Faster Cross-Border Payments In Africa: A USDC-Powered Solution

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Faster Cross-Border Payments in Africa: A USDC-Powered Solution

Africa's vibrant and rapidly growing economies are increasingly hampered by slow and expensive cross-border payment systems. Traditional methods often involve multiple intermediaries, lengthy processing times, and significant fees, hindering trade and economic development. However, a groundbreaking solution leveraging the power of USD Coin (USDC) is emerging, promising to revolutionize how money moves across African borders.

This innovative approach utilizes blockchain technology to streamline the process, offering significant advantages over traditional banking channels. Let's delve into the details of this game-changing development and explore its potential impact on the African continent.

The Challenges of Traditional Cross-Border Payments in Africa

For decades, businesses and individuals in Africa have faced numerous hurdles when sending and receiving money internationally. These challenges include:

- High transaction fees: Traditional methods often involve multiple banks and intermediaries, leading to exorbitant fees that eat into the transferred amount.

- Slow processing times: Transfers can take days, even weeks, to complete, creating significant delays and impacting business operations.

- Lack of transparency: The lack of real-time tracking and visibility into the transaction process makes it difficult to monitor progress and resolve discrepancies.

- Limited access: Many individuals and businesses, particularly in rural areas, lack access to formal banking systems, further exacerbating the problem.

These limitations significantly stifle economic growth, hindering trade, investment, and the overall development of African nations.

USDC: A Game-Changer for African Cross-Border Payments

Enter USDC, a stablecoin pegged to the US dollar, offering a faster, cheaper, and more transparent alternative. Its blockchain-based nature allows for:

- Faster transaction speeds: Transactions are processed significantly faster compared to traditional methods, often within minutes or hours.

- Lower transaction costs: Eliminating intermediaries reduces fees dramatically, making cross-border payments more affordable.

- Increased transparency: The entire transaction history is recorded on a public, immutable ledger, enhancing transparency and accountability.

- Improved accessibility: Digital wallets and mobile money platforms make USDC accessible to a wider range of users, including those in underserved communities.

How USDC Facilitates Faster Cross-Border Payments

The process typically involves a few key steps:

- Sending USDC: The sender converts their local currency to USDC and initiates the transfer via a compatible platform.

- On-chain transfer: The USDC is transferred across the blockchain network, bypassing traditional banking infrastructure.

- Receipt of USDC: The recipient receives the USDC in their digital wallet.

- Conversion (optional): The recipient can then convert the USDC back to their local currency.

The Future of Cross-Border Payments in Africa

The adoption of USDC and similar blockchain-based solutions holds immense potential for transforming cross-border payments in Africa. This technology empowers businesses, facilitates remittances, and fosters economic growth by:

- Boosting trade: Reduced costs and faster processing times stimulate trade between African nations and with the rest of the world.

- Facilitating remittances: Millions of Africans living abroad can send money home more easily and affordably.

- Driving financial inclusion: Digital payment systems improve access to financial services for the unbanked population.

- Creating new opportunities: The technology fosters innovation and the development of new fintech solutions within the African ecosystem.

While challenges remain, such as regulatory clarity and internet access, the potential benefits of USDC-powered cross-border payments are undeniable. As the technology matures and adoption increases, we can expect to see a significant positive impact on the economic landscape of Africa. This move towards a more efficient and accessible financial system is a crucial step towards unlocking Africa's full economic potential.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Faster Cross-Border Payments In Africa: A USDC-Powered Solution. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

