Final Chance: Claim Your $1,400 & Become A Compliant U.S. Expat

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Final Chance: Claim Your $1,400 & Become a Compliant U.S. Expat

Are you a U.S. citizen living abroad? Did you miss out on claiming your stimulus payment? Time is running out! The IRS is offering a final opportunity to claim your potential $1,400 Economic Impact Payment (EIP), but you need to act fast. This isn't just about the money; it's about ensuring your tax compliance as a U.S. expat and avoiding potential penalties.

What's the Deadline?

While the official deadline has passed for many, the IRS is providing a limited window for eligible U.S. citizens living overseas to claim their missing stimulus money. Don't delay – research your eligibility and file immediately. Missing this window means potentially losing out on significant funds and risking future tax complications.

Who is Eligible?

Many U.S. expats missed the initial deadlines due to the complexities of filing taxes while living abroad. If you:

- Are a U.S. citizen or resident alien living outside the U.S.

- Filed your 2020 or 2021 taxes by the extended deadlines

- Meet the income requirements for the EIP

You may be eligible to claim the missing payment. The specific requirements depend on your individual circumstances and filing status. It's crucial to consult the IRS website or a qualified tax professional to determine your eligibility.

How to Claim Your $1,400:

The process of claiming your missing stimulus payment requires careful attention to detail. You will likely need to file an amended tax return (Form 1040-X) and provide supporting documentation to prove your residency status. This might include:

- Passport: Showing your U.S. citizenship and foreign residency.

- Foreign Tax Returns: Demonstrating your income and tax obligations abroad.

- Proof of Address: Confirming your residence outside the United States.

The Importance of Tax Compliance for Expats:

Claiming your stimulus payment is not only about the money; it's a crucial step towards maintaining your tax compliance as a U.S. expat. Failure to file your taxes correctly can lead to significant penalties, including:

- Interest and Penalties: Accumulating on unpaid taxes.

- IRS Audits: Scrutiny of your financial records.

- Damaged Credit: Affecting your financial standing both domestically and internationally.

Avoid Future Complications:

Don't let the complexity of expat taxes deter you. Take proactive steps now to ensure you are fully compliant. The resources listed below can help.

Resources:

- IRS Website: [Link to the relevant IRS page for expats]

- Qualified Tax Advisor: Consider consulting a professional specializing in expat taxes.

Don't Miss Out!

This may be your last chance to claim your $1,400 stimulus payment and establish your tax compliance as a U.S. expat. Act swiftly to avoid future complications and secure your financial well-being. The deadline is rapidly approaching – check your eligibility today!

Keywords: U.S. expat taxes, stimulus check, Economic Impact Payment (EIP), $1400 stimulus, IRS, expat tax compliance, amended tax return, Form 1040-X, foreign tax, overseas taxes, U.S. citizen abroad, tax deadline.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Final Chance: Claim Your $1,400 & Become A Compliant U.S. Expat. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fartcoin Market Update Bounce At Key Support Suggests Bullish Continuation

May 08, 2025

Fartcoin Market Update Bounce At Key Support Suggests Bullish Continuation

May 08, 2025 -

Recent Developments Assessing The Risk Of Full Scale War Between India And Pakistan

May 08, 2025

Recent Developments Assessing The Risk Of Full Scale War Between India And Pakistan

