Exchange-Traded Funds And Wall Street Fuel Record US Bitcoin Market Share

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Exchange-Traded Funds and Wall Street Fuel Record US Bitcoin Market Share

Bitcoin's dominance in the US cryptocurrency market has surged to record highs, fueled by the growing influence of Wall Street and the emergence of Bitcoin exchange-traded funds (ETFs). This unprecedented growth signifies a major shift in the landscape of digital assets, bringing Bitcoin closer to mainstream financial acceptance than ever before.

The recent surge in US Bitcoin market share is not a coincidence. Several key factors have converged to create this perfect storm:

The Rise of Bitcoin ETFs: The approval of Bitcoin futures ETFs by the Securities and Exchange Commission (SEC) has opened the floodgates for institutional investment. These ETFs provide a regulated and accessible pathway for traditional investors, including pension funds and hedge funds, to gain exposure to Bitcoin without directly holding the cryptocurrency. This significantly lowers the barrier to entry and encourages broader participation. The ease of access through brokerage accounts familiar to Wall Street professionals is a game-changer.

Wall Street's Embrace of Crypto: Previously hesitant, major Wall Street firms are now actively embracing Bitcoin and other cryptocurrencies. This shift is driven by increasing investor demand and the recognition of Bitcoin's potential as a valuable asset class. Several financial giants are launching their own crypto-related products and services, further legitimizing Bitcoin's place in the financial world. This institutional backing provides a level of confidence that previously lacked in the cryptocurrency market.

Increased Regulatory Clarity (While Still Evolving): Although regulatory clarity remains a work in progress, the gradual introduction of regulations and guidelines provides a more stable and predictable environment for institutional investment. This reduces uncertainty and encourages more significant capital inflows into the Bitcoin market. While complete regulatory clarity is still sought after, the current trajectory suggests a positive trend for institutional adoption.

Impact on the US Market: The combined effect of these factors is a dramatic increase in Bitcoin's market share within the United States. This isn't just about price fluctuations; it represents a fundamental shift in how Bitcoin is perceived and utilized within the US financial system. This heightened adoption will likely have ripple effects throughout the broader cryptocurrency market and beyond.

What This Means for the Future: The current trajectory suggests continued growth in Bitcoin's US market share. As more ETFs are approved and more institutional investors enter the market, we can anticipate even greater levels of adoption. However, it's important to acknowledge that market volatility remains a key characteristic of cryptocurrencies. While the long-term outlook appears positive, short-term fluctuations are to be expected.

Key Takeaways:

- Increased Institutional Investment: Wall Street's involvement is a crucial driver of Bitcoin's growth.

- Bitcoin ETF Approvals: ETFs have made Bitcoin accessible to a wider range of investors.

- Growing Regulatory Clarity: A more regulated environment encourages institutional participation.

- US Market Dominance: Bitcoin is establishing a powerful foothold in the US cryptocurrency market.

The future of Bitcoin in the US, and globally, is undeniably linked to the ongoing interplay between regulatory frameworks, institutional adoption, and the continued development of innovative financial products like Bitcoin ETFs. The record US market share currently enjoyed by Bitcoin signals a significant turning point in its journey towards mainstream acceptance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Exchange-Traded Funds And Wall Street Fuel Record US Bitcoin Market Share. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Blues To Brilliance Revells Path To Redemption

