Fiscal Outlook Jitters: Impact On Treasury Yields And Stock Market Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fiscal Outlook Jitters: Treasury Yields Rise, Stock Market Dips

The ongoing debate surrounding the nation's fiscal outlook is sending ripples through financial markets, causing a noticeable increase in Treasury yields and a corresponding decline in the stock market. This uncertainty, fueled by concerns over government spending, the debt ceiling, and potential economic slowdowns, is leaving investors on edge and prompting a reassessment of risk.

Rising Treasury Yields: A Safe Haven Under Pressure?

Treasury yields, which reflect the return investors receive on government bonds, have been steadily climbing in recent weeks. This upward trend is primarily attributed to the escalating concerns about the nation's fiscal health. As investors become increasingly apprehensive about the future, they are flocking to the perceived safety of government bonds, driving up demand and consequently, pushing yields higher. This flight to safety, however, is not without its complexities. Higher yields indicate a rising cost of borrowing for the government, potentially exacerbating the very fiscal issues that are causing the initial concern.

- Impact on Businesses: Increased borrowing costs for businesses translate to higher interest expenses, potentially impacting profitability and investment decisions. This could lead to reduced economic activity and slower job growth.

- Mortgage Rates: The increase in Treasury yields often foreshadows similar increases in mortgage rates, making homeownership more expensive and potentially cooling the housing market.

- Inflationary Concerns: While higher yields can reflect investor confidence in the economy's ability to handle higher interest rates, they can also fuel inflationary pressures if borrowing costs increase significantly across the board.

Stock Market Decline: A Reflection of Investor Sentiment

The stock market has mirrored the anxieties surrounding the fiscal outlook, experiencing a notable decline. This downturn reflects a decrease in investor confidence and a shift away from riskier assets like stocks towards the perceived safety of Treasury bonds. The uncertainty surrounding government spending and potential economic consequences is prompting investors to reassess their portfolios and adopt a more cautious approach.

- Sector-Specific Impacts: The impact of the fiscal outlook is not uniform across all sectors. Companies heavily reliant on government contracts or sensitive to interest rate changes are particularly vulnerable during periods of fiscal uncertainty.

- Long-Term Implications: Prolonged fiscal uncertainty can lead to decreased business investment, slower economic growth, and a sustained period of market volatility.

- The Role of the Federal Reserve: The actions of the Federal Reserve, including interest rate decisions, will play a significant role in mitigating or exacerbating the impact of the fiscal outlook on the markets.

What Lies Ahead?

The coming weeks will be crucial in determining the trajectory of both Treasury yields and the stock market. Resolution of the fiscal debate, coupled with clear communication from the Federal Reserve, could help stabilize markets and restore investor confidence. However, prolonged uncertainty could lead to further market volatility and a more protracted period of economic unease. Careful monitoring of economic indicators, government policy announcements, and Federal Reserve actions will be essential for investors navigating this turbulent period. Experts suggest diversification and a long-term investment strategy as crucial elements in weathering these market fluctuations. The situation remains fluid, and investors should remain vigilant and informed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fiscal Outlook Jitters: Impact On Treasury Yields And Stock Market Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

