Federal Regulation Of Tokenized RWAs: Robinhood's Proposal To The SEC

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Bold Move: A Proposal to Reshape Federal Regulation of Tokenized Real-World Assets (RWAs)

The financial landscape is shifting, and Robinhood is at the forefront, proposing a groundbreaking approach to federal regulation of tokenized Real-World Assets (RWAs). This move has sent ripples through the industry, sparking crucial conversations about the future of finance and the SEC's role in overseeing this rapidly evolving sector. This article delves into the specifics of Robinhood's proposal and its potential implications for investors and the broader market.

Understanding the Landscape: Tokenized RWAs and Regulatory Uncertainty

Tokenized RWAs represent a revolutionary concept: fractional ownership of traditional assets like real estate, art, or commodities, represented digitally on a blockchain. This opens up a world of possibilities, offering increased liquidity and accessibility to previously illiquid markets. However, this innovative space currently lacks clear regulatory frameworks, creating significant uncertainty for both issuers and investors. The SEC, tasked with protecting investors, is grappling with how best to regulate this nascent but rapidly growing market.

Robinhood's Proposal: A Framework for Clarity

Robinhood's proposal to the SEC aims to provide much-needed clarity and structure. While the specifics remain confidential pending SEC review, reports suggest the proposal focuses on:

- Clearer definitions of tokenized RWAs: Establishing a precise definition of what constitutes a tokenized RWA is crucial for effective regulation. This will help distinguish between securities and non-securities, determining which regulatory frameworks apply.

- Risk-based regulatory approach: Instead of a one-size-fits-all approach, Robinhood likely advocates for a system that tailors regulatory requirements to the specific risks associated with different types of tokenized RWAs. This acknowledges the diverse nature of the assets involved.

- Streamlined registration and compliance processes: The proposal likely suggests simplifying the registration and compliance procedures for issuers, reducing bureaucratic hurdles and encouraging innovation. This could involve a tiered system based on asset value or risk profile.

- Investor protection mechanisms: Protecting investors remains paramount. The proposal probably includes measures to ensure transparency, prevent fraud, and mitigate potential risks to investors involved in this new asset class.

Potential Impacts of Robinhood's Proposal

The success of Robinhood's proposal could significantly impact the future of tokenized RWAs. A clear regulatory framework could:

- Boost investor confidence: Reduced uncertainty will attract more institutional and retail investors, fueling the growth of the market.

- Stimulate innovation: A streamlined regulatory process will encourage more companies to explore tokenization, leading to innovation in various sectors.

- Improve market efficiency: Increased liquidity and transparency will lead to more efficient price discovery and better allocation of capital.

- Enhance financial inclusion: Tokenization can democratize access to previously exclusive asset classes, offering greater financial opportunities.

Challenges and Considerations

While Robinhood's proposal offers a positive step forward, challenges remain. The SEC needs to carefully consider:

- Balancing innovation and investor protection: Finding the right balance between fostering innovation and safeguarding investors is crucial. Overly stringent regulation could stifle growth, while insufficient regulation could expose investors to undue risk.

- International harmonization: Global coordination of regulations is necessary to avoid regulatory arbitrage and ensure a level playing field for all participants.

- Technological advancements: The rapidly evolving technology underlying tokenized RWAs necessitates a regulatory framework that can adapt to future advancements.

Conclusion: A Pivotal Moment for the Future of Finance

Robinhood's proposal marks a pivotal moment for the future of tokenized RWAs. The SEC's response will significantly shape the trajectory of this disruptive technology. A well-crafted regulatory framework will unlock the transformative potential of tokenized RWAs, benefiting investors, businesses, and the broader economy. The coming months will be crucial in determining the outcome and its long-term effects on the financial industry. We will continue to monitor developments closely and provide updates as they emerge.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Federal Regulation Of Tokenized RWAs: Robinhood's Proposal To The SEC. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jokics Reign Ends Shai Gilgeous Alexander Crowned Nba Mvp