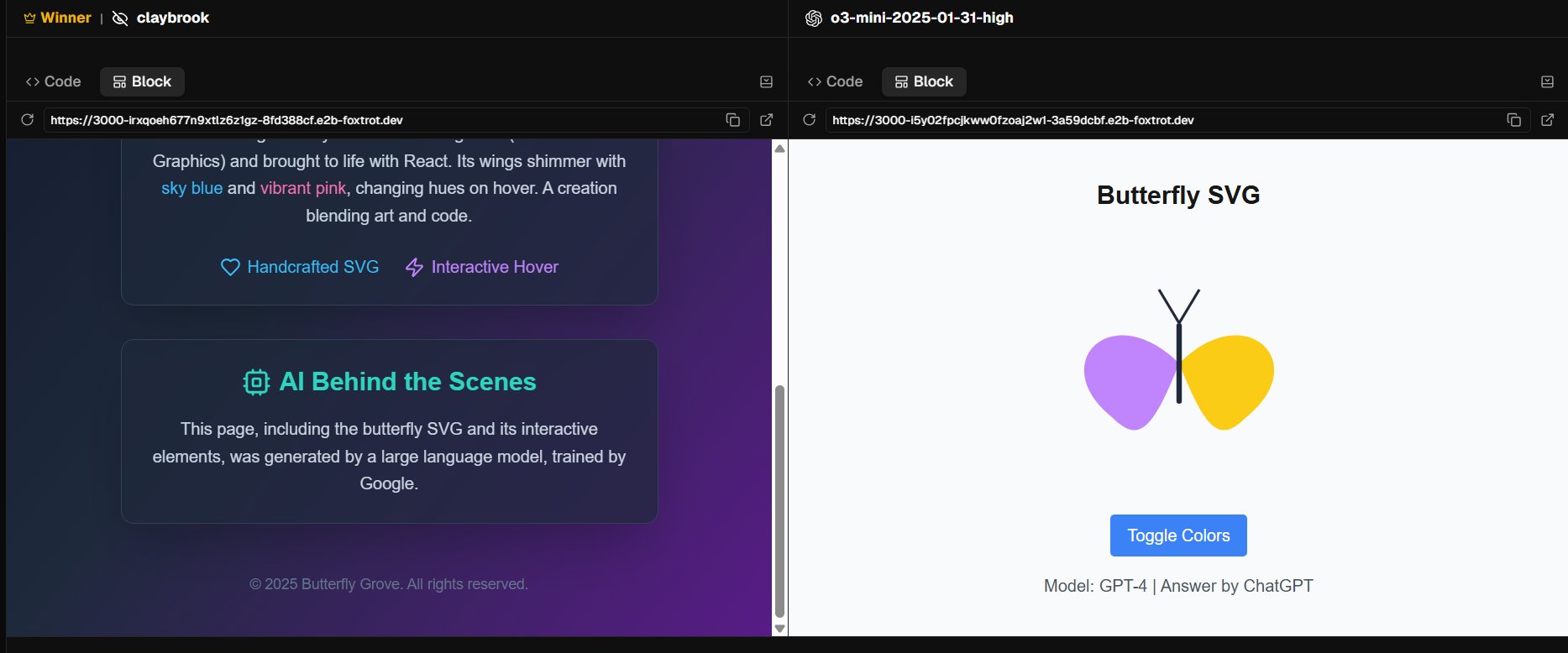

Boosting Productivity How Googles Claybrook Ai Impacts Ui Ux And Web Development

May 02, 2025

Boosting Productivity How Googles Claybrook Ai Impacts Ui Ux And Web Development

May 02, 2025 -

Mid 2030s Nuclear Power Goal Coalitions Progress And Challenges

May 02, 2025

Mid 2030s Nuclear Power Goal Coalitions Progress And Challenges

May 02, 2025 -

Betis Siviglia Vs Fiorentina Dove Vedere La Semifinale Andata Di Conference League

May 02, 2025

Betis Siviglia Vs Fiorentina Dove Vedere La Semifinale Andata Di Conference League

May 02, 2025 -

Champions League Club Eyes Chelsea Outcast Solution To Summer Transfer Dilemma

May 02, 2025

Champions League Club Eyes Chelsea Outcast Solution To Summer Transfer Dilemma

May 02, 2025 -

Old Trafford Shake Up Ratcliffes Latest Round Of Senior Staff Cuts

May 02, 2025

Old Trafford Shake Up Ratcliffes Latest Round Of Senior Staff Cuts

May 02, 2025