EU Challenges US Crypto Hegemony: Protecting European Financial Autonomy

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

EU Challenges US Crypto Hegemony: Protecting European Financial Autonomy

The European Union is increasingly pushing back against the United States' dominance in the cryptocurrency market, aiming to foster its own independent digital financial infrastructure and safeguard its economic sovereignty. This move signifies a crucial shift in the global crypto landscape, with implications for innovation, regulation, and international relations.

For years, the US has held a significant lead in cryptocurrency development and adoption, boasting prominent exchanges, innovative companies, and a relatively mature regulatory framework (though still evolving). However, concerns about US regulatory uncertainty, geopolitical tensions, and the potential for unilateral actions are driving the EU to prioritize the development of a robust and autonomous crypto ecosystem.

H2: The EU's Strategy for Crypto Independence

The EU's strategy involves a multi-pronged approach encompassing several key areas:

-

Regulatory Framework: The Markets in Crypto-Assets (MiCA) regulation, set to come into effect in 2024, represents a landmark achievement. MiCA aims to provide a comprehensive legal framework for cryptocurrencies operating within the EU, offering clarity and investor protection while fostering innovation. This contrasts with the more piecemeal approach adopted in the US, creating a more predictable environment for European crypto businesses.

-

Digital Euro: The potential introduction of a central bank digital currency (CBDC), the digital euro, is another significant step. This would provide an alternative to existing fiat currencies and potentially challenge the dollar's dominance in international transactions, enhancing the EU's financial autonomy. The ongoing pilot programs are crucial for shaping the future of digital finance within the European Union.

-

Blockchain Technology Development: The EU is investing heavily in research and development of blockchain technology, seeking to become a global leader in innovation. This includes supporting startups, fostering academic collaboration, and promoting the use of blockchain for various applications beyond cryptocurrencies, such as supply chain management and digital identity.

-

International Cooperation: The EU is actively engaging with other nations and international organizations to establish global standards for crypto regulation, aiming to counter US influence and create a more balanced global financial system. This collaborative approach is critical for achieving widespread adoption and preventing fragmentation of the crypto market.

H2: Challenges and Opportunities

While the EU's ambition is commendable, it faces several significant challenges:

-

Talent Acquisition: Attracting and retaining skilled professionals in the crypto sector remains a crucial hurdle. Competition from the US and other countries with established crypto hubs necessitates significant investment in education and talent development.

-

Technological Advancement: Keeping pace with the rapid technological advancements in the crypto space requires constant innovation and adaptation. The EU must invest in research and infrastructure to stay competitive.

-

Regulatory Harmonization: Ensuring consistent implementation of MiCA across all member states is essential for creating a unified and efficient market. Variations in national approaches could hinder the overall success of the EU's strategy.

H2: The Geopolitical Implications

The EU's push for crypto autonomy carries significant geopolitical implications. It represents a challenge to US dominance in the global financial system, potentially leading to increased competition and a reshaping of the international financial landscape. This move could also influence other countries to develop their own independent crypto ecosystems, potentially leading to a more decentralized and multipolar world.

H2: Conclusion: A New Era in Global Finance

The EU's proactive approach to regulating and developing its own cryptocurrency infrastructure signifies a pivotal moment in the evolution of global finance. While challenges remain, the EU's commitment to protecting its financial autonomy through initiatives like MiCA and the digital euro is paving the way for a more balanced and competitive crypto landscape. This shift promises to reshape international financial relations and potentially redefine the future of money itself. The coming years will be crucial in determining the success of this ambitious endeavor and its impact on the global economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on EU Challenges US Crypto Hegemony: Protecting European Financial Autonomy. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Man United Facing Major Transfer Blow Big Name Player Could Leave For 20m

Mar 13, 2025

Man United Facing Major Transfer Blow Big Name Player Could Leave For 20m

Mar 13, 2025 -

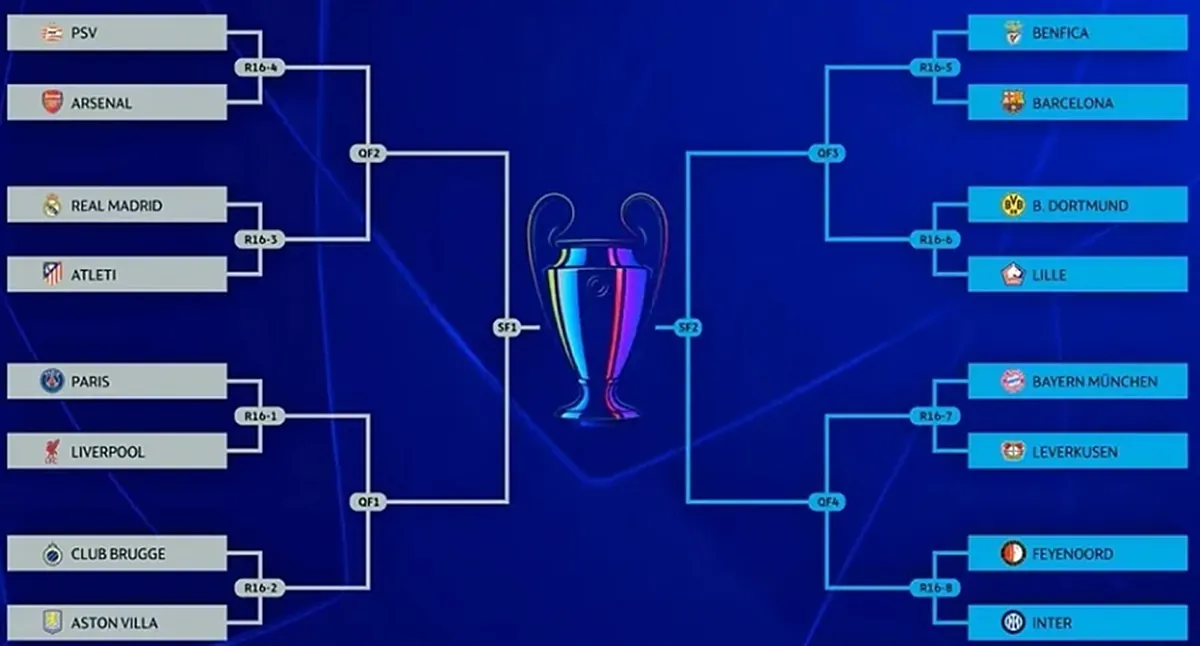

Definidos Los Cruces Cuartos De Final Champions League 2024

Mar 13, 2025

Definidos Los Cruces Cuartos De Final Champions League 2024

Mar 13, 2025 -

Your Guide To The 2025 Acc Tournament Bracket Schedule And Live Scores

Mar 13, 2025

Your Guide To The 2025 Acc Tournament Bracket Schedule And Live Scores

Mar 13, 2025 -

Situacao Critica No Rs Apos Chuvas Balanco De Vitimas E Impactos Na Infraestrutura

Mar 13, 2025

Situacao Critica No Rs Apos Chuvas Balanco De Vitimas E Impactos Na Infraestrutura

Mar 13, 2025 -

Tesla Fsds Winter Performance Navigating Snowy And Icy Roads

Mar 13, 2025

Tesla Fsds Winter Performance Navigating Snowy And Icy Roads

Mar 13, 2025