Financial Woes At Klarna: 100 Million Customers Can't Offset Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Financial Woes at Klarna: 100 Million Customers Can't Offset Mounting Losses

Klarna, the Swedish buy now, pay later (BNPL) giant boasting over 100 million customers, is facing significant financial headwinds. Despite its massive user base, the company is struggling to offset substantial losses, prompting concerns about the long-term sustainability of its business model and the broader BNPL sector. This article delves into the challenges Klarna is confronting and explores the implications for both the company and its customers.

Klarna's Troubled Waters: A Deep Dive into the Losses

Klarna's recent financial reports paint a concerning picture. While the company has experienced impressive user growth, translating that growth into profitability has proven elusive. The core issue lies in the inherent risks associated with the BNPL model: high default rates, rising operational costs, and increasing competition. These factors have combined to create a perfect storm, leaving Klarna battling significant losses.

-

High Default Rates: A key challenge for BNPL providers is the risk of customers failing to repay their debts. Klarna, like its competitors, is grappling with increasing default rates, impacting its bottom line significantly. This is exacerbated by economic uncertainty and rising inflation, leaving many consumers struggling to manage their finances.

-

Intense Competition: The BNPL market is fiercely competitive, with established players and new entrants vying for market share. This intense competition forces companies like Klarna to offer increasingly attractive deals and promotions, squeezing profit margins.

-

Rising Operational Costs: Managing a vast customer base and processing millions of transactions comes with substantial operational costs. These costs, coupled with the challenges of managing risk and dealing with defaults, are contributing to Klarna's financial woes.

The Impact on Customers: What Does This Mean for You?

While Klarna's financial struggles are primarily a concern for its investors, they also have implications for its vast customer base. While the service remains operational, potential future changes could include:

-

Tighter Credit Checks: Klarna may implement stricter credit checks to mitigate the risk of defaults, potentially making it harder for some customers to access its services.

-

Increased Fees: To improve profitability, Klarna might introduce new fees or increase existing ones.

-

Reduced Services or Features: The company may be forced to streamline its operations, potentially reducing the range of services offered.

The Future of Klarna and the BNPL Industry:

Klarna's financial difficulties raise crucial questions about the long-term viability of the BNPL industry as a whole. While the convenience and accessibility of BNPL have fueled its rapid growth, the inherent risks associated with the model are becoming increasingly apparent. The company's future hinges on its ability to adapt to the changing economic landscape, improve its risk management strategies, and find new avenues for profitability. This might involve exploring alternative revenue streams, focusing on more profitable customer segments, or potentially even consolidating with a competitor.

Looking Ahead: What to Watch For

The coming months will be critical for Klarna. Investors and analysts will be closely watching its efforts to address its financial challenges. The company's success will not only impact its own future but also serve as a significant indicator for the broader BNPL sector. Whether Klarna can successfully navigate these turbulent waters and emerge as a profitable and sustainable business remains to be seen. The story of Klarna serves as a cautionary tale, highlighting the complexities and inherent risks of rapid growth in the fintech sector.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Financial Woes At Klarna: 100 Million Customers Can't Offset Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

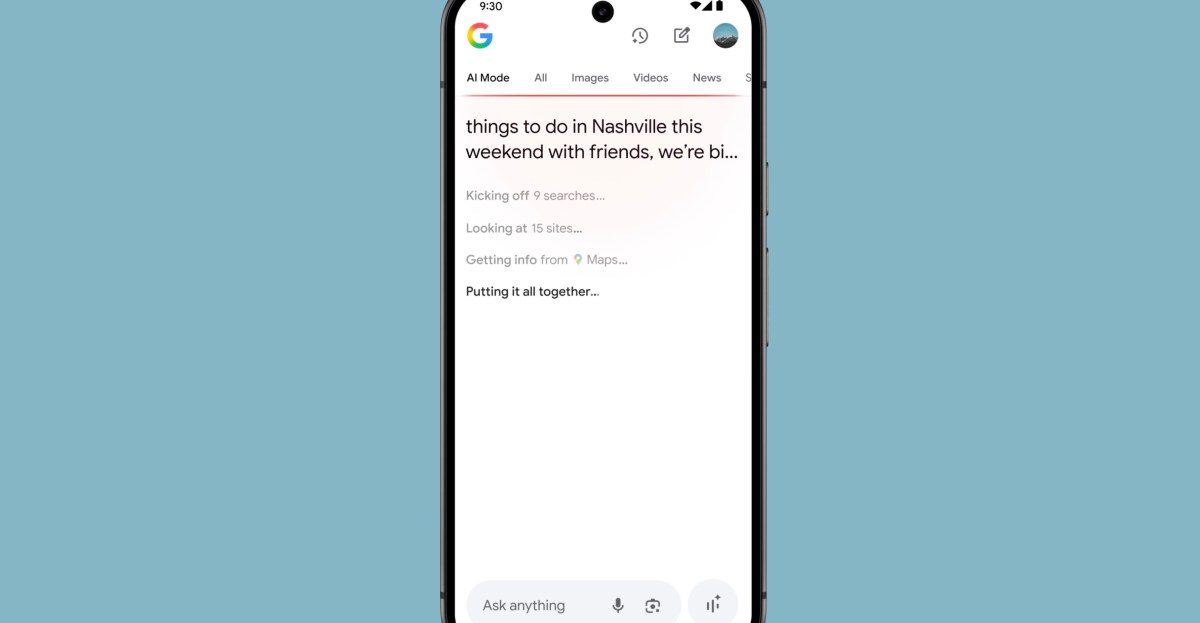

Understanding Ai Mode Google Searchs Next Generation

May 22, 2025

Understanding Ai Mode Google Searchs Next Generation

May 22, 2025 -

Trump Pardoned January 6th Rioter Rearrested New Burglary Charges Filed

May 22, 2025

Trump Pardoned January 6th Rioter Rearrested New Burglary Charges Filed

May 22, 2025 -

Bitcoins Future Standard Chartered Forecasts 500 000 Driven By Institutional Adoption

May 22, 2025

Bitcoins Future Standard Chartered Forecasts 500 000 Driven By Institutional Adoption

May 22, 2025 -

Western Conference Finals De Boers Dallas Stars Aim For Stanley Cup

May 22, 2025

Western Conference Finals De Boers Dallas Stars Aim For Stanley Cup

May 22, 2025 -

Transfer News Rodrygo Wirtz Diaz De Bruyne Mc Atee And Fernandezs Future

May 22, 2025

Transfer News Rodrygo Wirtz Diaz De Bruyne Mc Atee And Fernandezs Future

May 22, 2025