Ethereum's 10% Rebound: A Path To $3,000 Or A Temporary Relief Rally?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum's 10% Rebound: A Path to $3,000 or a Temporary Relief Rally?

Ethereum (ETH) has experienced a significant surge, rebounding by over 10% in the past 24 hours. This dramatic shift has sparked intense debate within the crypto community: Is this a genuine sign of a bullish trend pushing ETH towards the coveted $3,000 mark, or merely a temporary respite before further price corrections? Let's delve into the potential factors driving this rally and explore the possible scenarios ahead.

The Factors Fueling Ethereum's Recent Surge:

Several interconnected factors could be contributing to Ethereum's recent price jump. It's crucial to consider these elements in assessing the sustainability of this upward trajectory.

-

Increased Institutional Interest: Despite the overall crypto market downturn, institutional investors continue to show increasing interest in Ethereum. Their long-term investment strategies, focusing on the underlying technology and potential of the Ethereum ecosystem, can provide significant price support. This sustained institutional buying can act as a counterbalance to short-term market volatility.

-

Positive Developments in the DeFi Sector: The decentralized finance (DeFi) ecosystem built on Ethereum continues to innovate and grow. New projects, improved protocols, and increased user adoption contribute to the overall health and value of the Ethereum network. A thriving DeFi landscape indirectly strengthens ETH's price.

-

Shaping Up for the Shanghai Upgrade: The highly anticipated Shanghai upgrade, set to unlock staked ETH, is looming. This development is viewed positively by many investors, as it addresses a key concern surrounding staked ETH liquidity. Anticipation surrounding this upgrade is likely injecting bullish sentiment into the market.

-

Macroeconomic Factors: While not directly related to Ethereum, improving global macroeconomic conditions can positively impact the crypto market as a whole. A decrease in inflation or positive economic news can encourage investors to move capital back into riskier assets, including cryptocurrencies.

Is $3,000 Achievable? The Bullish Case:

The 10% rebound presents a compelling argument for those who believe Ethereum can reclaim the $3,000 price point. This scenario hinges on continued institutional investment, sustained growth within the DeFi sector, and a successful Shanghai upgrade. The anticipation surrounding the upgrade alone could propel ETH higher in the short term. Moreover, a broader market recovery could significantly boost Ethereum’s price.

The Bearish Counterpoint: A Temporary Rally?

However, it's essential to consider the bearish arguments. The current rally could simply be a temporary relief rally, a brief respite from a broader downtrend. Several factors could contribute to this pessimistic outlook:

-

Regulatory Uncertainty: The ongoing regulatory scrutiny of the cryptocurrency market remains a significant headwind. Uncertain regulatory landscapes can deter investors and lead to price corrections.

-

Overall Market Sentiment: The overall crypto market sentiment is still cautious. A negative shift in broader market sentiment could easily reverse Ethereum's recent gains.

-

Technical Analysis: While price action is positive, technical analysis may reveal bearish signals that suggest a continued downward trend.

Conclusion: Navigating Uncertainty

Ethereum's 10% rebound is undoubtedly encouraging, but whether it marks a sustained path to $3,000 or a temporary reprieve remains uncertain. Investors should carefully consider the various factors at play, conduct thorough research, and diversify their portfolios before making any investment decisions. The cryptocurrency market is inherently volatile, and predicting future price movements with absolute certainty is impossible. Staying informed about market trends, regulatory updates, and technological developments is crucial for navigating this dynamic landscape. Remember to always invest responsibly and only with capital you can afford to lose.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum's 10% Rebound: A Path To $3,000 Or A Temporary Relief Rally?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Future Of Flight Venus Aerospace And Hermeus Game Changing Hypersonic Drones

Mar 04, 2025

The Future Of Flight Venus Aerospace And Hermeus Game Changing Hypersonic Drones

Mar 04, 2025 -

Shifting Gears Googles Ai Strategy Under Scrutiny After Brins Remarks

Mar 04, 2025

Shifting Gears Googles Ai Strategy Under Scrutiny After Brins Remarks

Mar 04, 2025 -

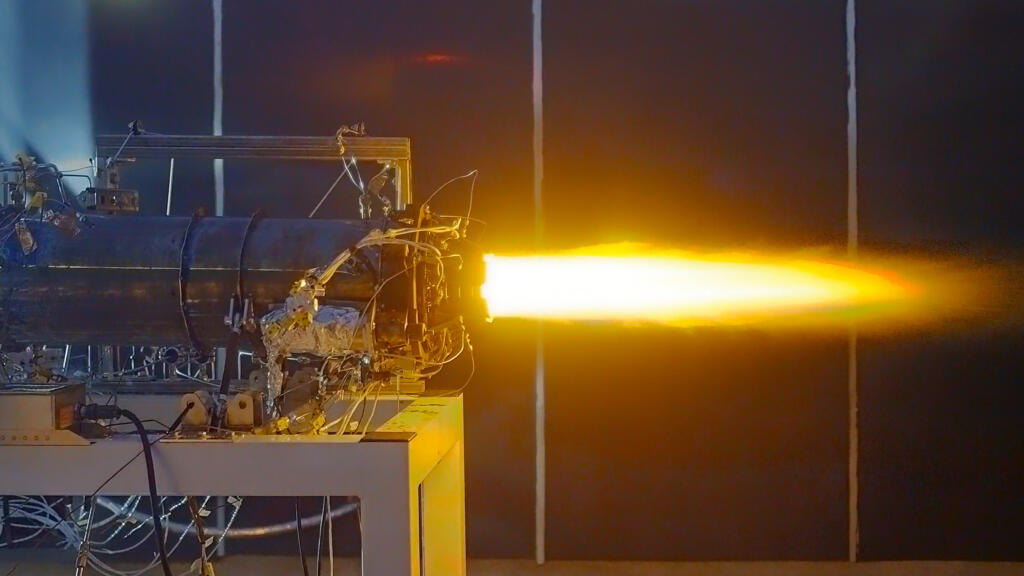

Venus Aerospace Successfully Tests Rotating Detonation Rocket Engine

Mar 04, 2025

Venus Aerospace Successfully Tests Rotating Detonation Rocket Engine

Mar 04, 2025 -

Ancient Quarry Or Recycled Ruins Investigating The Origin Of Stonehenges Massive Stones

Mar 04, 2025

Ancient Quarry Or Recycled Ruins Investigating The Origin Of Stonehenges Massive Stones

Mar 04, 2025 -

Space X Starlink A Commercial Solution For Remote Base And Town Connectivity

Mar 04, 2025

Space X Starlink A Commercial Solution For Remote Base And Town Connectivity

Mar 04, 2025