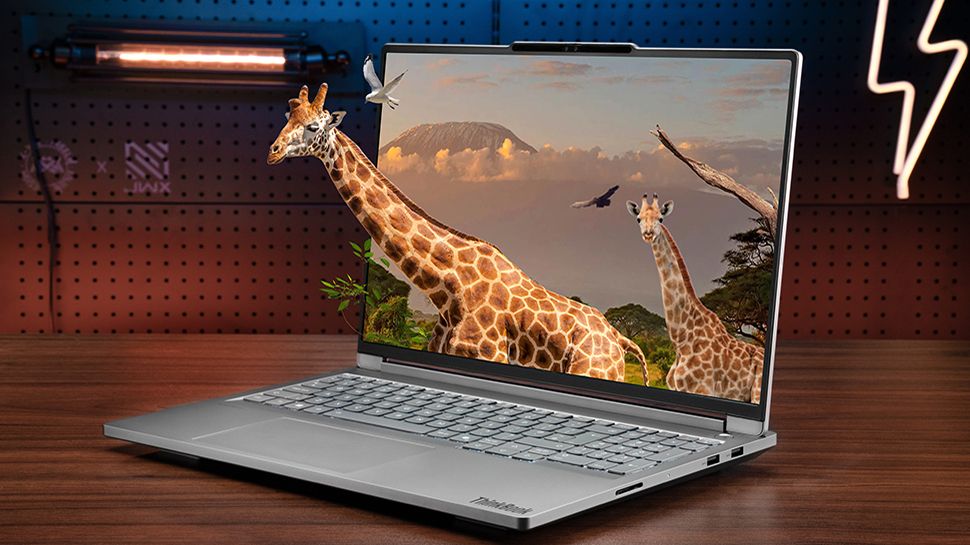

Glasses Free 3 D On A Laptop Lenovo Think Book 3 Ds Strengths And Weaknesses

Mar 04, 2025

Glasses Free 3 D On A Laptop Lenovo Think Book 3 Ds Strengths And Weaknesses

Mar 04, 2025 -

The Rise Of Black Family Travel Reasons For The Increase

Mar 04, 2025

The Rise Of Black Family Travel Reasons For The Increase

Mar 04, 2025 -

Mapping Mars Unveiling Planetary Processes And Potential For Life

Mar 04, 2025

Mapping Mars Unveiling Planetary Processes And Potential For Life

Mar 04, 2025