May 08, 2025 -

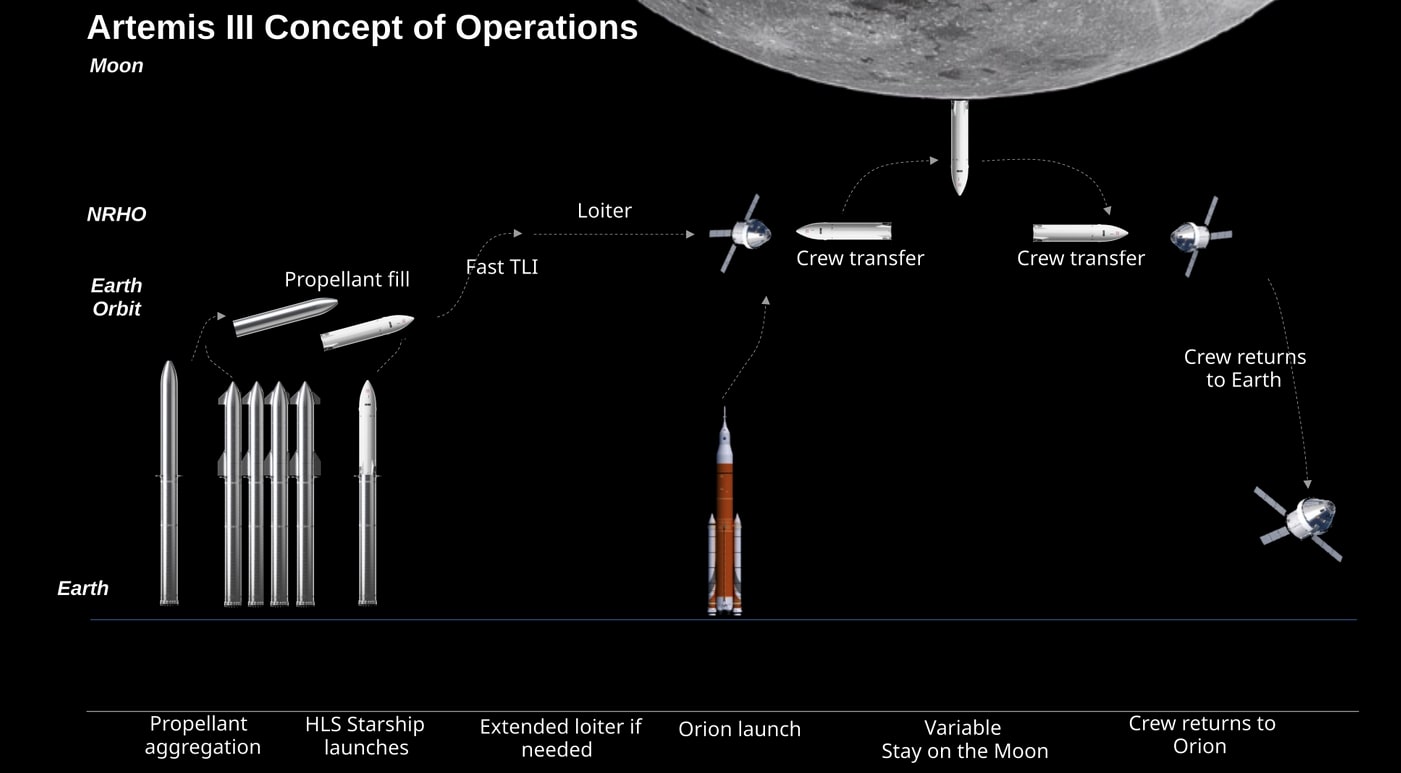

Analyzing Federal Budget Overruns Case Study Nasa

May 08, 2025

Analyzing Federal Budget Overruns Case Study Nasa

May 08, 2025 -

Controversial Film Age Record Shattered In On Screen Fire Scene

May 08, 2025

Controversial Film Age Record Shattered In On Screen Fire Scene

May 08, 2025 -

Yemen Conflict Trump Claims Houthi Concession Ceasefire Achieved

May 08, 2025

Yemen Conflict Trump Claims Houthi Concession Ceasefire Achieved

May 08, 2025

Latest Posts

-

Final Destination Bloodlines Directors Respond To Backlash Over Fire Stunt World Record

May 08, 2025

Final Destination Bloodlines Directors Respond To Backlash Over Fire Stunt World Record

May 08, 2025 -

Ai Agents And Saa S Integration The Next Big Leap Forward

May 08, 2025

Ai Agents And Saa S Integration The Next Big Leap Forward

May 08, 2025 -

Nba Playoffs Knicks Resilience Fuels Game 2 Win 2 0 Series Advantage Over Celtics

May 08, 2025

Nba Playoffs Knicks Resilience Fuels Game 2 Win 2 0 Series Advantage Over Celtics

May 08, 2025 -

Geminis New Feature Direct Image Editing

May 08, 2025

Geminis New Feature Direct Image Editing

May 08, 2025 -

Terrorism Accusations Fly Uk Media Scrutinizes Shehbaz Sharifs Minister Following Op Sindoor

May 08, 2025

Terrorism Accusations Fly Uk Media Scrutinizes Shehbaz Sharifs Minister Following Op Sindoor

May 08, 2025