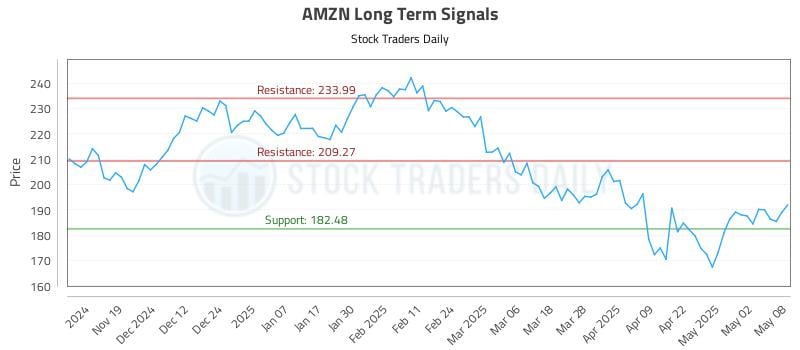

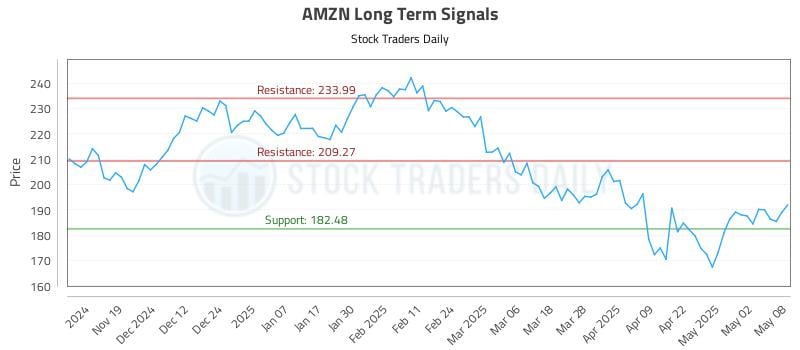

Evaluating AMZN: A Detailed Investment Report And Stock Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating AMZN: A Detailed Investment Report and Stock Analysis

Amazon (AMZN) remains a behemoth in the e-commerce and cloud computing landscapes, but its stock performance has seen significant fluctuations recently. This detailed investment report and stock analysis delves into the current state of AMZN, examining its strengths, weaknesses, opportunities, and threats (SWOT) to help investors make informed decisions.

Amazon's Dominant Market Positions:

Amazon's success is built on its dominance in multiple sectors. Its e-commerce platform, Amazon.com, remains the undisputed king, offering unparalleled selection and convenience. This core business continues to generate substantial revenue, even amidst increased competition. Further bolstering its financial health is Amazon Web Services (AWS), the undisputed leader in cloud computing. AWS provides a powerful recurring revenue stream and substantial profit margins, mitigating some of the challenges faced by the retail segment.

Recent Performance and Key Financial Metrics:

While Amazon's overall revenue continues to grow, investors are scrutinizing its profitability. Recent quarterly reports have shown fluctuating profits, influenced by factors like increased operating expenses and investments in new initiatives. Key metrics investors should watch include:

- Revenue Growth: Sustained growth in both e-commerce and AWS is crucial for AMZN's continued success. Analyzing year-over-year and quarter-over-quarter growth is essential.

- Operating Income: Tracking operating income provides insight into the profitability of AMZN's core operations, excluding interest and taxes. A shrinking operating margin warrants careful consideration.

- Free Cash Flow: Free cash flow (FCF) indicates the amount of cash available to reinvest in the business, pay dividends, or repurchase shares. Strong FCF is a positive signal.

- AWS Growth: The performance of AWS is a key indicator of AMZN's long-term prospects, given its high margins and growth potential. Monitoring its revenue growth and market share is essential.

Challenges and Risks Facing Amazon:

Despite its market leadership, AMZN faces significant challenges:

- Increased Competition: Intense competition from other e-commerce giants and rising smaller, niche players puts pressure on margins and market share.

- Inflationary Pressures: Rising inflation impacts both consumer spending and Amazon's operating costs, potentially squeezing profits.

- Labor Relations: Maintaining positive labor relations and addressing concerns about working conditions are crucial for long-term operational stability.

- Regulatory Scrutiny: Amazon faces increasing regulatory scrutiny regarding antitrust concerns and its market dominance.

Growth Opportunities and Future Outlook:

Amazon continues to invest heavily in areas with significant growth potential:

- Expansion into New Markets: International expansion offers significant opportunities for revenue growth.

- Amazon Advertising: Its advertising platform is rapidly growing, representing a significant new revenue stream.

- Subscription Services: Prime membership and other subscription services provide recurring revenue and customer loyalty.

- Artificial Intelligence (AI) and Machine Learning: Investment in AI and machine learning will likely drive efficiency gains and product innovation.

Investment Recommendation:

AMZN remains a complex investment. While its dominance in key sectors and significant growth opportunities are attractive, investors should carefully consider the risks associated with increased competition, inflationary pressures, and regulatory scrutiny. A long-term perspective is crucial, and diversification within a broader investment portfolio is recommended. Consult with a financial advisor before making any investment decisions. The information provided in this report is for educational purposes only and should not be construed as financial advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Conduct your own thorough research and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating AMZN: A Detailed Investment Report And Stock Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bitcoins Rally To 100 K Fuels Largest Short Squeeze In Years

May 12, 2025

Bitcoins Rally To 100 K Fuels Largest Short Squeeze In Years

May 12, 2025 -

E Xch Crypto Platform Closed In Germany Following E34 Million Seizure Bybit Hack Links Revealed

May 12, 2025

E Xch Crypto Platform Closed In Germany Following E34 Million Seizure Bybit Hack Links Revealed

May 12, 2025 -

The Rise Of Ai In Phishing Improved Detection Methods For Enhanced Email Security

May 12, 2025

The Rise Of Ai In Phishing Improved Detection Methods For Enhanced Email Security

May 12, 2025 -

Uk Equity Outflows Government Urged To Act Now

May 12, 2025

Uk Equity Outflows Government Urged To Act Now

May 12, 2025 -

Robert Whittaker And Reinier De Ridder Headline Ufc Fight Night Abu Dhabi

May 12, 2025

Robert Whittaker And Reinier De Ridder Headline Ufc Fight Night Abu Dhabi

May 12, 2025

Latest Posts

-

Taylan Mays Road To Recovery Nrl Comeback Nears Completion

May 13, 2025

Taylan Mays Road To Recovery Nrl Comeback Nears Completion

May 13, 2025 -

Death Of Bob Cowper Tributes Pour In For Australian Cricket Icon

May 13, 2025

Death Of Bob Cowper Tributes Pour In For Australian Cricket Icon

May 13, 2025 -

From 269 To Retirement Virat Kohlis Legacy In Test Cricket

May 13, 2025

From 269 To Retirement Virat Kohlis Legacy In Test Cricket

May 13, 2025 -

Despite Mc Tominays Performance Napoli Faces Serie A Race Challenges

May 13, 2025

Despite Mc Tominays Performance Napoli Faces Serie A Race Challenges

May 13, 2025 -

Post Ceasefire Relief Sensex Nifty Record Sharp Gains 2 300 And 24 700 Milestones Achieved

May 13, 2025

Post Ceasefire Relief Sensex Nifty Record Sharp Gains 2 300 And 24 700 Milestones Achieved

May 13, 2025