May 23, 2025

Jokics Reign Ends Shai Gilgeous Alexander Crowned Nba Mvp

May 23, 2025 -

2025 Stanley Cup Playoffs In Depth Analysis And Predictions For Panthers Hurricanes And Stars Oilers

May 23, 2025

2025 Stanley Cup Playoffs In Depth Analysis And Predictions For Panthers Hurricanes And Stars Oilers

May 23, 2025 -

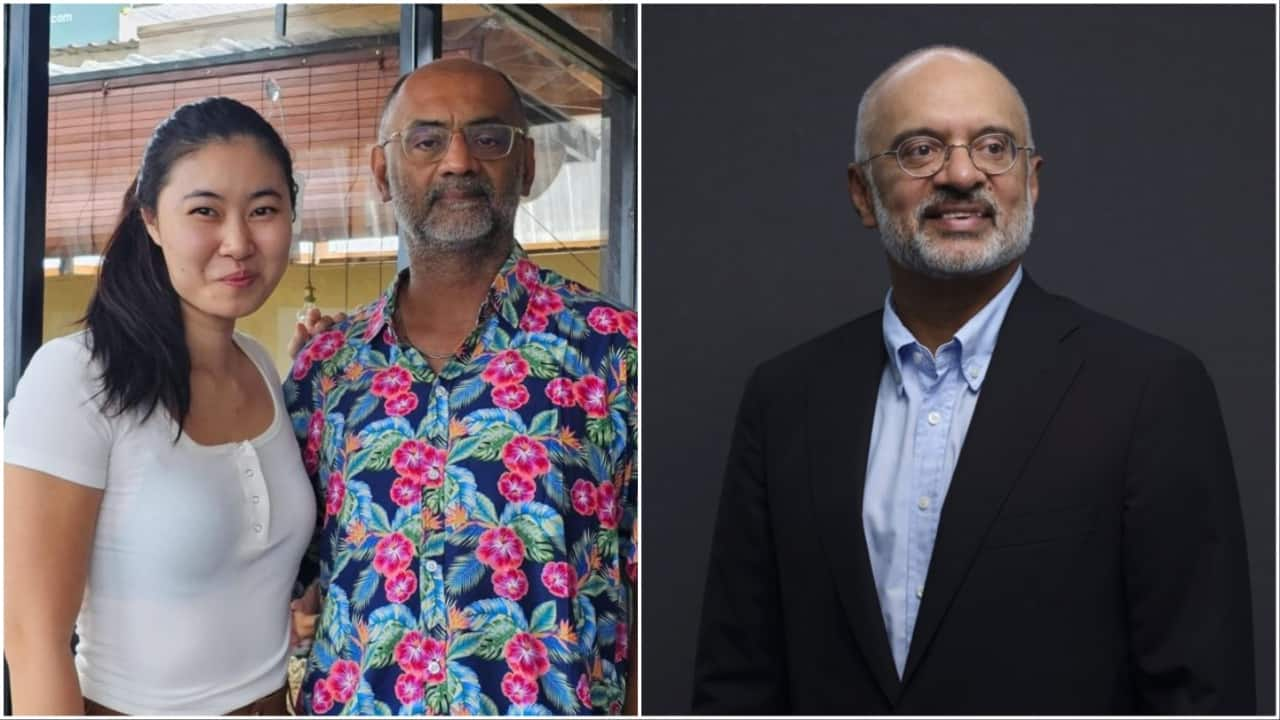

He Says She Says Ex Dbs Employee And Ceo Piyush Gupta Dispute Bali Meeting

May 23, 2025

He Says She Says Ex Dbs Employee And Ceo Piyush Gupta Dispute Bali Meeting

May 23, 2025 -

Standard Chartered Predicts Bitcoin To Reach 500 000 Impact Of Institutional Holdings

May 23, 2025

Standard Chartered Predicts Bitcoin To Reach 500 000 Impact Of Institutional Holdings

May 23, 2025 -

Knicks Vs Pacers A List Celebrities Courtside Including Chalamet And Stiller

May 23, 2025

Knicks Vs Pacers A List Celebrities Courtside Including Chalamet And Stiller

May 23, 2025

Latest Posts

-

Rcb Vs Srh Coach Confirms Travis Heads Status For Upcoming Match

May 23, 2025

Rcb Vs Srh Coach Confirms Travis Heads Status For Upcoming Match

May 23, 2025 -

Kentucky Lottery Winner 150 000 Scratch Off Ticket Changes Lives

May 23, 2025

Kentucky Lottery Winner 150 000 Scratch Off Ticket Changes Lives

May 23, 2025 -

Expect Heavy Traffic Singapore Malaysia Land Checkpoints During June Holidays

May 23, 2025

Expect Heavy Traffic Singapore Malaysia Land Checkpoints During June Holidays

May 23, 2025 -

Laos Faces Economic Hardship Inflations Impact On Employment And Living Costs

May 23, 2025

Laos Faces Economic Hardship Inflations Impact On Employment And Living Costs

May 23, 2025 -

Gillian Andersons Bold Admission Car And Tent Encounters

May 23, 2025

Gillian Andersons Bold Admission Car And Tent Encounters

May 23, 2025