FHA Alters Residency Rules: What Homebuyers Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

FHA Alters Residency Rules: What Homebuyers Need to Know

The Federal Housing Administration (FHA) has recently made changes to its residency requirements, impacting potential homebuyers across the nation. These alterations could significantly influence your eligibility for an FHA-insured mortgage, so understanding these updates is crucial before you begin your home-buying journey. This article breaks down the key changes and explains what you need to know to navigate the new rules.

What's Changed? A Closer Look at the Revised Residency Requirements

Previously, FHA loans had relatively straightforward residency requirements. However, the updated guidelines introduce nuances that homebuyers must carefully consider. The most significant change involves a stricter interpretation of "principal residence." The FHA now places greater emphasis on verifying the buyer's intent to occupy the property as their primary dwelling. This means simply having a mailing address at the property is no longer sufficient. Expect a more thorough review of your residency status, including documentation such as:

- Utility bills: Demonstrating consistent service at the property address.

- Driver's license and other identification: Ensuring the address matches the property you're purchasing.

- Tax returns: Verifying your address and ties to the community.

- Employment records: Showing your place of work and commute distance.

Impact on Borrowers: Who is Affected?

These stricter rules may particularly affect:

- Second-home buyers: Individuals looking to purchase a vacation home or investment property using an FHA loan will face a more rigorous application process. The FHA's focus on primary residence makes obtaining approval considerably more challenging.

- Individuals with complex living situations: Those who frequently travel for work or have multiple residences may find it more difficult to prove their intent to occupy the purchased property as their primary residence.

- Military personnel: Service members with frequent relocations may need to provide additional documentation to meet the updated residency requirements.

Navigating the New Rules: Tips for a Successful Application

Successfully navigating the updated FHA residency rules requires proactive preparation. Here are some key steps to increase your chances of approval:

- Gather comprehensive documentation: Assemble all relevant documents mentioned above well in advance of applying for a loan.

- Be transparent and upfront: Clearly articulate your living situation and intentions to the lender. Hiding information can lead to application delays or rejection.

- Consult with a mortgage professional: A knowledgeable lender can guide you through the process and help you prepare a strong application. They can advise you on the best way to present your information to meet FHA requirements.

- Consider alternative financing options: If you don't meet the new residency requirements, exploring other mortgage options may be necessary.

The Bottom Line: Understanding is Key

The FHA's altered residency rules represent a significant shift in their lending policies. By understanding these changes and taking proactive steps, prospective homebuyers can significantly improve their chances of securing an FHA-insured mortgage. Thorough preparation and open communication with your lender are paramount to a successful application. Remember to consult with a qualified mortgage professional to discuss your specific circumstances and explore the best options for your home-buying needs. Failing to understand these new rules could lead to significant delays and potential rejection of your loan application. Don't let unexpected changes derail your dream of homeownership; plan accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on FHA Alters Residency Rules: What Homebuyers Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Market Meltdown Trumps Tariffs Cost India Rs 20 Lakh Crore In Seconds

