EU Warns Of US Crypto Hegemony: Protecting European Financial Stability

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

EU Warns of US Crypto Hegemony: Protecting European Financial Stability

The European Union is sounding the alarm over the growing dominance of the United States in the cryptocurrency market, expressing concerns about the potential threat to European financial stability and sovereignty. This isn't simply about market share; the EU fears a dependence on US-centric crypto infrastructure could leave Europe vulnerable to regulatory changes, geopolitical tensions, and even potential sanctions.

The escalating tension highlights a crucial point: the decentralized nature of cryptocurrency is increasingly being challenged by the centralized power of a few key players, predominantly based in the US. This concentration of power raises significant concerns for the EU, a bloc striving for greater financial autonomy.

The US Crypto Advantage: A Multi-Faceted Threat

The US boasts a significant head start in the cryptocurrency landscape. This advantage stems from several factors:

- Early Adoption: The US has been a hotbed for early cryptocurrency adoption, fostering innovation and attracting significant investment.

- Regulatory Clarity (Relative): While still evolving, the US regulatory framework, particularly in certain states, provides a clearer path for crypto businesses than in many other jurisdictions. This clarity attracts companies and talent.

- Technological Infrastructure: Major cryptocurrency exchanges and infrastructure providers are heavily concentrated in the US, creating a network effect that is difficult for other regions to compete with.

- Dominant Stablecoin Market: US-based stablecoins hold a large share of the global market, further reinforcing the US's influence.

EU Concerns: More Than Just Competition

The EU's concerns extend beyond simple economic competition. The bloc worries about:

- Sanctions Risk: The potential for the US to leverage its control over key crypto infrastructure to impose sanctions on European entities is a major concern. This could cripple European businesses and undermine the stability of the financial system.

- Regulatory Capture: The EU fears that a US-dominated crypto market could lead to regulatory frameworks that disproportionately benefit US interests, potentially harming European companies and consumers.

- Data Privacy: The concentration of crypto data within US jurisdictions raises concerns about data privacy and compliance with EU regulations like GDPR.

Europe's Response: Fostering a "Crypto-Sovereign" Future

The EU is actively working to mitigate these risks. This involves a multi-pronged approach:

- Strengthening Regulatory Frameworks: The EU is developing a comprehensive regulatory framework for crypto assets, aiming to create a secure and innovative environment while protecting consumers and maintaining financial stability. The Markets in Crypto-Assets (MiCA) regulation is a key part of this effort.

- Investing in Infrastructure: The EU is promoting investment in European-based crypto infrastructure, including exchanges and payment processors.

- Promoting Innovation: The EU is supporting the development of innovative blockchain technologies and decentralized finance (DeFi) projects within Europe.

- International Cooperation: The EU is seeking to collaborate with other jurisdictions to create a more balanced and globally coordinated approach to crypto regulation.

The Road Ahead: Navigating a Geopolitical Crypto Landscape

The EU's efforts to counter US crypto hegemony are crucial not just for European financial stability but also for the future of global cryptocurrency regulation. The path forward will involve balancing innovation with robust regulatory oversight, ensuring that the benefits of cryptocurrency are accessible to all while mitigating the risks of over-centralization and geopolitical vulnerability. The coming years will be critical in determining whether a truly decentralized and globally balanced cryptocurrency ecosystem can emerge or if the US will maintain its dominant position. The implications are far-reaching, impacting everything from international trade to national security.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on EU Warns Of US Crypto Hegemony: Protecting European Financial Stability. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Behind To The Quarter Finals Dortmunds Epic Champions League Comeback

