Factors Contributing To The Recent Increase In Meta (META) Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Meta (META) Stock Soars: Unpacking the Factors Behind the Recent Surge

Meta Platforms (META) stock has experienced a significant upswing recently, leaving investors and analysts scrambling to understand the driving forces behind this resurgence. After a period of considerable volatility and market skepticism, several key factors have converged to propel META shares to new heights. This article delves into the contributing elements, offering insights into the company's renewed momentum and potential future trajectory.

The Metaverse Momentum (and Beyond):

While the "Metaverse" itself hasn't yet delivered the immediate returns some anticipated, Meta's strategic pivots and investments in this space are finally starting to show promise. Improved user engagement metrics within its VR and AR initiatives, coupled with increased developer interest and the launch of new features, signal a growing ecosystem. This progress, though incremental, is reassuring investors who were previously concerned about the substantial resources allocated to this long-term bet. Furthermore, the company's strategic partnerships and acquisitions in the AR/VR space are beginning to bear fruit, adding to the overall positive sentiment.

AI Integration and Advertising Revenue:

Meta's aggressive integration of artificial intelligence across its platforms, particularly in advertising, is a major contributor to its stock's recent climb. Improved targeting capabilities, enhanced ad relevance, and streamlined campaign management tools are boosting advertiser ROI, leading to increased ad spend and, consequently, higher revenue for Meta. This strategic move showcases Meta's adaptability and its ability to leverage cutting-edge technology to maintain its dominant position in the digital advertising landscape. The enhanced AI tools also improve content moderation and user experience, creating a virtuous cycle of growth.

Stronger-Than-Expected Earnings Reports:

Recent earnings reports from Meta have consistently exceeded analysts' expectations. These positive financial results, showcasing robust revenue growth and improved profitability, have significantly boosted investor confidence. The reports highlight not only the success of core advertising revenue streams but also the growing contribution of other revenue segments, demonstrating diversification and resilience within the company's business model. This positive financial performance directly translates to higher stock valuations.

Improved Market Sentiment and Macroeconomic Factors:

The overall improvement in market sentiment, following a period of economic uncertainty, has also played a role in Meta's stock price appreciation. Investors are increasingly looking towards tech giants with strong fundamentals and growth potential, and Meta fits this profile. Furthermore, favorable macroeconomic factors, such as easing inflation and a more stable interest rate environment, have contributed to a more positive investor outlook across the broader market, benefiting companies like Meta.

Increased Focus on Efficiency and Cost-Cutting Measures:

Meta's commitment to streamlining operations and implementing cost-cutting measures has also resonated positively with investors. The company has demonstrated a renewed focus on efficiency, improving profitability margins and demonstrating a responsible approach to resource management. This fiscal discipline reassures investors concerned about previous spending on ambitious projects.

Looking Ahead:

While the recent surge in Meta's stock price is encouraging, investors should remain mindful of potential risks and challenges. The competitive landscape remains intense, with other tech giants vying for market share. Furthermore, regulatory scrutiny and concerns about data privacy continue to pose potential headwinds. However, the factors outlined above suggest that Meta is well-positioned for continued growth, making it an attractive investment for those with a long-term perspective. The company's adaptability, strategic investments, and strong financial performance contribute to a bullish outlook for META stock in the coming months and years.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Factors Contributing To The Recent Increase In Meta (META) Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Progress In Us China Trade Negotiations Fuels Market Optimism

