Financial Markets React To Escalating India-Pakistan Conflict

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Markets React to Escalating India-Pakistan Conflict: Global Uncertainty Rises

The recent escalation of tensions between India and Pakistan has sent shockwaves through global financial markets, triggering significant volatility and raising concerns about regional stability and potential wider economic repercussions. Investors are closely monitoring the situation, with concerns ranging from disruptions to trade and supply chains to a potential escalation of conflict with far-reaching consequences.

Immediate Market Reactions:

The news of escalating tensions has already impacted various asset classes. We've witnessed:

- Sharp decline in Indian and Pakistani stock markets: Both the Bombay Stock Exchange (BSE) and the Pakistan Stock Exchange (PSX) experienced significant drops in their indices immediately following the latest reports of conflict. Investors are fleeing riskier assets in favor of safer havens.

- Flight to safety: Global investors are increasingly seeking refuge in safe-haven assets like gold and US Treasury bonds. Demand for these assets has risen sharply, reflecting a growing sense of uncertainty and risk aversion.

- Currency fluctuations: The Indian Rupee (INR) and Pakistani Rupee (PKR) have experienced considerable volatility against major currencies like the US dollar. This reflects the uncertainty surrounding the economic outlook for both nations.

- Oil price spikes: Given the geopolitical significance of the region and its proximity to major oil shipping lanes, the escalating conflict has already caused a noticeable rise in oil prices. Further escalation could lead to significantly higher prices, impacting global inflation.

Long-Term Economic Implications:

The longer the conflict persists, the more severe the economic consequences are likely to be. Potential impacts include:

- Disrupted trade: India and Pakistan are significant trading partners within the region, and any prolonged conflict will inevitably disrupt trade flows, impacting businesses and consumers on both sides.

- Supply chain disruptions: The region plays a crucial role in global supply chains for various goods. Disruptions to these chains could lead to shortages and price increases in several sectors.

- Tourism slump: The tourism sector in both countries is likely to suffer a significant downturn as travel advisories are issued and tourists are deterred from visiting.

- Foreign investment slowdown: Uncertainty surrounding the political and security situation will likely discourage foreign direct investment (FDI) in both India and Pakistan.

- Increased military spending: A prolonged conflict would necessitate increased military spending by both nations, potentially diverting resources from other critical areas like healthcare and education.

Geopolitical Uncertainty and Global Markets:

The India-Pakistan conflict is not an isolated incident; it adds to a complex web of global geopolitical uncertainties. This overall instability creates a climate of fear and uncertainty for investors worldwide. The situation requires constant monitoring, and any further escalation could trigger even more dramatic market reactions.

Looking Ahead:

The coming days and weeks will be crucial in determining the trajectory of the conflict and its impact on the global economy. Investors will be closely scrutinizing diplomatic efforts and any signs of de-escalation. The situation highlights the interconnectedness of global markets and the significant impact that geopolitical events can have on investment decisions and overall economic stability. Keeping a close watch on news developments and expert analyses is crucial for navigating this period of uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Markets React To Escalating India-Pakistan Conflict. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Controversy Erupts Kanye West Samples Hitler Speech In New Track

May 10, 2025

Controversy Erupts Kanye West Samples Hitler Speech In New Track

May 10, 2025 -

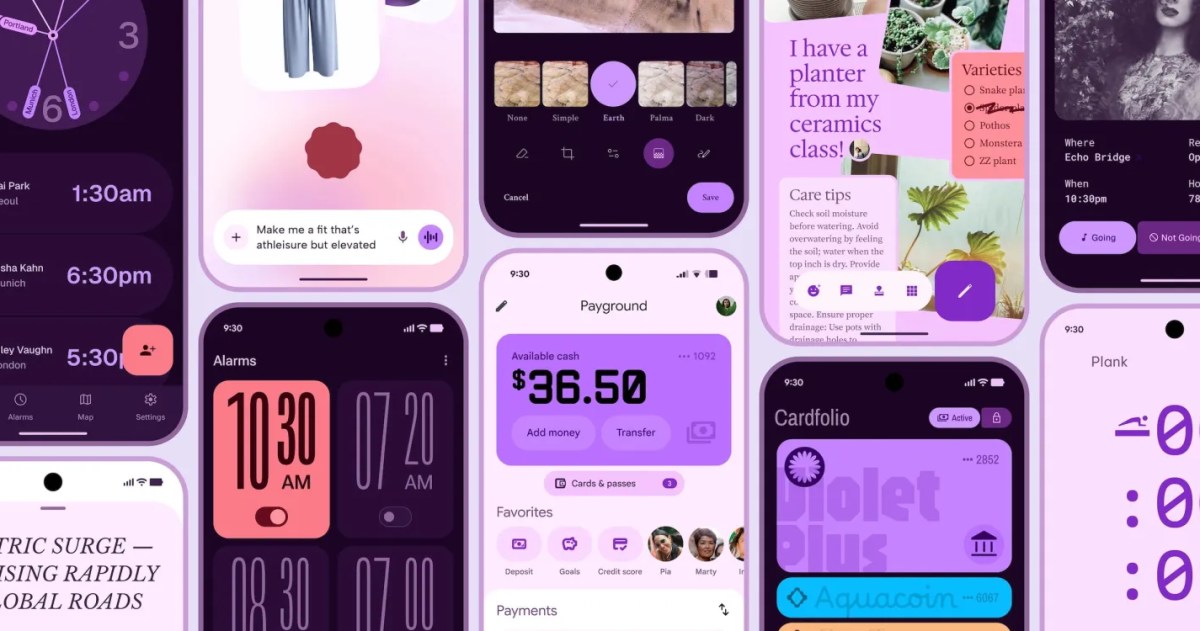

Is Androids New Look Enough To Compete With I Phones

May 10, 2025

Is Androids New Look Enough To Compete With I Phones

May 10, 2025 -

Singapores Ocbc Confirms 2025 Targets Despite Difficult Economic Climate

May 10, 2025

Singapores Ocbc Confirms 2025 Targets Despite Difficult Economic Climate

May 10, 2025 -

Crude Oil Price Hike Renewed U S China Trade Hopes Boost Markets

May 10, 2025

Crude Oil Price Hike Renewed U S China Trade Hopes Boost Markets

May 10, 2025 -

Scrapped Andor Episode A K 2 So Horror Story Uncovered

May 10, 2025

Scrapped Andor Episode A K 2 So Horror Story Uncovered

May 10, 2025

Latest Posts

-

Mothers Day 2025 Best Fast Food Brunch And Dining Deals

May 10, 2025

Mothers Day 2025 Best Fast Food Brunch And Dining Deals

May 10, 2025 -

The Implications Of Amazons Touch Sensitive Warehouse Robot

May 10, 2025

The Implications Of Amazons Touch Sensitive Warehouse Robot

May 10, 2025 -

Risky Business Widespread Unauthorized Ai Adoption Among It Professionals

May 10, 2025

Risky Business Widespread Unauthorized Ai Adoption Among It Professionals

May 10, 2025 -

Thunderbolts Strikes Gold 35 Million Second Weekend Box Office

May 10, 2025

Thunderbolts Strikes Gold 35 Million Second Weekend Box Office

May 10, 2025 -

Two Presidents Two Americas Analyzing Divergent Approaches To Power

May 10, 2025

Two Presidents Two Americas Analyzing Divergent Approaches To Power

May 10, 2025