Ethereum's $3K Target: A Realistic Goal Amidst Current Market Dynamics?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum's $3K Target: A Realistic Goal Amidst Current Market Dynamics?

Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has seen its price fluctuate significantly in recent months. While it has shown periods of impressive growth, the question on many investors' minds is whether a return to the $3,000 mark is a realistic goal, given the current market dynamics. This article delves into the factors influencing ETH's price and explores the likelihood of reaching this key price point.

The Road to $3,000: Analyzing the Current Landscape

Several factors contribute to the ongoing uncertainty surrounding Ethereum's price trajectory. These include macroeconomic conditions, regulatory developments, and the evolving technological landscape of the cryptocurrency market.

Macroeconomic Headwinds: The global economic climate plays a significant role. Inflationary pressures and rising interest rates continue to impact investor sentiment, leading to increased risk aversion and potentially lower investment in risk assets like cryptocurrencies. This creates a headwind for ETH's price appreciation.

Regulatory Scrutiny: The regulatory environment remains a key concern. Governments worldwide are grappling with how best to regulate cryptocurrencies, and increased regulatory scrutiny could negatively impact the price of ETH and other crypto assets. Uncertainty surrounding future regulations can dampen investor confidence and hinder price growth.

Technological Advancements and Network Activity: On the other hand, positive developments within the Ethereum ecosystem could drive price appreciation. The successful transition to proof-of-stake (PoS) and the ongoing development of layer-2 scaling solutions like Polygon and Optimism are crucial steps in improving the network's efficiency and scalability. Increased network activity, reflected in higher transaction volumes and decentralized application (dApp) usage, often correlates with higher prices. The growing adoption of Ethereum for decentralized finance (DeFi) applications and non-fungible tokens (NFTs) also plays a vital role.

Staking and ETH Supply: The implementation of staking has significantly altered the dynamics of ETH supply. A substantial portion of ETH is now locked up in staking, reducing the circulating supply and potentially creating upward pressure on price. This reduced supply, combined with increasing demand, could contribute to price appreciation.

Is $3,000 Achievable? A Balanced Perspective

Reaching the $3,000 target is not guaranteed, and several scenarios are possible.

-

Bullish Scenario: A combination of positive macroeconomic factors, favorable regulatory developments, continued technological advancements, and strong network adoption could propel ETH's price towards and beyond $3,000.

-

Bearish Scenario: Persistent macroeconomic headwinds, stricter regulatory measures, or a significant drop in network activity could prevent ETH from reaching this price target, potentially leading to further price declines.

-

Neutral Scenario: A balance of bullish and bearish factors could result in a period of sideways price movement, with ETH consolidating around its current price levels before a potential future surge.

Conclusion: Cautious Optimism

While reaching $3,000 is a possibility, it's crucial to maintain a realistic and balanced perspective. The current market dynamics present both opportunities and challenges. Investors should carefully assess their risk tolerance and conduct thorough research before making any investment decisions. The future price of ETH remains highly dependent on a complex interplay of macroeconomic, regulatory, and technological factors. Monitoring these factors closely is essential for navigating the ever-evolving landscape of the cryptocurrency market. Remember to always diversify your portfolio and consult with a financial advisor before making significant investments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum's $3K Target: A Realistic Goal Amidst Current Market Dynamics?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Past Wordle Answers Full List In Alphabetical And Date Order

Mar 04, 2025

Past Wordle Answers Full List In Alphabetical And Date Order

Mar 04, 2025 -

A Semana Na Economia Copom Decide Ipca E Industria Em Foco Olho Na China

Mar 04, 2025

A Semana Na Economia Copom Decide Ipca E Industria Em Foco Olho Na China

Mar 04, 2025 -

Uk Banking Chaos Lloyds Halifax And Nationwide Outages Spark System Upgrade Debate

Mar 04, 2025

Uk Banking Chaos Lloyds Halifax And Nationwide Outages Spark System Upgrade Debate

Mar 04, 2025 -

Compartilhamento De Imoveis A Solucao Para Ter Uma Casa Na Praia Ou No Campo Sem Grandes Investimentos

Mar 04, 2025

Compartilhamento De Imoveis A Solucao Para Ter Uma Casa Na Praia Ou No Campo Sem Grandes Investimentos

Mar 04, 2025 -

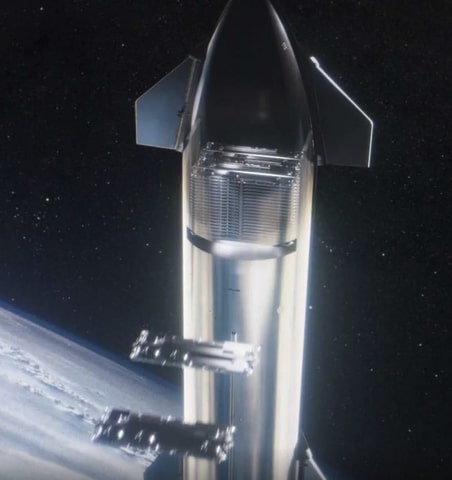

Space X Starlinks 5 Million User Milestone Giant V3 Satellites And Reusable Starship Launch Timeline

Mar 04, 2025

Space X Starlinks 5 Million User Milestone Giant V3 Satellites And Reusable Starship Launch Timeline

Mar 04, 2025