Financial Trouble For Klarna: Loan Repayment Failures Drive Losses Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Trouble for Klarna: Loan Repayment Failures Drive Losses Higher

Klarna, the Swedish buy-now-pay-later giant, is facing increasing financial headwinds as loan repayment failures surge, pushing the company deeper into losses. This news sends shockwaves through the fintech industry, raising questions about the long-term viability of the BNPL model and its susceptibility to economic downturns. The recent financial reports paint a stark picture, revealing a concerning trend that could significantly impact Klarna's future.

Rising Defaults and Mounting Losses:

Klarna's latest financial results highlight a sharp increase in loan defaults. The company, known for its flexible payment options, is now grappling with a growing number of customers struggling to repay their debts. This rise in defaults is directly correlated to the current economic climate, characterized by rising inflation and increased cost of living. Many consumers, already burdened by debt, are finding it increasingly difficult to manage their Klarna payments, leading to a significant increase in losses for the company.

The increasing losses are forcing Klarna to re-evaluate its business model and implement stricter lending criteria. The company is reportedly tightening its credit checks and focusing on lower-risk customers to mitigate future losses. This shift in strategy could impact the company's growth trajectory, as it may limit its accessibility to a wider customer base.

Impact on the Buy Now, Pay Later Industry:

Klarna's struggles are not isolated incidents. The entire buy now, pay later (BNPL) industry is facing growing scrutiny. Regulators are increasingly concerned about the potential for irresponsible lending practices and the impact on consumer debt levels. The rising interest rates globally are also exacerbating the problem, making repayments more expensive for consumers. Klarna's financial woes serve as a cautionary tale for other BNPL companies, highlighting the risks associated with this rapidly growing sector.

Klarna's Response and Future Outlook:

In response to the challenges, Klarna has announced several initiatives aimed at improving its financial performance. These include:

- Stricter credit checks: Implementing more rigorous checks to assess the creditworthiness of potential customers.

- Improved risk management: Investing in advanced technology and analytics to better predict and manage risk.

- Cost-cutting measures: Reducing operational expenses to improve profitability.

- Focus on profitability over growth: Shifting from an aggressive growth strategy to a more sustainable, profit-oriented approach.

However, the road to recovery is likely to be challenging. The company faces intense competition from other BNPL providers and needs to regain investor confidence. The future success of Klarna, and indeed the entire BNPL sector, hinges on its ability to adapt to the changing economic landscape and demonstrate responsible lending practices.

Keywords: Klarna, Buy Now Pay Later, BNPL, Financial Trouble, Loan Defaults, Losses, Fintech, Economic Downturn, Credit Risk, Repayment Failures, Financial Report, Consumer Debt, Regulatory Scrutiny.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Trouble For Klarna: Loan Repayment Failures Drive Losses Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Secrets We Keep Season 1 Worth Watching A Critical Analysis

May 21, 2025

Is Secrets We Keep Season 1 Worth Watching A Critical Analysis

May 21, 2025 -

The Evolution Of Seth Jarvis Analyzing His Development In The Nhl

May 21, 2025

The Evolution Of Seth Jarvis Analyzing His Development In The Nhl

May 21, 2025 -

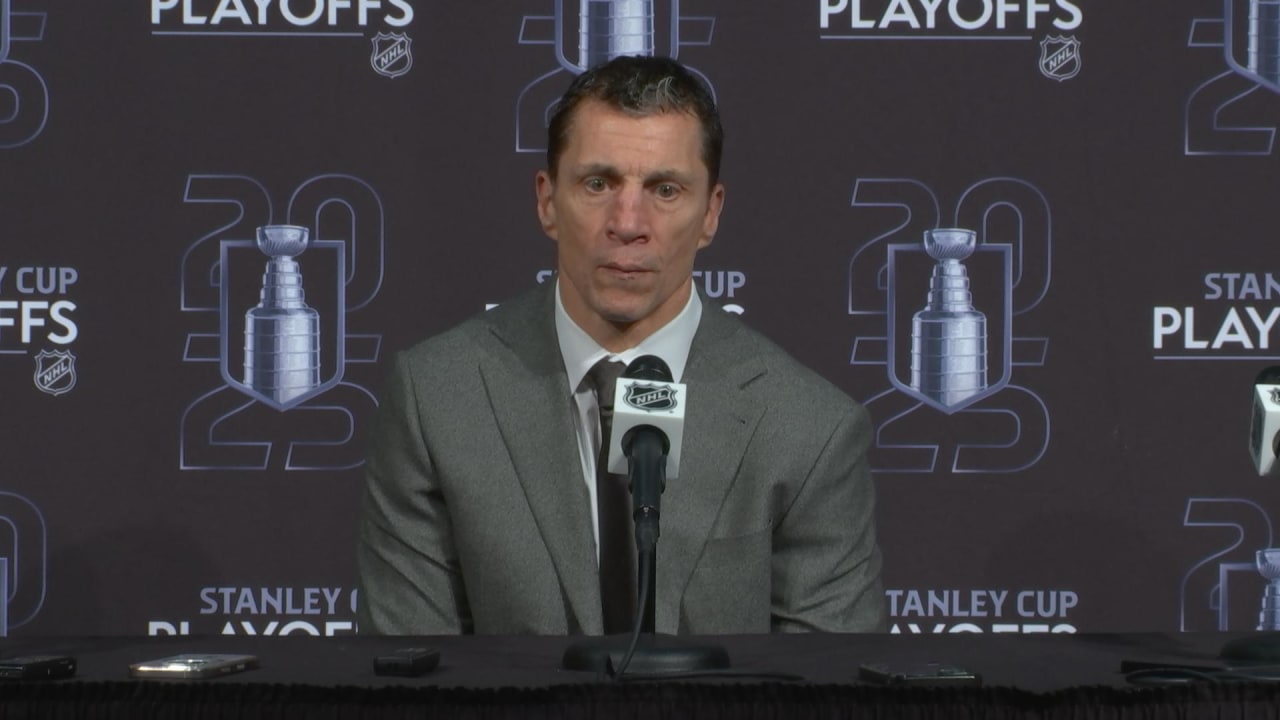

Canes Coach Rod Brind Amours Postgame Comments A Full Transcript

May 21, 2025

Canes Coach Rod Brind Amours Postgame Comments A Full Transcript

May 21, 2025 -

Windows Boosts Ai Capabilities With New Usb C Support

May 21, 2025

Windows Boosts Ai Capabilities With New Usb C Support

May 21, 2025 -

Lawsuit Claims Affair Between Phoenix Suns Ceo And Sophie Cunningham

May 21, 2025

Lawsuit Claims Affair Between Phoenix Suns Ceo And Sophie Cunningham

May 21, 2025