Ethereum's $3000 Target: Technical Analysis And Price Prediction For ETH

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Ethereum's $3000 Target: Technical Analysis and Price Prediction for ETH

Ethereum (ETH), the world's second-largest cryptocurrency, has experienced significant price fluctuations in recent months. While currently trading below its all-time high, many analysts are predicting a bullish run towards the coveted $3000 mark. But is this ambitious target realistic? Let's delve into the technical analysis and explore potential price predictions for ETH.

Technical Analysis: Signs of a Bullish Trend?

Several technical indicators suggest a potential upswing for Ethereum. The recent price action shows signs of a potential bullish breakout pattern.

-

Moving Averages: The 50-day and 200-day moving averages are converging, often a precursor to a significant price movement. A clear break above these averages could signal a strong bullish trend.

-

Relative Strength Index (RSI): The RSI, a momentum indicator, is showing signs of recovering from oversold conditions. While not definitively bullish, it suggests that further downside is limited, paving the way for potential upside.

-

Support Levels: The price has found support at crucial levels in the past, suggesting strong buying pressure at those points. Holding these support levels is crucial for the continuation of the bullish trend.

However, it's important to note that technical analysis is not foolproof. Market sentiment, regulatory changes, and unexpected events can all drastically impact the price of ETH.

Factors Influencing Ethereum's Price:

Several factors beyond technical indicators contribute to ETH's price movement:

-

Ethereum 2.0 (ETH2): The ongoing transition to Ethereum 2.0 is a major catalyst for long-term growth. The upgrade promises improved scalability, security, and efficiency, making ETH more attractive for both developers and investors.

-

Decentralized Finance (DeFi): The explosive growth of the DeFi ecosystem built on Ethereum continues to drive demand for ETH. As more DeFi applications emerge, the demand for ETH as collateral and transaction fees is likely to increase.

-

Institutional Adoption: Increased institutional investment in cryptocurrencies, including Ethereum, signifies growing mainstream acceptance. Large-scale institutional adoption could significantly boost ETH's price.

-

Market Sentiment: Overall market sentiment towards cryptocurrencies plays a critical role. Positive news and broader market optimism often translate into higher prices for ETH. Conversely, negative news or regulatory uncertainty can lead to price declines.

Price Prediction: Reaching $3000?

Predicting the price of any cryptocurrency is inherently speculative. While some analysts are optimistic about ETH reaching $3000, it's essential to approach such predictions with caution.

Several factors could contribute to a price surge towards $3000:

-

Sustained bullish momentum: Continued positive price action and sustained buying pressure could propel ETH towards the $3000 mark.

-

Positive regulatory developments: Favorable regulatory changes could significantly boost investor confidence and drive price increases.

-

Continued growth of the DeFi ecosystem: Continued expansion of the DeFi ecosystem built on Ethereum will likely increase demand and drive price appreciation.

However, factors like regulatory crackdowns, market corrections, or unforeseen technological challenges could hinder ETH's progress towards $3000.

Conclusion:

While a $3000 target for Ethereum is not unrealistic based on current technical analysis and market trends, it is by no means guaranteed. Investors should conduct their own thorough research and consider their risk tolerance before investing in Ethereum or any other cryptocurrency. The cryptocurrency market is volatile and unpredictable; therefore, informed decision-making is paramount. Remember that past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Ethereum's $3000 Target: Technical Analysis And Price Prediction For ETH. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

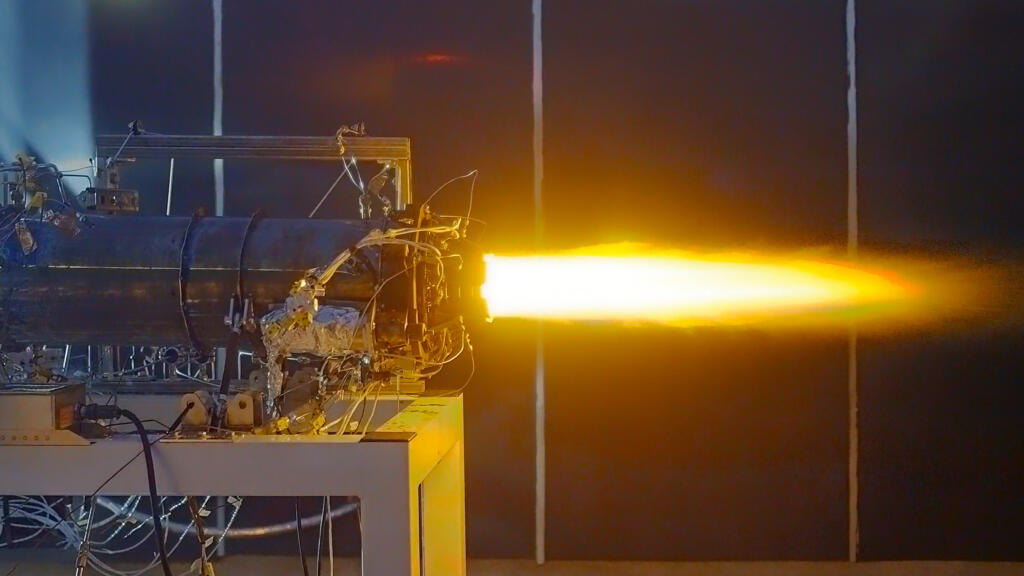

Venus Aerospace Successfully Tests Rotating Detonation Rocket Engine

Mar 04, 2025

Venus Aerospace Successfully Tests Rotating Detonation Rocket Engine

Mar 04, 2025 -

Global Ai Spending To Reach Trillions Current 350 Billion Annual Investment Shows Explosive Growth

Mar 04, 2025

Global Ai Spending To Reach Trillions Current 350 Billion Annual Investment Shows Explosive Growth

Mar 04, 2025 -

Rio Grande Do Sul Chuvas Causam Suspensao Das Operacoes Da Gerdau

Mar 04, 2025

Rio Grande Do Sul Chuvas Causam Suspensao Das Operacoes Da Gerdau

Mar 04, 2025 -

Best Speakers Headphones And Music Accessories For Audiophiles

Mar 04, 2025

Best Speakers Headphones And Music Accessories For Audiophiles

Mar 04, 2025 -

Lenovos New Think Pad X13 Gen 6 A Featherweight Laptop With Powerful Amd Ryzen Ai

Mar 04, 2025

Lenovos New Think Pad X13 Gen 6 A Featherweight Laptop With Powerful Amd Ryzen Ai

Mar 04, 2025