Examining The Trump-Era Tax Cuts On Inexpensive Chinese Goods

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Examining the Trump-Era Tax Cuts: Did They Really Help Inexpensive Chinese Goods?

The Trump administration's 2017 tax cuts, touted as a boon for the American economy, had a complex and often debated impact on consumer goods, particularly those sourced from China. While the cuts aimed to stimulate domestic investment and job growth, their effect on the price of inexpensive Chinese imports remains a subject of ongoing analysis. Did these tax cuts truly lead to lower prices for consumers on goods like clothing, electronics, and household items imported from China? Let's delve into the details.

Understanding the Tax Cuts:

The Tax Cuts and Jobs Act of 2017 significantly lowered the corporate tax rate from 35% to 21%. Proponents argued this would encourage businesses to invest more, leading to higher wages and economic growth. However, the impact on import prices was less direct. The reduction in corporate taxes affected American companies in various ways, some of which indirectly influenced the cost of imported goods.

The Indirect Impact on Chinese Imports:

The relationship between the corporate tax cuts and the prices of inexpensive Chinese goods is nuanced. Several factors come into play:

-

Reduced Production Costs (Debated): Some argued that lower corporate taxes for American importers could potentially translate to lower costs, eventually leading to lower prices for consumers. This assumes that the tax savings were passed on to consumers, which is not always the case. Many companies chose to reinvest profits or increase shareholder dividends instead of lowering prices.

-

The Strength of the Dollar: The impact of the tax cuts on the US dollar's value also plays a role. A stronger dollar makes imports cheaper, including those from China. However, the dollar's fluctuation is influenced by many factors beyond just the tax cuts, making it difficult to isolate the impact.

-

Tariffs and Trade Wars: It's crucial to remember that the Trump administration also engaged in a trade war with China, imposing significant tariffs on numerous goods. These tariffs directly increased the price of Chinese imports, potentially offsetting any potential price reductions from the tax cuts. The net effect was often a price increase, despite the corporate tax cuts.

-

Supply Chain Dynamics: Global supply chains are intricate. The tax cuts' impact on individual links within these chains is difficult to isolate and measure accurately. The complexities of international trade make a simple cause-and-effect relationship almost impossible to establish.

Analyzing the Data:

Empirical evidence regarding the impact of the tax cuts on the prices of inexpensive Chinese goods is inconclusive. Studies have yielded mixed results, with some showing minimal price changes and others suggesting slight decreases. The challenge lies in separating the impact of the tax cuts from other influential factors like tariffs, currency fluctuations, and global economic conditions.

Conclusion:

While the 2017 tax cuts aimed to boost the American economy, their direct impact on the prices of inexpensive Chinese goods is far from clear-cut. The interplay of corporate tax rates, tariffs, currency exchange rates, and global supply chain dynamics makes it challenging to isolate the effect of the tax cuts alone. Further research and more nuanced economic modelling are necessary to arrive at a definitive conclusion. The narrative that the tax cuts significantly lowered the price of Chinese imports needs more substantial evidence to support it. The reality is far more complex and multifaceted than a simple narrative suggests.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Examining The Trump-Era Tax Cuts On Inexpensive Chinese Goods. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Indigenous Data Sovereignty Challenges And Solutions For Cultural Preservation

