February Highs Revisited: Tracking Key Price Levels For Tesla Stock

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

February Highs Revisited: Tracking Key Price Levels for Tesla Stock

Tesla's stock price has been on a rollercoaster ride, recently experiencing a significant surge. Investors are now keenly watching to see if the electric vehicle giant can reclaim its February highs and maintain this upward momentum. This article delves into the key price levels to watch and analyzes the factors influencing Tesla's stock performance.

Reclaiming the Peak: February's Highs as a Crucial Benchmark

Tesla's stock reached significant highs in February 2024 (specify the exact date and price for accuracy). This peak serves as a crucial psychological and technical level for traders and investors. Breaking above this resistance could signal a sustained bullish trend, potentially opening the door for further gains. Conversely, failure to surpass this level might indicate a temporary rally, potentially leading to a pullback.

Key Price Levels to Watch:

-

Immediate Resistance: The February high itself presents the most immediate resistance level. A decisive break above this level would be a strong bullish signal. (Specify the exact price).

-

Psychological Levels: Round numbers like $200, $250, and $300 often act as significant support and resistance levels due to psychological factors influencing investor behavior. Monitoring these levels is crucial.

-

Moving Averages: Tracking key moving averages, such as the 50-day and 200-day moving averages, can provide insights into the short-term and long-term trends. A break above these moving averages would confirm a bullish trend. (Specify the current values of these averages).

-

Support Levels: Identifying potential support levels, based on previous price lows or technical indicators, is crucial for assessing potential downside risks. (Specify potential support levels based on chart analysis).

Factors Influencing Tesla's Stock Price:

Several factors are currently influencing Tesla's stock performance, including:

-

Production and Delivery Numbers: Stronger-than-expected production and delivery figures usually boost investor confidence. Any updates on production targets and delivery timelines will significantly impact the stock price.

-

Elon Musk's Activities: Elon Musk's public statements and actions can have a considerable influence on Tesla's stock. Any news related to his ventures or tweets should be closely monitored.

-

Competition in the EV Market: The increasing competition in the electric vehicle market is a key factor to consider. News about competitors' products or market share will impact Tesla's stock.

-

Overall Market Sentiment: The broader economic climate and overall market sentiment significantly affect Tesla's stock, alongside other tech stocks. A positive market outlook generally benefits Tesla.

-

Regulatory Changes: Any significant regulatory changes affecting the automotive or technology industry can impact Tesla’s stock price.

Analyzing the Chart: Technical Indicators to Consider

Technical analysis is vital for understanding the potential trajectory of Tesla’s stock. Key indicators to watch include:

-

RSI (Relative Strength Index): An indicator of momentum, often used to identify overbought and oversold conditions.

-

MACD (Moving Average Convergence Divergence): Another momentum indicator, used to identify potential buy and sell signals.

-

Volume: High trading volume often accompanies significant price movements, confirming the strength of a trend.

Conclusion: Navigating the Tesla Stock Trajectory

Whether Tesla can successfully reclaim its February highs remains to be seen. However, by closely monitoring key price levels, understanding the influencing factors, and utilizing technical analysis, investors can navigate this dynamic situation more effectively. The information provided here is for informational purposes only and should not be considered financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on February Highs Revisited: Tracking Key Price Levels For Tesla Stock. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

