Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024

![Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024 Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024](https://newsone.smadcstdo.sch.id/image/evaluating-amzn-stock-a-detailed-investment-report-for-q-current-quarter-2024.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Evaluating AMZN Stock: A Detailed Investment Report for Q3 2024

Amazon (AMZN) stock has been a rollercoaster ride in recent years, defying easy categorization as a consistently growth-oriented or value-focused investment. As we delve into Q3 2024, evaluating AMZN requires a nuanced understanding of its diverse business segments and the broader economic landscape. This report provides a comprehensive analysis, aiming to help investors make informed decisions.

Q3 2024 Earnings: Key Highlights and Surprises

Amazon's Q3 2024 earnings announcement ( insert actual date and link to official report here) revealed [insert actual key highlights from the report: e.g., revenue growth, EPS, AWS performance, advertising revenue, etc.]. While [insert positive aspect, e.g., AWS continued its strong performance], [insert a challenge or area of concern, e.g., e-commerce growth slowed slightly compared to previous quarters]. This mixed performance necessitates a closer examination of the underlying factors.

Amazon's Diversified Business Model: A Strength and a Challenge

AMZN's success hinges on its diverse portfolio, encompassing:

- E-commerce: While facing increased competition, Amazon's massive market share and Prime membership base remain significant assets. However, evolving consumer behavior and inflationary pressures continue to present challenges. [Insert specific data points related to e-commerce performance in Q3 2024].

- Amazon Web Services (AWS): The undisputed leader in cloud computing, AWS remains a crucial driver of AMZN's profitability. [Insert specific data points regarding AWS revenue growth and market share in Q3 2024]. However, increasing competition from Microsoft Azure and Google Cloud Platform warrants monitoring.

- Advertising: Amazon's advertising platform is experiencing rapid growth, benefiting from its massive user base and targeted advertising capabilities. [Insert specific data points on advertising revenue growth]. This segment offers significant long-term potential.

- Other Businesses: This includes areas like physical stores (Whole Foods Market), subscription services (Prime Video, Audible), and devices (Alexa, Kindle). Their performance contributes to the overall picture but often receives less individual attention.

Analyzing Key Performance Indicators (KPIs):

To effectively evaluate AMZN stock, investors should focus on these KPIs:

- Revenue Growth: Overall revenue growth and the contribution of each segment are critical indicators of AMZN's overall health.

- Operating Income: Analyzing operating income helps assess profitability, excluding the impact of interest and taxes.

- Free Cash Flow (FCF): FCF is a crucial metric for assessing AMZN's ability to invest in growth, pay down debt, and return value to shareholders.

- Customer Acquisition Cost (CAC): In the highly competitive e-commerce space, understanding CAC is vital for evaluating the efficiency of AMZN's marketing efforts.

Valuation and Future Outlook:

[Insert a brief discussion of AMZN's current valuation, including metrics like P/E ratio and Price-to-Sales ratio. Compare these to historical values and industry averages]. The outlook for AMZN remains complex. While its long-term growth potential remains significant, investors must carefully weigh the risks associated with macroeconomic uncertainty, increased competition, and potential regulatory changes.

Investment Recommendation:

[Insert a balanced and cautious investment recommendation based on your analysis. This could include a "hold," "buy," or "sell" recommendation, along with a justification]. Remember that this is not financial advice, and investors should conduct their own thorough research before making any investment decisions.

Disclaimer: This article provides general information and commentary and does not constitute financial advice. Investment decisions should be based on your own research and consultation with a qualified financial advisor.

![Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024 Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024](https://newsone.smadcstdo.sch.id/image/evaluating-amzn-stock-a-detailed-investment-report-for-q-current-quarter-2024.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Evaluating AMZN Stock: A Detailed Investment Report For Q[Current Quarter] 2024. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai And Crypto Market Crashes Analyzing Mantras Om Collapse And Future Prevention

May 12, 2025

Ai And Crypto Market Crashes Analyzing Mantras Om Collapse And Future Prevention

May 12, 2025 -

Securing Battery Supplies Teslas Strategies For Future Growth

May 12, 2025

Securing Battery Supplies Teslas Strategies For Future Growth

May 12, 2025 -

Nvidia Stock Forecast Following The First Sell Rating And Potential Market Reactions

May 12, 2025

Nvidia Stock Forecast Following The First Sell Rating And Potential Market Reactions

May 12, 2025 -

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025

Hong Kong Stocks Year Long Winning Streak Continues Amidst Positive China Us Developments

May 12, 2025 -

Carberys Comments A Subtle Diss Of The Hurricanes From Capitals Bench

May 12, 2025

Carberys Comments A Subtle Diss Of The Hurricanes From Capitals Bench

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

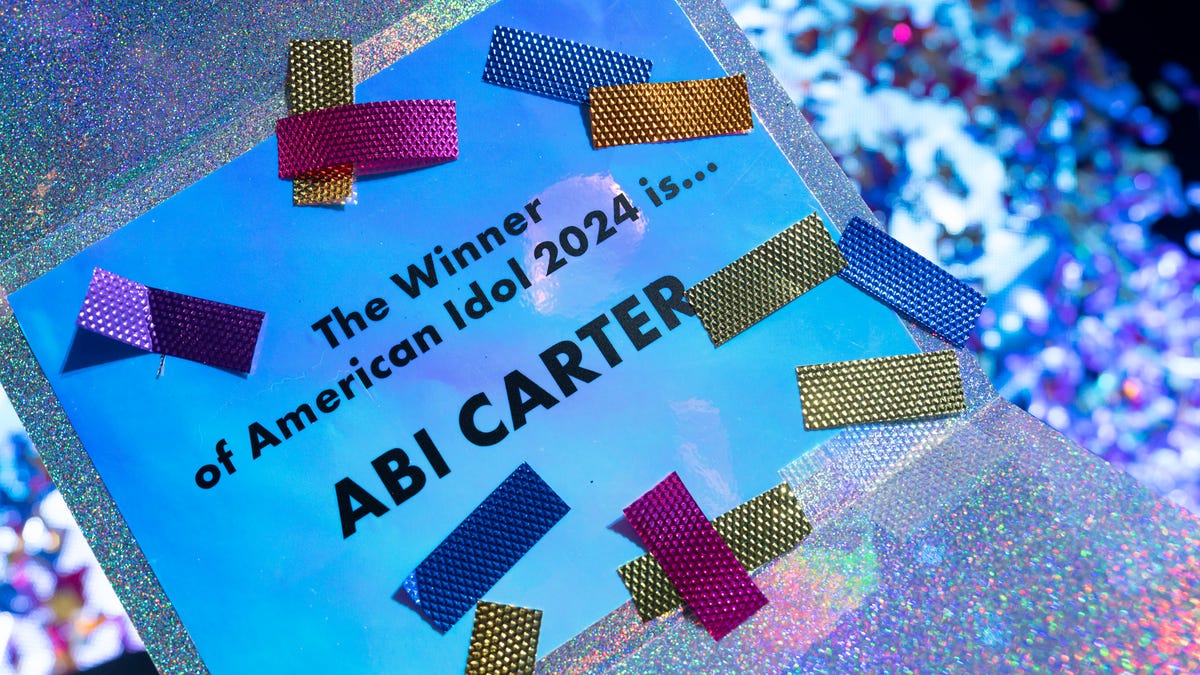

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025