May 15, 2025

Indigenous Data Sovereignty Challenges And Solutions For Cultural Preservation

May 15, 2025 -

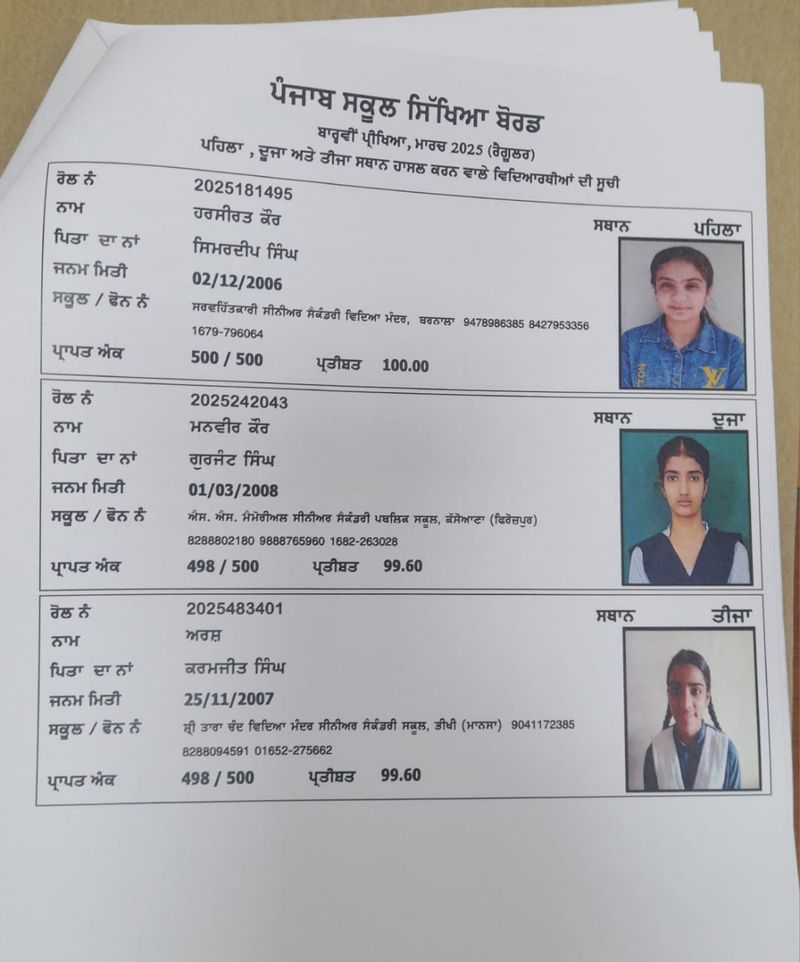

Barnala Students Perfect Score Pseb Announces Class Xii Results

May 15, 2025

Barnala Students Perfect Score Pseb Announces Class Xii Results

May 15, 2025 -

Redemption And Thanks Millers 200th Payback Mission

May 15, 2025

Redemption And Thanks Millers 200th Payback Mission

May 15, 2025 -

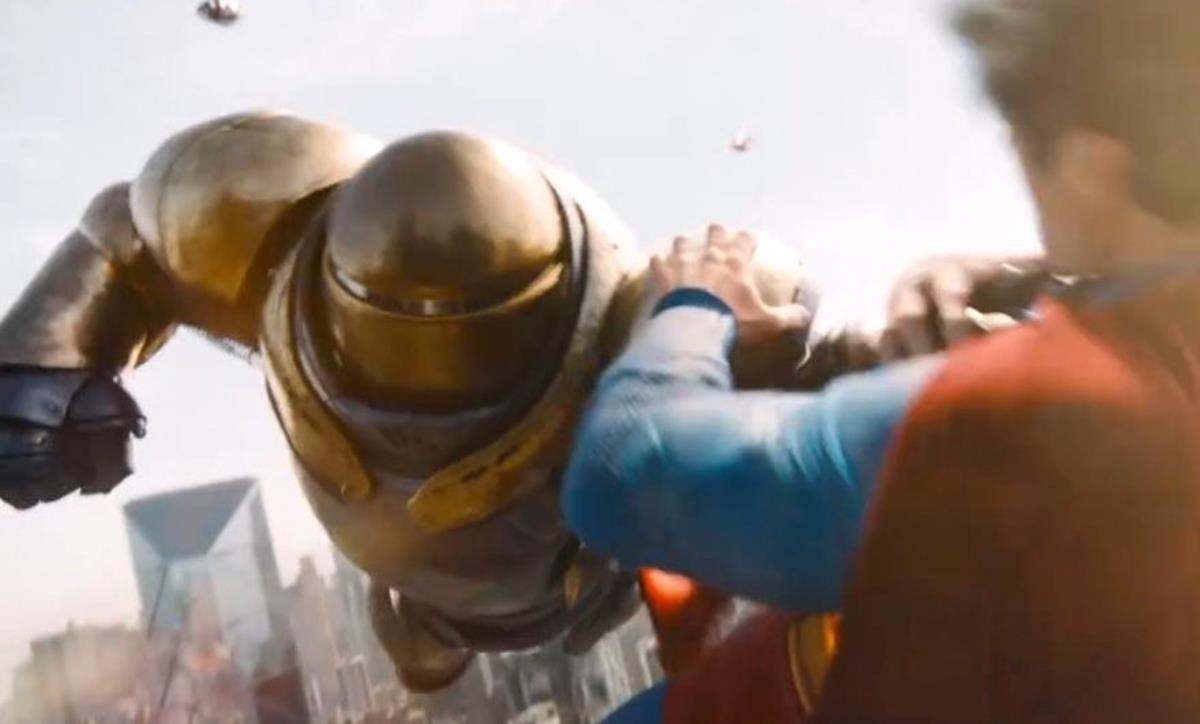

Superman Trailer Update James Gunn Shares Exciting News

May 15, 2025

Superman Trailer Update James Gunn Shares Exciting News

May 15, 2025 -

Belichick To Carolina Week 1 Coaching Status Update And Analysis

May 15, 2025

Belichick To Carolina Week 1 Coaching Status Update And Analysis

May 15, 2025

Latest Posts

-

The Hammer Of Boravia Vs Superman Trailer Teases Intense Confrontation Spoilers Inside

May 15, 2025

The Hammer Of Boravia Vs Superman Trailer Teases Intense Confrontation Spoilers Inside

May 15, 2025 -

Health Update On Martin Brundle Damon Hill Among Those Offering Support

May 15, 2025

Health Update On Martin Brundle Damon Hill Among Those Offering Support

May 15, 2025 -

New Study Suggests Stonehenge Stones Transported From Other Prehistoric Sites

May 15, 2025

New Study Suggests Stonehenge Stones Transported From Other Prehistoric Sites

May 15, 2025 -

Four Key Features And Enhanced Security In The New I Os 18 5 Update

May 15, 2025

Four Key Features And Enhanced Security In The New I Os 18 5 Update

May 15, 2025 -

Analyzing The Bruins 2025 Nhl Mock Draft A Critical Selection

May 15, 2025

Analyzing The Bruins 2025 Nhl Mock Draft A Critical Selection

May 15, 2025