EU Warns: US Crypto Drive Undermines Europe's Financial Sovereignty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

EU Warns: US Crypto Drive Undermines Europe's Financial Sovereignty

The European Union has issued a stark warning about the potential threat posed by the United States' aggressive push into the cryptocurrency market, claiming it undermines Europe's financial sovereignty and stability. The escalating tensions highlight a growing transatlantic rift over the regulation and future of digital assets.

The EU's concerns center around the dominance of US-based cryptocurrency exchanges and stablecoin issuers. These entities, the EU argues, wield disproportionate influence over the global crypto market, potentially jeopardizing the EU's ability to independently shape its financial landscape. This isn't just about market share; it’s about control over crucial financial infrastructure and the potential for manipulation.

<h3>A Clash of Regulatory Approaches</h3>

The EU's Markets in Crypto-Assets (MiCA) regulation, set to take effect in 2024, represents a significant attempt to create a comprehensive and robust framework for cryptocurrencies within the European Union. This contrasts sharply with the more fragmented and, according to the EU, less stringent regulatory environment in the United States. This difference in approach is at the heart of the growing conflict.

The EU believes the US's relatively hands-off approach allows for greater risk and instability within the crypto market, ultimately spilling over and impacting European financial systems. The lack of consistent oversight, they argue, creates opportunities for market manipulation and potentially harmful financial activities that could destabilize the Eurozone.

<h3>Concerns Beyond Market Dominance</h3>

The EU's concerns extend beyond simple market share. They are worried about:

- Data Privacy: The concentration of user data with US-based crypto firms raises significant data privacy concerns under the EU's General Data Protection Regulation (GDPR).

- Sanctions Evasion: The decentralized nature of cryptocurrencies presents challenges for enforcing international sanctions, and the EU fears that lax US regulation could facilitate illicit activities.

- Monetary Policy: The dominance of US-based stablecoins could potentially impact the effectiveness of the European Central Bank's monetary policy.

<h3>The Path Forward: A Need for International Cooperation</h3>

The EU's warning isn't a call for isolationism, but rather a plea for greater international cooperation on cryptocurrency regulation. They advocate for a coordinated global approach to ensure a stable and secure digital asset ecosystem that protects consumers and prevents financial instability. This requires a dialogue between the US and the EU, focusing on shared regulatory principles and mechanisms to mitigate the risks posed by the rapidly evolving crypto landscape.

The coming months will be crucial in determining how this transatlantic disagreement plays out. The EU's assertive stance signals a willingness to defend its financial autonomy, setting the stage for potential negotiations and potentially even trade disputes if a compromise can't be reached. The future of the global cryptocurrency market hinges, in part, on the ability of these two economic giants to find common ground.

Keywords: EU, United States, Crypto, Cryptocurrency, Financial Sovereignty, MiCA, Regulation, Stablecoins, Digital Assets, Transatlantic Relations, Data Privacy, Sanctions Evasion, Monetary Policy, International Cooperation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on EU Warns: US Crypto Drive Undermines Europe's Financial Sovereignty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tom Holland And Sadie Sink New Spider Man Movie Casting

Mar 13, 2025

Tom Holland And Sadie Sink New Spider Man Movie Casting

Mar 13, 2025 -

Towns Resilience Pays Off Hard Earned Victory

Mar 13, 2025

Towns Resilience Pays Off Hard Earned Victory

Mar 13, 2025 -

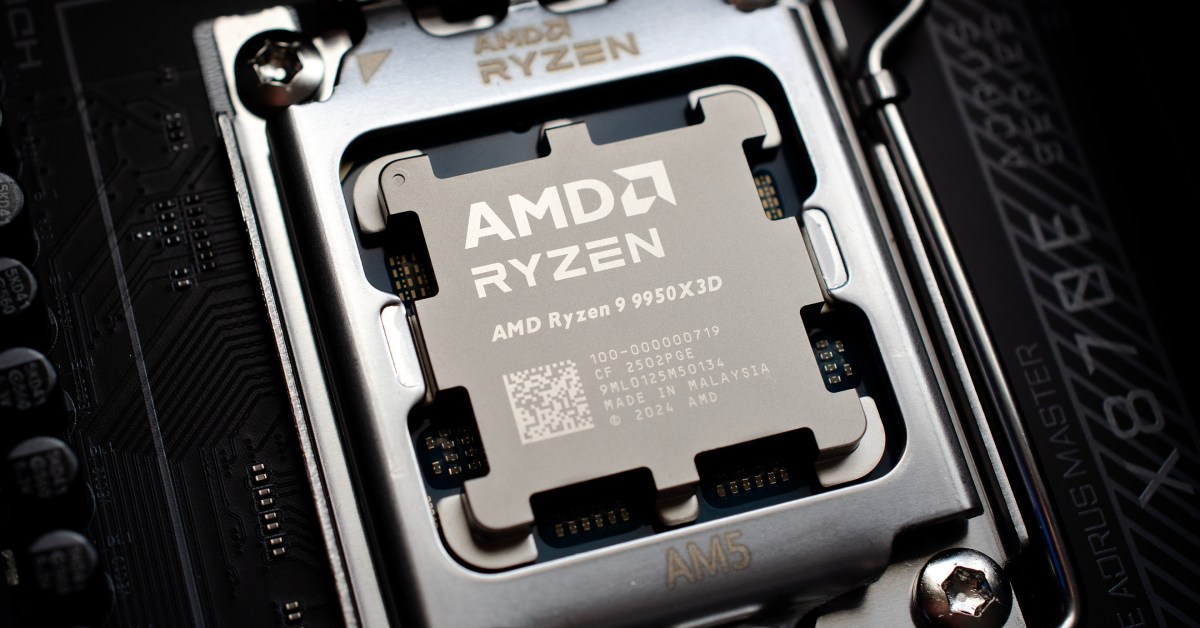

Ryzen 9 9950 X3 D In Depth Review And Benchmark Analysis

Mar 13, 2025

Ryzen 9 9950 X3 D In Depth Review And Benchmark Analysis

Mar 13, 2025 -

Lost In Translation A Celtic Players Near Transfer To A Major European Club

Mar 13, 2025

Lost In Translation A Celtic Players Near Transfer To A Major European Club

Mar 13, 2025 -

Singapore Airlines And Scoot Implement Power Bank Ban Passenger Impact And Safety Concerns

Mar 13, 2025

Singapore Airlines And Scoot Implement Power Bank Ban Passenger Impact And Safety Concerns

Mar 13, 2025