Apr 28, 2025

From Blues To Brilliance Revells Path To Redemption

Apr 28, 2025 -

Ge 2025 Analyzing The Singaporean Political Landscape

Apr 28, 2025

Ge 2025 Analyzing The Singaporean Political Landscape

Apr 28, 2025 -

Rr Vs Gt Live Score Ipl 2025 Match Update Gill Out Buttlers Drop

Apr 28, 2025

Rr Vs Gt Live Score Ipl 2025 Match Update Gill Out Buttlers Drop

Apr 28, 2025 -

Massive Bitcoin Whale Purchases Spark Price Rally Market Analysis

Apr 28, 2025

Massive Bitcoin Whale Purchases Spark Price Rally Market Analysis

Apr 28, 2025 -

Dados Economicos Copom Ipca China E Perspectivas Para A Industria

Apr 28, 2025

Dados Economicos Copom Ipca China E Perspectivas Para A Industria

Apr 28, 2025

Latest Posts

-

Justice Gorsuch Scolds Litigator In Unprecedented Supreme Court Exchange

Apr 30, 2025

Justice Gorsuch Scolds Litigator In Unprecedented Supreme Court Exchange

Apr 30, 2025 -

Arsenal Psg Rematch Luis Enrique Urges Team To Rewrite The Narrative

Apr 30, 2025

Arsenal Psg Rematch Luis Enrique Urges Team To Rewrite The Narrative

Apr 30, 2025 -

Mertens Falls To Sabalenka In Three Sets Belarusians Ninth Straight Win

Apr 30, 2025

Mertens Falls To Sabalenka In Three Sets Belarusians Ninth Straight Win

Apr 30, 2025 -

Disability Rights Face Supreme Court Scrutiny Will Landmark Ruling Emerge

Apr 30, 2025

Disability Rights Face Supreme Court Scrutiny Will Landmark Ruling Emerge

Apr 30, 2025 -

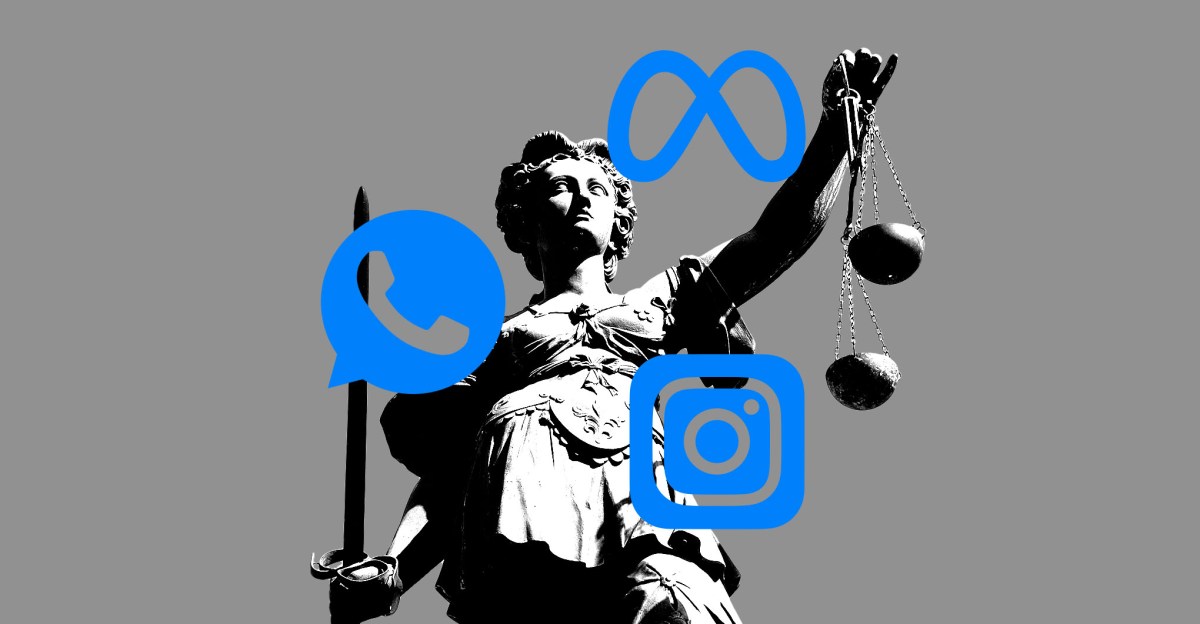

Ftc V Meta Live Updates On Instagram And Whats App Case

Apr 30, 2025

Ftc V Meta Live Updates On Instagram And Whats App Case

Apr 30, 2025