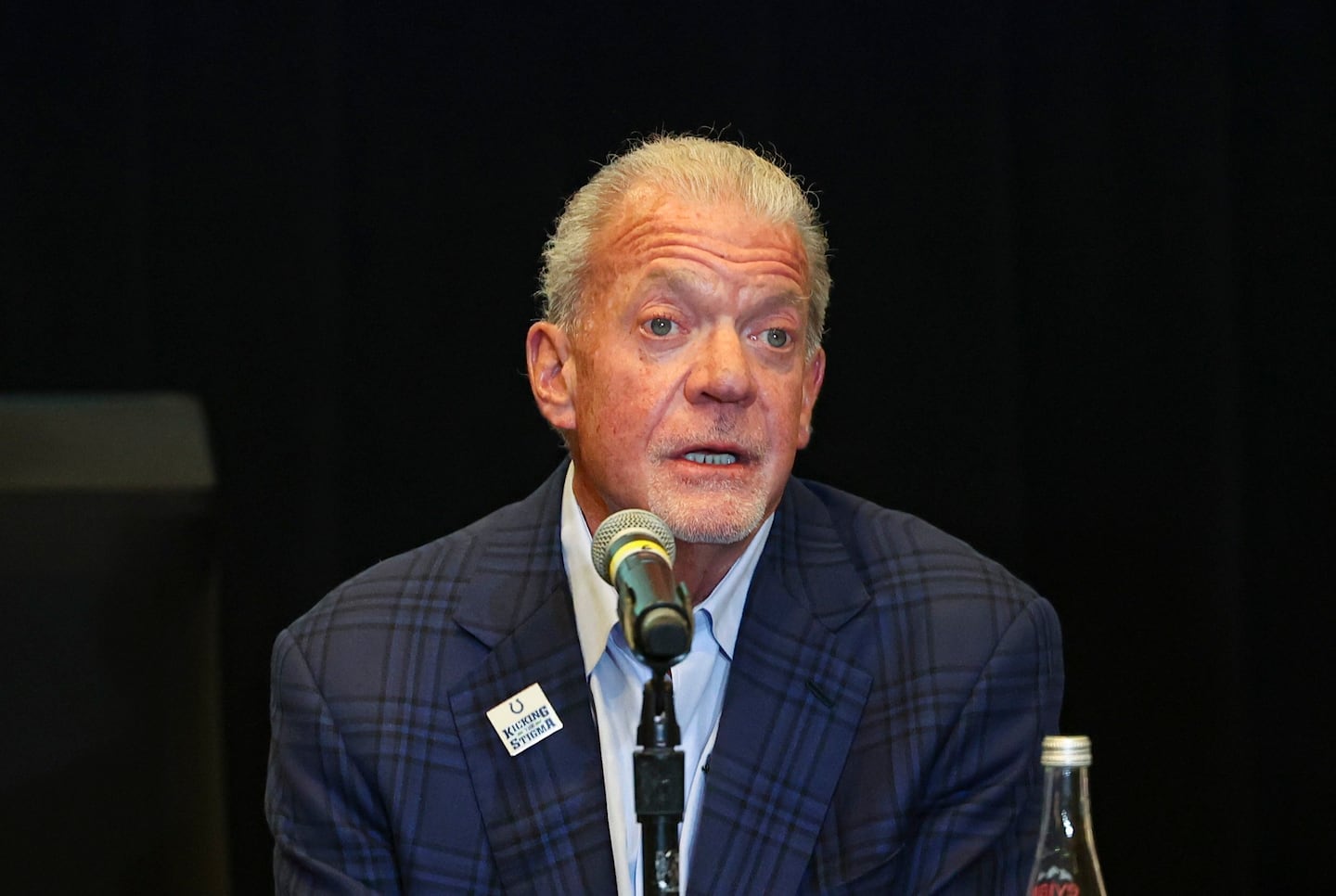

Jim Irsay 65 Impactful Reign As Indianapolis Colts Owner Ends

May 22, 2025

Jim Irsay 65 Impactful Reign As Indianapolis Colts Owner Ends

May 22, 2025 -

Google Addresses Virtual Meeting Pain Points Enhanced User Experience

May 22, 2025

Google Addresses Virtual Meeting Pain Points Enhanced User Experience

May 22, 2025 -

Avrupa Ligi Finali Tottenham Mi Manchester United Mi

May 22, 2025

Avrupa Ligi Finali Tottenham Mi Manchester United Mi

May 22, 2025 -

Dissecting The Success A Ap Rockys Highest 2 Lowest And Its Impact

May 22, 2025

Dissecting The Success A Ap Rockys Highest 2 Lowest And Its Impact

May 22, 2025 -

Stock Market Update Sharp Decline In Dow S And P 500 And Nasdaq Bitcoins Historic High

May 22, 2025

Stock Market Update Sharp Decline In Dow S And P 500 And Nasdaq Bitcoins Historic High

May 22, 2025