Mar 13, 2025

From Behind To The Quarter Finals Dortmunds Epic Champions League Comeback

Mar 13, 2025 -

Atletico Madrid Comeback Simeones Confidence Fuels Champions League Hope

Mar 13, 2025

Atletico Madrid Comeback Simeones Confidence Fuels Champions League Hope

Mar 13, 2025 -

Mufasa The Lion King Finally Arrives On Disney Heres When

Mar 13, 2025

Mufasa The Lion King Finally Arrives On Disney Heres When

Mar 13, 2025 -

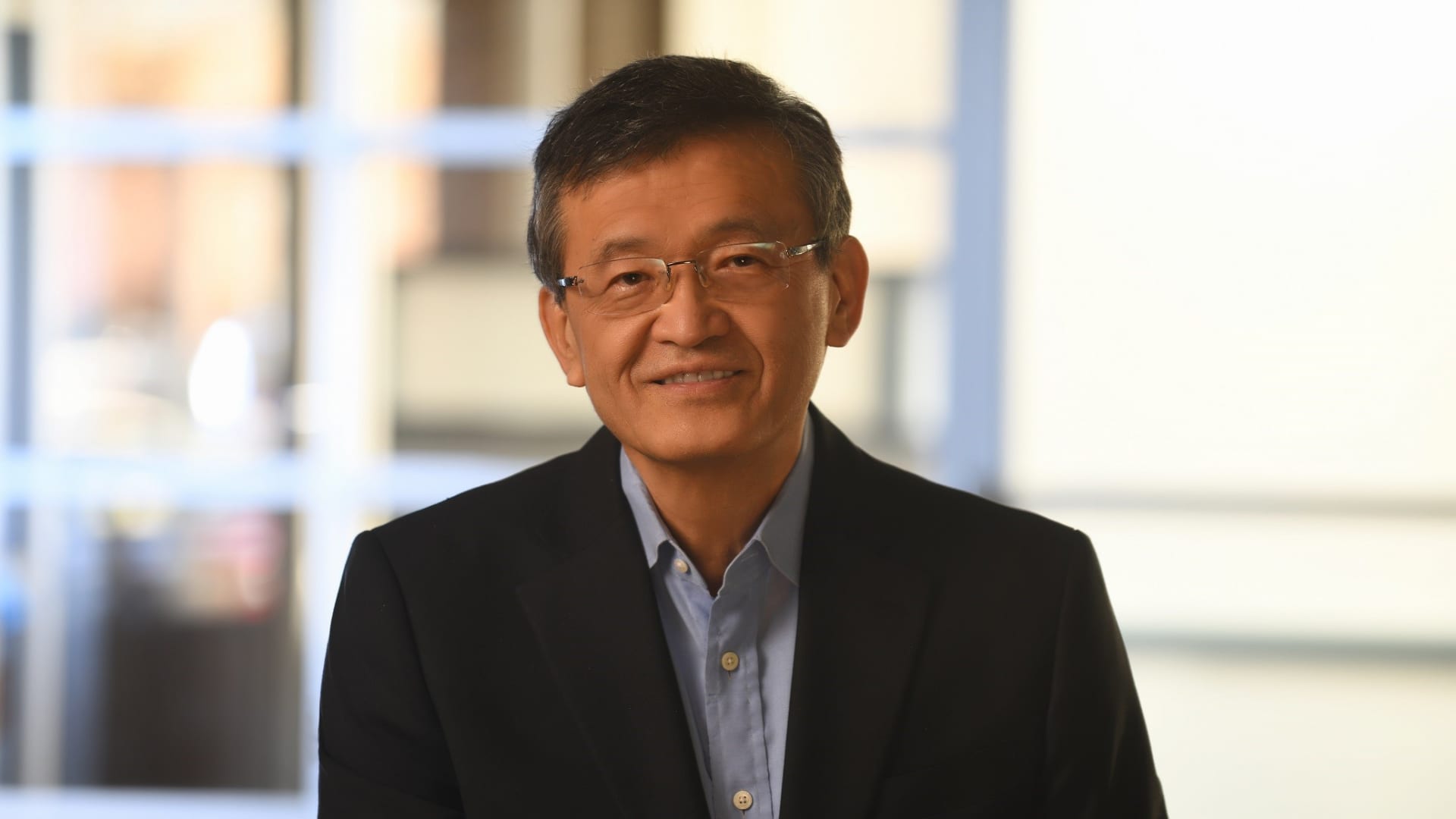

New Intel Ceo Lip Bu Tan Impact On Stock Price And Future Outlook

Mar 13, 2025

New Intel Ceo Lip Bu Tan Impact On Stock Price And Future Outlook

Mar 13, 2025 -

Post Cyclone Alfred The Unexpected Sight Of Giant Fire Ant Rafts

Mar 13, 2025

Post Cyclone Alfred The Unexpected Sight Of Giant Fire Ant Rafts

Mar 13, 2025