Apr 07, 2025

Market Meltdown Trumps Tariffs Cost India Rs 20 Lakh Crore In Seconds

Apr 07, 2025 -

Kabar Duka Pengusaha Ternama Murdaya Poo Tutup Usia

Apr 07, 2025

Kabar Duka Pengusaha Ternama Murdaya Poo Tutup Usia

Apr 07, 2025 -

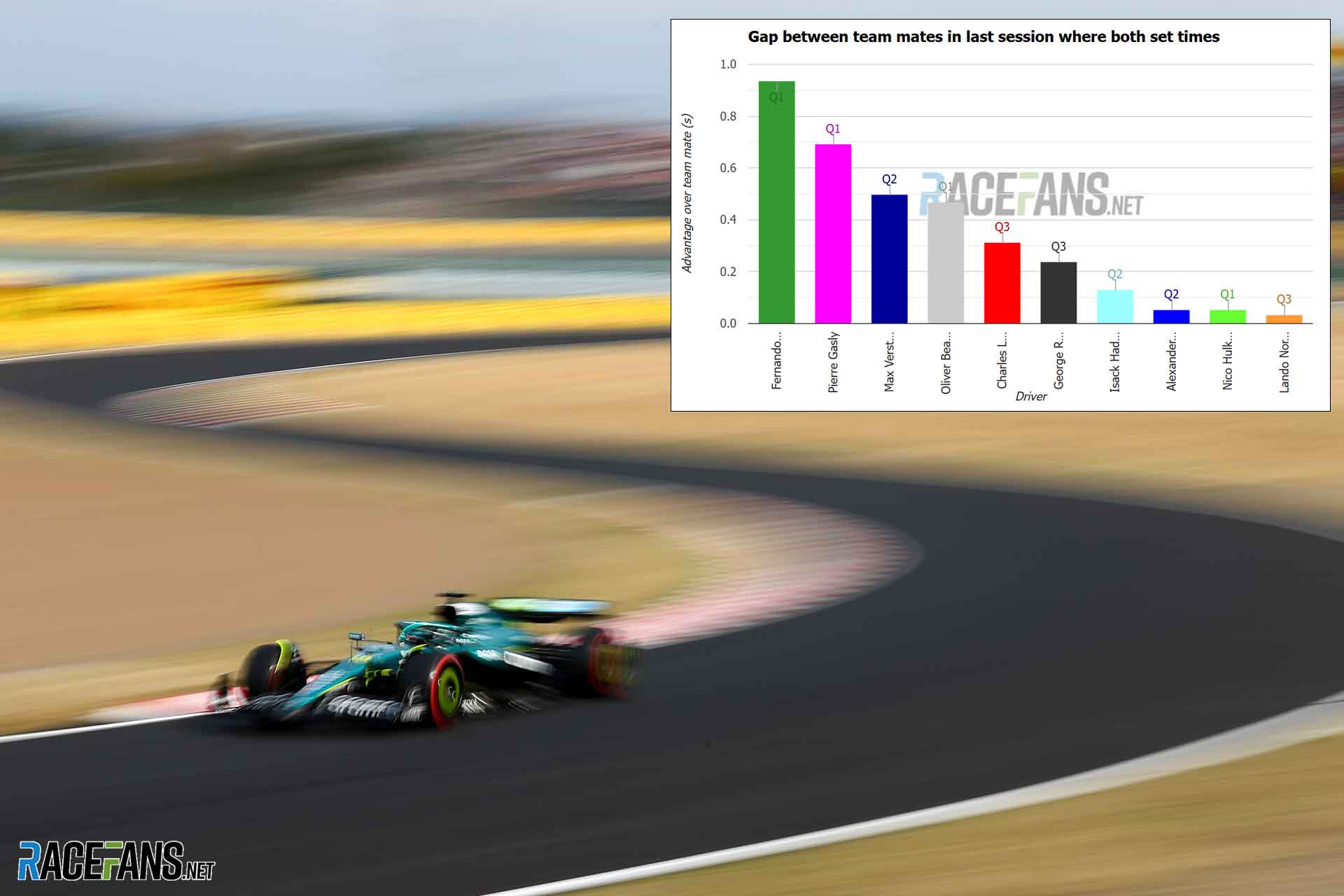

Wind Speed And Qualifying Performance Dissecting Strolls 15th Qualifying Failure

Apr 07, 2025

Wind Speed And Qualifying Performance Dissecting Strolls 15th Qualifying Failure

Apr 07, 2025 -

Japanese Grand Prix Verstappens Race Start Advantage Alonso Vs Gasly

Apr 07, 2025

Japanese Grand Prix Verstappens Race Start Advantage Alonso Vs Gasly

Apr 07, 2025 -

Think Investments Top Stock Pick Is Amazon Amzn The Best Buy

Apr 07, 2025

Think Investments Top Stock Pick Is Amazon Amzn The Best Buy

Apr 07, 2025