Exploring Tether's Operational Reach: A Contrast With Traditional Banking Practices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Exploring Tether's Operational Reach: A Contrast with Traditional Banking Practices

Tether (USDT), the world's largest stablecoin, operates within a complex regulatory landscape, significantly different from traditional banking. This article delves into Tether's operational reach, comparing and contrasting its functions with established banking practices.

The meteoric rise of cryptocurrencies has brought forth innovative financial instruments, challenging traditional banking models. Tether, pegged to the US dollar, plays a pivotal role in this new ecosystem, facilitating transactions and providing a bridge between the crypto and fiat worlds. However, its operations differ dramatically from those of traditional banks, raising important questions about transparency, regulation, and systemic risk.

Transparency and Reserve Management: A Key Difference

One of the most significant distinctions lies in transparency. Traditional banks are subject to rigorous regulatory oversight, requiring regular audits and public disclosure of their financial health. This ensures accountability and builds trust among depositors. Tether, while claiming to maintain a 1:1 reserve ratio with the US dollar, has faced considerable scrutiny regarding the composition and verification of its reserves. The company has published attestations, but these haven't fully quelled concerns about the full transparency of its backing assets. This lack of comprehensive, independently verified audits creates a stark contrast to the stringent reporting requirements imposed on traditional banks.

Global Reach vs. Geographic Limitations:

Tether boasts a global reach, facilitating transactions across borders with relative ease. This contrasts with traditional banking, which often involves complex correspondent banking relationships and stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance regulations that can hinder cross-border payments. While Tether's global accessibility offers significant advantages for speed and efficiency, it also raises concerns regarding its potential use in illicit activities. The lack of comprehensive regulatory oversight across all jurisdictions makes monitoring and controlling such activities significantly more challenging.

Operational Efficiency and Speed:

Tether's operational efficiency is undeniable. Transactions are often processed considerably faster and at lower costs than traditional bank wire transfers. This speed and efficiency are crucial for the fast-paced world of cryptocurrency trading. Traditional banks, bound by regulatory compliance and established procedures, often lag behind in terms of speed and cost-effectiveness, particularly for international transactions.

Regulatory Scrutiny and the Future:

Tether's operational model has attracted significant regulatory scrutiny from various authorities worldwide. Concerns around its reserve management, transparency, and potential role in money laundering are driving calls for stricter oversight. The future of Tether and stablecoins, in general, will likely depend on increased transparency, stricter regulatory frameworks, and the adoption of more robust auditing procedures. This evolution will likely necessitate a shift towards practices that more closely align with the established regulatory norms of the traditional banking sector.

In Conclusion:

While Tether offers significant advantages in terms of speed, efficiency, and global reach, its operational practices differ substantially from traditional banking. The lack of comprehensive transparency and the challenges posed by its global reach necessitate a clear and robust regulatory framework. The future of Tether and the broader stablecoin landscape will be shaped by the evolution of this regulatory landscape and the industry's ability to address concerns around transparency and risk management. The contrast between Tether's operations and established banking practices highlights the need for a balanced approach: fostering innovation while mitigating potential risks to the financial system.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Exploring Tether's Operational Reach: A Contrast With Traditional Banking Practices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monte Carlo Qf Predictions Tsitsipas Musetti And De Minaur Dimitrov Showdowns

Apr 12, 2025

Monte Carlo Qf Predictions Tsitsipas Musetti And De Minaur Dimitrov Showdowns

Apr 12, 2025 -

Bringing Back The Dire Wolf A Milestone In Genetic Engineering

Apr 12, 2025

Bringing Back The Dire Wolf A Milestone In Genetic Engineering

Apr 12, 2025 -

Csks Ipl 2025 Strategy Dhonis Leadership Gaikwads Absence

Apr 12, 2025

Csks Ipl 2025 Strategy Dhonis Leadership Gaikwads Absence

Apr 12, 2025 -

Enges Rennen Rahm Kaempft Um Seinen Wahlkreis

Apr 12, 2025

Enges Rennen Rahm Kaempft Um Seinen Wahlkreis

Apr 12, 2025 -

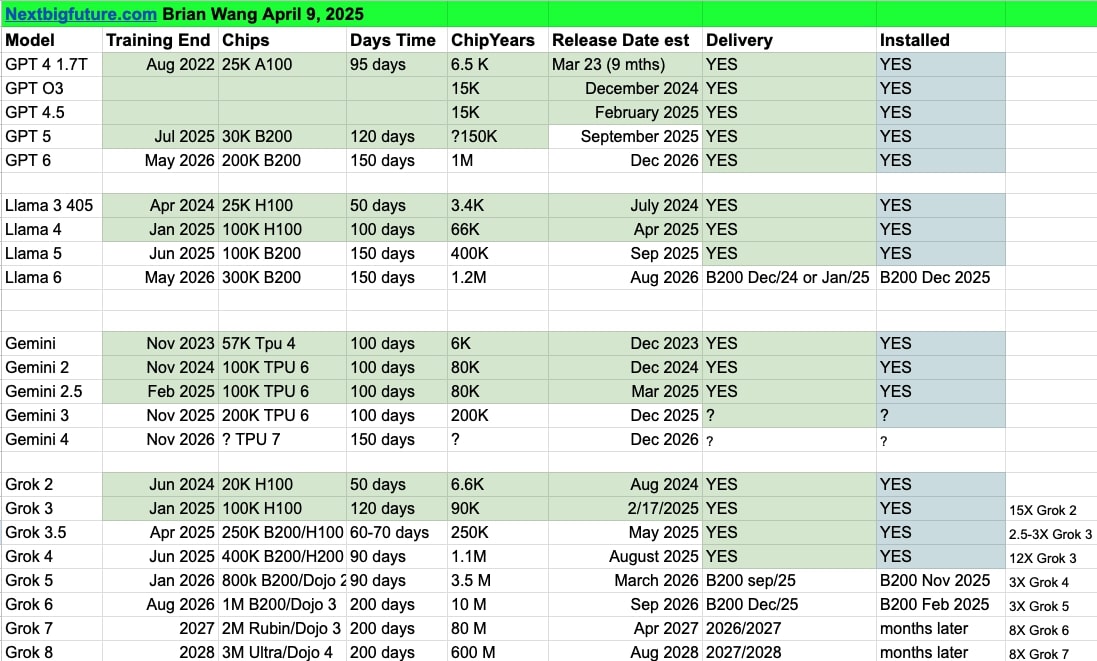

X Ais Grok 3 5 Release In May Grok 4 In September

Apr 12, 2025

X Ais Grok 3 5 Release In May Grok 4 In September

Apr 12, 2025