May 13, 2025

Progress In Us China Trade Negotiations Fuels Market Optimism

May 13, 2025 -

Ryzen 7 Pc In A Foldable Keyboard Chassis Pocket Sized Powerhouse

May 13, 2025

Ryzen 7 Pc In A Foldable Keyboard Chassis Pocket Sized Powerhouse

May 13, 2025 -

O Custo Das Greves Impacto Financeiro Em Empresas Devido A Paralisacoes Publicas

May 13, 2025

O Custo Das Greves Impacto Financeiro Em Empresas Devido A Paralisacoes Publicas

May 13, 2025 -

Virgin Media O2 And Daisy Group A B2 B Merger Reshapes The Uk Telecom Landscape

May 13, 2025

Virgin Media O2 And Daisy Group A B2 B Merger Reshapes The Uk Telecom Landscape

May 13, 2025 -

Descubra Como Aproveitar Casas Na Praia E Campo Sem Compra Melhores Opcoes

May 13, 2025

Descubra Como Aproveitar Casas Na Praia E Campo Sem Compra Melhores Opcoes

May 13, 2025

Latest Posts

-

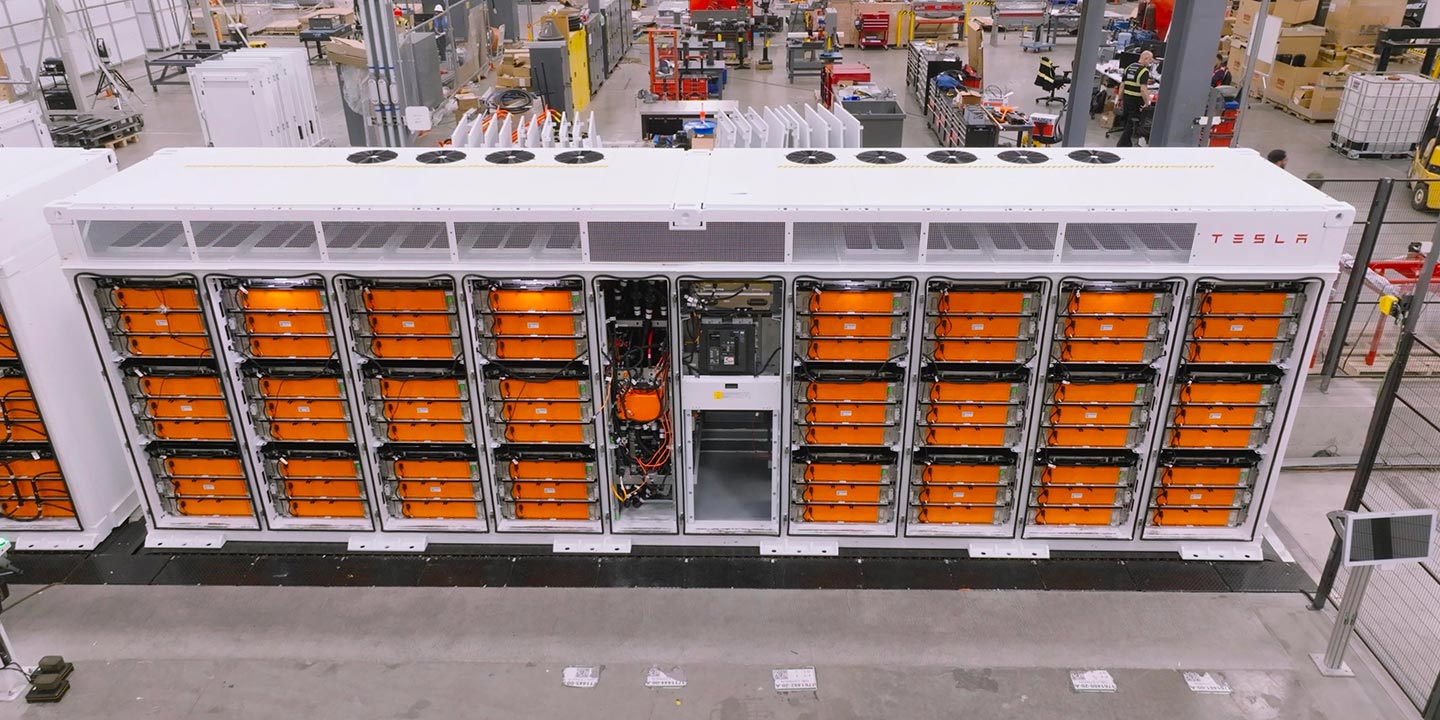