To Buy Or Not To Buy Evaluating Amazon Stock For Long Term Growth

May 13, 2025

To Buy Or Not To Buy Evaluating Amazon Stock For Long Term Growth

May 13, 2025 -

Mexican Cattle Imports Suspended Us Cites Flesh Eating Maggot Risk

May 13, 2025

Mexican Cattle Imports Suspended Us Cites Flesh Eating Maggot Risk

May 13, 2025 -

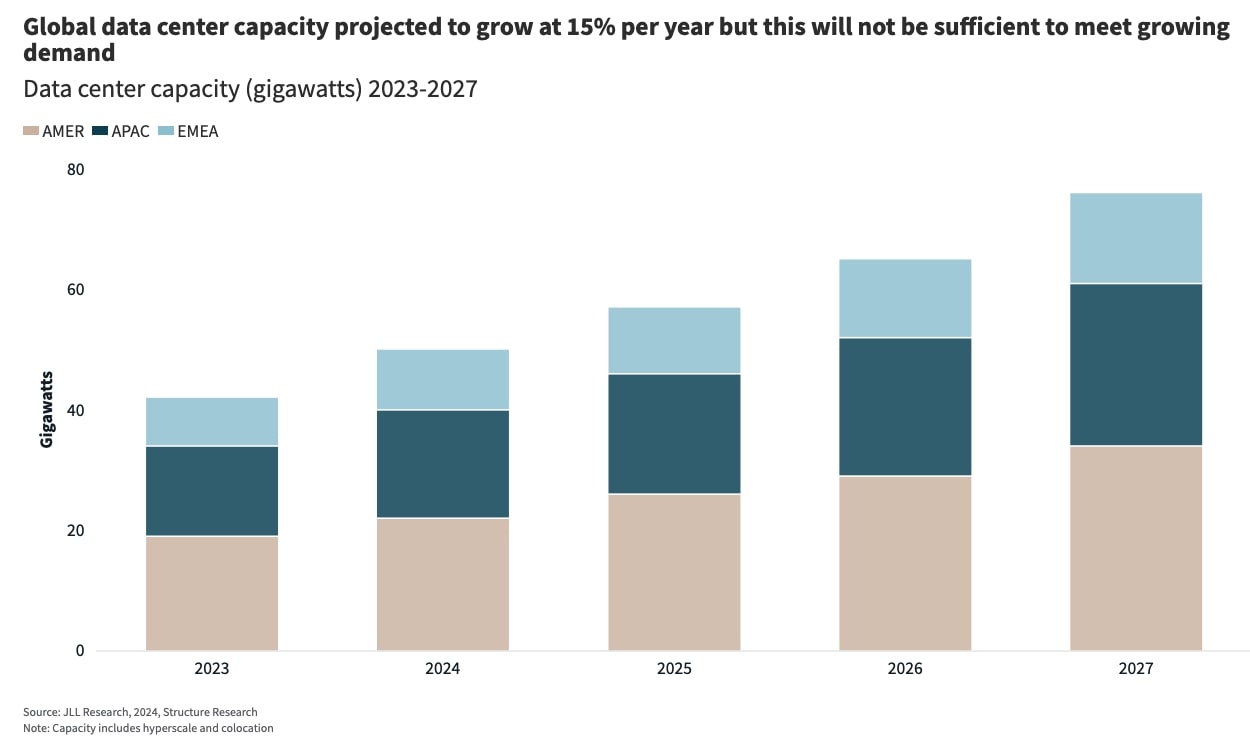

Ai Data Center Growth A Deep Dive Into Current Trends And Projections

May 13, 2025

Ai Data Center Growth A Deep Dive Into Current Trends And Projections

May 13, 2025 -

Smarter Phishing Safer You Combating Ai Driven Email Scams

May 13, 2025

Smarter Phishing Safer You Combating Ai Driven Email Scams

May 13, 2025 -

Oklahoma City Denver Nba Showdown May 11 2025 Playoff Match Analysis

May 13, 2025

Oklahoma City Denver Nba Showdown May 11 2025 Playoff Match Analysis

May 13, 2025

Latest Posts

-

Investor Relief As Us And China Make Headway In Trade Negotiations

May 13, 2025

Investor Relief As Us And China Make Headway In Trade Negotiations

May 13, 2025 -

Ceasefire Continues India And Pakistans Military Chiefs To Hold Crucial Talks

May 13, 2025

Ceasefire Continues India And Pakistans Military Chiefs To Hold Crucial Talks

May 13, 2025 -

Hong Kongs Richest Man Faces Geopolitical Dilemma China Vs America

May 13, 2025

Hong Kongs Richest Man Faces Geopolitical Dilemma China Vs America

May 13, 2025 -

Gerdau Operacoes No Rio Grande Do Sul Suspensas Por Chuvas

May 13, 2025

Gerdau Operacoes No Rio Grande Do Sul Suspensas Por Chuvas

May 13, 2025 -

Hong Kongs Hang Seng Index Positive Weekly Performance Driven By Stimulus And Trade

May 13, 2025

Hong Kongs Hang Seng Index Positive Weekly Performance Driven By Stimulus And Trade

May 13, 2025