Fear And Greed In Crypto: Applying Buffett's Principles

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fear and Greed in Crypto: Applying Buffett's Principles for Smarter Investing

The cryptocurrency market is notorious for its volatility, a rollercoaster ride fueled by intense fear and greed. While fortunes can be made (and lost) overnight, navigating this turbulent landscape requires a level head and a sound investment strategy. This is where the timeless wisdom of Warren Buffett, the Oracle of Omaha, can offer valuable insights. By applying Buffett's principles of value investing, long-term perspective, and risk management, crypto investors can significantly improve their chances of success and mitigate the emotional pitfalls of the market.

Understanding the Emotional Rollercoaster:

The crypto market is driven by powerful emotions. Fear of missing out (FOMO) often leads to impulsive purchases at inflated prices, while sudden market dips trigger panic selling, exacerbating losses. Conversely, greed can lead to over-investment and ignoring crucial risk factors. These emotional responses are precisely what Buffett cautions against.

Buffett's Principles: A Crypto Context:

Buffett’s core investment philosophy centers on identifying undervalued assets with strong fundamentals and holding them for the long term. Applying this to crypto requires a shift in mindset:

-

Value Investing: Instead of chasing the next "moon shot," focus on cryptocurrencies with demonstrable utility, strong community support, and a clear roadmap. Consider factors like adoption rates, technological innovation, and the overall project's potential for long-term growth. Don't let hype dictate your decisions.

-

Long-Term Perspective: Buffett famously advocates for a buy-and-hold strategy. The crypto market's volatility can be daunting, but short-term fluctuations should not derail your long-term plan. Resist the urge to react impulsively to every price swing. Conduct thorough research before entering the market.

-

Understanding Risk: Diversification is key. Don't put all your eggs in one basket. Spread your investments across different cryptocurrencies and asset classes to mitigate potential losses. Thorough due diligence is crucial; understand the technology, the team behind the project, and the potential risks before investing. Never invest more than you can afford to lose.

-

Ignore the Noise: The crypto space is saturated with speculation and misinformation. Filter out the noise and focus on reliable sources of information. Avoid making investment decisions based on social media trends or unsubstantiated claims.

Practical Application:

Applying Buffett's principles in the crypto world might look like this:

-

Research: Deeply research projects before investing. Understand the whitepaper, the team, the technology, and the market potential.

-

Diversification: Invest in a diversified portfolio of cryptocurrencies with different use cases and levels of risk.

-

Dollar-Cost Averaging (DCA): Instead of investing a lump sum, invest smaller amounts regularly to reduce the impact of market volatility.

-

Long-Term Holding: Unless a fundamental shift occurs, hold onto your investments for the long term, ignoring short-term price fluctuations.

-

Risk Management: Set stop-loss orders to limit potential losses and avoid emotional decision-making.

Conclusion:

The cryptocurrency market presents both immense opportunities and significant risks. By applying Warren Buffett's principles of value investing, long-term perspective, and careful risk management, investors can navigate the emotional turmoil and increase their chances of long-term success. Remember, patience, discipline, and thorough research are invaluable in this volatile landscape. Don't let fear and greed dictate your decisions; let sound investment strategies guide your path to financial success in the crypto world.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fear And Greed In Crypto: Applying Buffett's Principles. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Black Family Travel Motivations And Impacts

May 17, 2025

Black Family Travel Motivations And Impacts

May 17, 2025 -

Lady Gaga To Perform Live At Netflix Tudum 2025 Exclusive Details

May 17, 2025

Lady Gaga To Perform Live At Netflix Tudum 2025 Exclusive Details

May 17, 2025 -

Jason Universe Unveils New Jason Voorhees Design By Horror Makeup Legend Greg Nicotero

May 17, 2025

Jason Universe Unveils New Jason Voorhees Design By Horror Makeup Legend Greg Nicotero

May 17, 2025 -

Brasil E China Perspectivas Economicas Para A Industria Com Foco No Ipca E Copom

May 17, 2025

Brasil E China Perspectivas Economicas Para A Industria Com Foco No Ipca E Copom

May 17, 2025 -

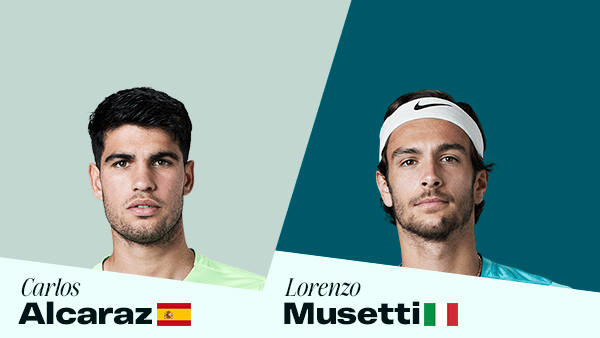

Where To Watch Alcaraz Vs Musetti Rome Semifinal Match Preview And Betting Odds

May 17, 2025

Where To Watch Alcaraz Vs Musetti Rome Semifinal Match Preview And Betting Odds

May 17, 2025