Securing Battery Supply Teslas Path To Sustainable Growth

May 13, 2025

Securing Battery Supply Teslas Path To Sustainable Growth

May 13, 2025 -

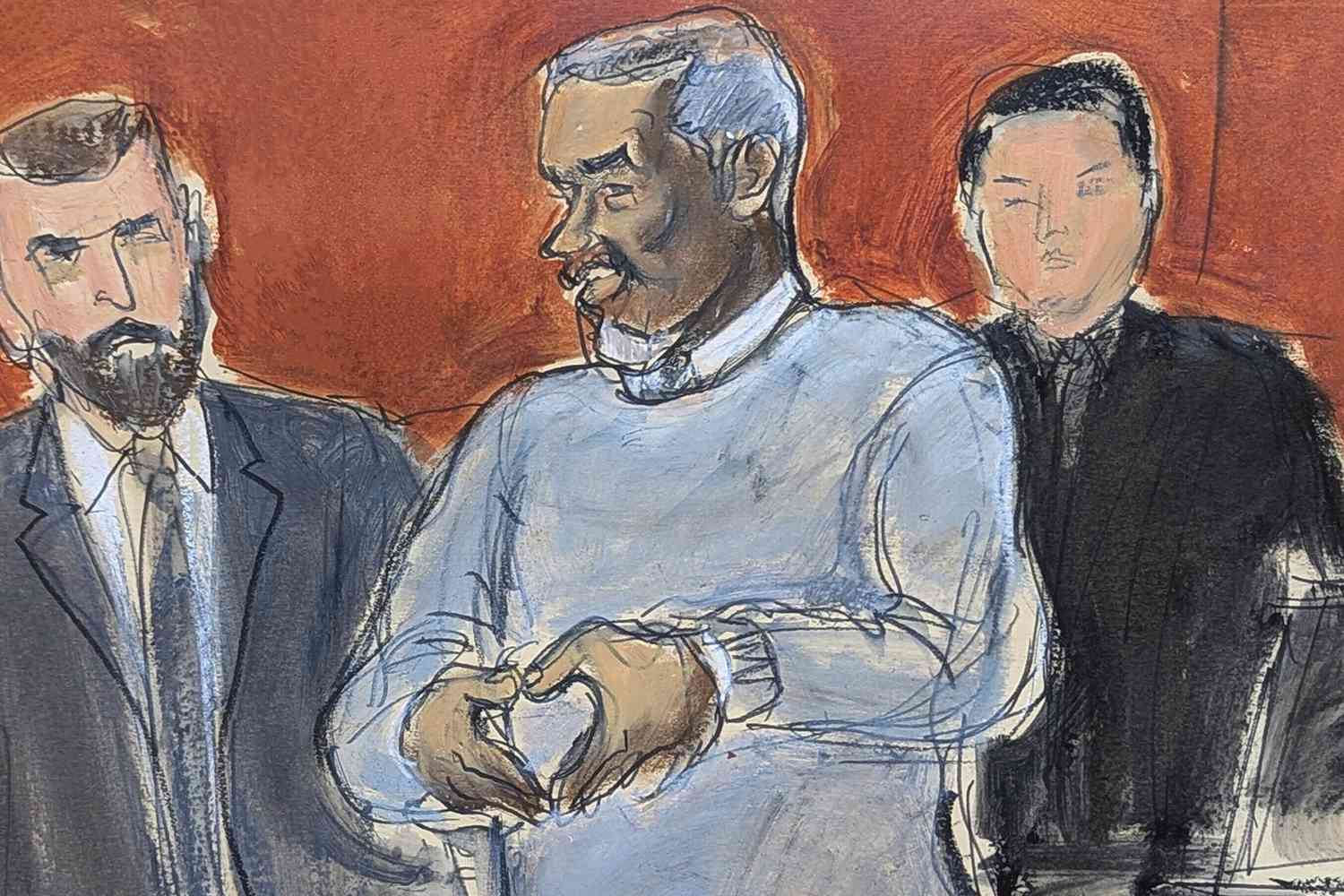

Exotic Dancer Alleges Forced Sex Act With Cassie While Diddy Watched

May 13, 2025

Exotic Dancer Alleges Forced Sex Act With Cassie While Diddy Watched

May 13, 2025 -

Singapores Covid 19 Situation Authorities Prepare For Periodic Case Increases

May 13, 2025

Singapores Covid 19 Situation Authorities Prepare For Periodic Case Increases

May 13, 2025 -

French Actor Gerard Depardieu Sentenced For Sexual Assault

May 13, 2025

French Actor Gerard Depardieu Sentenced For Sexual Assault

May 13, 2025 -

Mothers Day Tragedy Heartbreaking Video Of Grieving Elephant In Malaysia

May 13, 2025

Mothers Day Tragedy Heartbreaking Video Of Grieving Elephant In Malaysia

May 13, 2025