Europe's Financial Stability At Risk? EU Raises Concerns Over US Crypto Ambitions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Europe's Financial Stability at Risk? EU Raises Concerns Over US Crypto Ambitions

The transatlantic relationship is facing new strains as the European Union expresses serious concerns over the United States' ambitions in the cryptocurrency market. A potential clash of regulatory approaches is brewing, raising questions about the stability of the European financial system and the future of global cryptocurrency regulation.

The EU's apprehension stems from the perceived dominance of US-based cryptocurrency companies and the potential for this dominance to destabilize the European market. This isn't simply about competition; it's about the potential for regulatory arbitrage, where companies exploit differences in regulatory frameworks to gain an unfair advantage, potentially undermining the EU's efforts to create a stable and secure digital finance environment.

US Crypto Dominance: A Cause for Concern?

The rapid growth of the US cryptocurrency sector, fueled by significant private investment and a relatively less restrictive regulatory environment compared to the EU, is a key factor driving the EU's worries. Many prominent cryptocurrency exchanges and blockchain technology companies are based in the US, giving them a significant head start in global market share. This, coupled with the lack of a unified, comprehensive regulatory framework across the EU, creates a vulnerability.

The EU fears that this imbalance could lead to:

- Capital flight: European investors might be tempted to move their crypto assets to US-based platforms due to perceived regulatory uncertainties or more favorable conditions in the US.

- Regulatory arbitrage: Companies could exploit differences in regulations to avoid stricter EU rules, potentially leading to increased financial risks.

- Reduced innovation within the EU: A less competitive environment could stifle the growth of European cryptocurrency companies and hinder innovation in the sector.

The EU's Response: A Push for Harmonized Regulation

In response to these concerns, the EU is pushing for a more unified and robust regulatory framework for cryptocurrencies. The Markets in Crypto-Assets (MiCA) regulation, which is set to come into effect in 2024, represents a significant step towards this goal. MiCA aims to establish clear rules for crypto asset issuers and service providers operating within the EU, aiming to protect consumers and ensure market integrity.

However, the success of MiCA hinges on international cooperation. The EU needs to work closely with other major economies, particularly the US, to ensure a globally consistent approach to cryptocurrency regulation. A fragmented regulatory landscape only increases risks and creates opportunities for exploitation.

The Need for Transatlantic Dialogue

The current situation highlights the urgent need for constructive dialogue between the EU and the US on cryptocurrency regulation. A collaborative approach, focusing on shared goals of consumer protection, market stability, and the prevention of illicit activities, is crucial. Both sides need to recognize the interconnectedness of their financial systems and the potential for regulatory divergence to create systemic risks.

Failure to find common ground could lead to a significant deterioration in the transatlantic relationship and potentially undermine the stability of the global financial system. The future of cryptocurrency and global financial stability depends, in part, on the ability of the EU and US to navigate these challenges effectively. The stakes are high, and the time for decisive action is now.

Keywords: Europe, EU, USA, Cryptocurrency, Crypto, Regulation, MiCA, Financial Stability, Cryptocurrency Regulation, Digital Finance, Transatlantic Relations, Financial Risk, Blockchain, Global Finance, Capital Flight, Regulatory Arbitrage.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Europe's Financial Stability At Risk? EU Raises Concerns Over US Crypto Ambitions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Oltre I Confini Dello Sport Extra Olimpico Al Politecnico Di Milano

Mar 13, 2025

Oltre I Confini Dello Sport Extra Olimpico Al Politecnico Di Milano

Mar 13, 2025 -

Extra Olimpico Il Politecnico Di Milano Esplora Lo Sport Oltre Le Competizioni

Mar 13, 2025

Extra Olimpico Il Politecnico Di Milano Esplora Lo Sport Oltre Le Competizioni

Mar 13, 2025 -

Luton Town Edges Cardiff City 2 1 Aasgaards Goal Secures Victory

Mar 13, 2025

Luton Town Edges Cardiff City 2 1 Aasgaards Goal Secures Victory

Mar 13, 2025 -

2025 Stimulus Check Update 725 Payments Eligibility Requirements And Timeline

Mar 13, 2025

2025 Stimulus Check Update 725 Payments Eligibility Requirements And Timeline

Mar 13, 2025 -

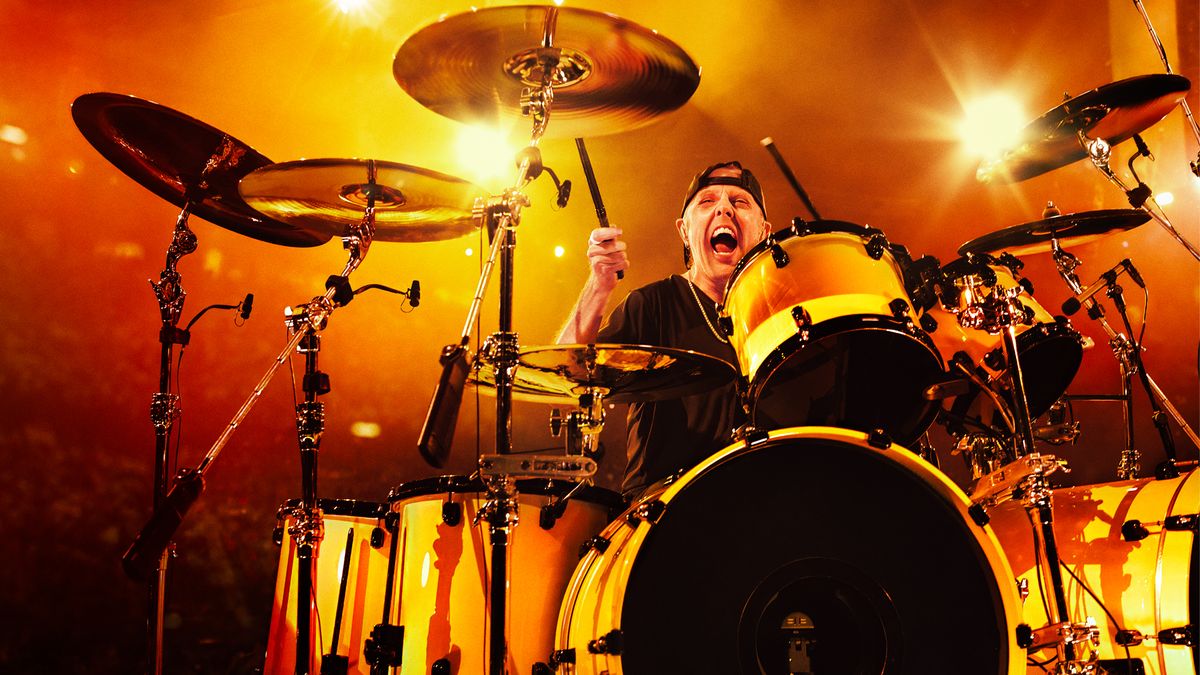

Review Metallicas Virtual Concert On Apple Vision Pro Headset

Mar 13, 2025

Review Metallicas Virtual Concert On Apple Vision Pro Headset

Mar 13, 2025