Fixing The US Economy: A Practical Guide To Debt Reduction And Tax Policy Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Fixing the US Economy: A Practical Guide to Debt Reduction and Tax Policy Reform

The US economy faces significant challenges, including a burgeoning national debt and a complex tax system hindering growth. This article explores practical solutions for debt reduction and tax policy reform, offering a pathway towards a healthier and more prosperous future for all Americans.

The Looming Debt Crisis: Understanding the Scale of the Problem

The national debt has reached alarming levels, impacting the nation's credit rating and limiting its ability to invest in crucial infrastructure and social programs. This unsustainable trajectory necessitates immediate and decisive action. The sheer magnitude of the debt demands a multi-pronged approach, encompassing both spending cuts and revenue enhancements. Ignoring this crisis will only lead to more severe consequences in the future, including higher interest rates, reduced government services, and increased economic instability. Understanding the root causes—unsustainable spending habits coupled with insufficient revenue generation—is the first step towards formulating effective solutions.

Strategic Debt Reduction Strategies: A Balanced Approach

Effective debt reduction requires a balanced approach, carefully considering both spending cuts and revenue increases. Simple cuts are not enough; the government needs a comprehensive plan. Here's a breakdown of key strategies:

-

Targeted Spending Cuts: Instead of indiscriminate cuts, prioritize areas where efficiency improvements can be made without sacrificing essential services. This includes streamlining government bureaucracy, negotiating better deals with contractors, and eliminating wasteful spending. Specific examples might include reforming entitlement programs to ensure long-term solvency and identifying areas of overlapping or redundant government functions.

-

Revenue Enhancement through Tax Reform: A comprehensive tax reform is vital. This isn't just about raising taxes; it's about creating a fairer and more efficient system. This could include closing loopholes that benefit wealthy individuals and corporations, implementing a more progressive tax structure, and potentially broadening the tax base. The aim is not to penalize success but to ensure that everyone contributes their fair share to the nation's well-being.

-

Investing in Growth-Generating Initiatives: Counterintuitively, strategic investments can contribute to debt reduction in the long run. Investing in infrastructure, education, and research & development can boost economic productivity, leading to increased tax revenues. This is a long-term strategy, but crucial for sustainable economic growth.

Tax Policy Reform: Fairness, Efficiency, and Economic Growth

Tax policy reform is crucial for both debt reduction and economic growth. The current system is riddled with complexities and inequities, hindering investment and job creation. Key reforms to consider include:

-

Simplifying the Tax Code: A simpler tax code would reduce compliance costs for businesses and individuals, boosting economic activity. This might involve consolidating tax brackets and eliminating unnecessary deductions and credits.

-

Addressing Tax Loopholes: Closing tax loopholes that disproportionately benefit the wealthy could generate significant additional revenue for the government. This involves identifying and eliminating practices that allow high-income earners and corporations to avoid paying their fair share of taxes.

-

Promoting Investment and Job Creation: Tax incentives for businesses that invest in research and development, expand their operations, and create jobs can stimulate economic growth and increase tax revenues.

Conclusion: A Path Towards a Stronger Economy

Addressing the US economy's challenges requires a comprehensive and multifaceted approach. A combination of strategic spending cuts, carefully designed tax policy reforms, and investments in growth-generating initiatives are essential. This isn't a quick fix; it requires long-term commitment and political will. However, by taking decisive action now, the US can secure a more prosperous and stable future for generations to come. The path forward demands collaboration across the political spectrum, prioritizing the nation's long-term interests above partisan agendas. The time for decisive action is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Fixing The US Economy: A Practical Guide To Debt Reduction And Tax Policy Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

One Month On Denise Welch Addresses Loose Women Future Following Diagnosis

Mar 30, 2025

One Month On Denise Welch Addresses Loose Women Future Following Diagnosis

Mar 30, 2025 -

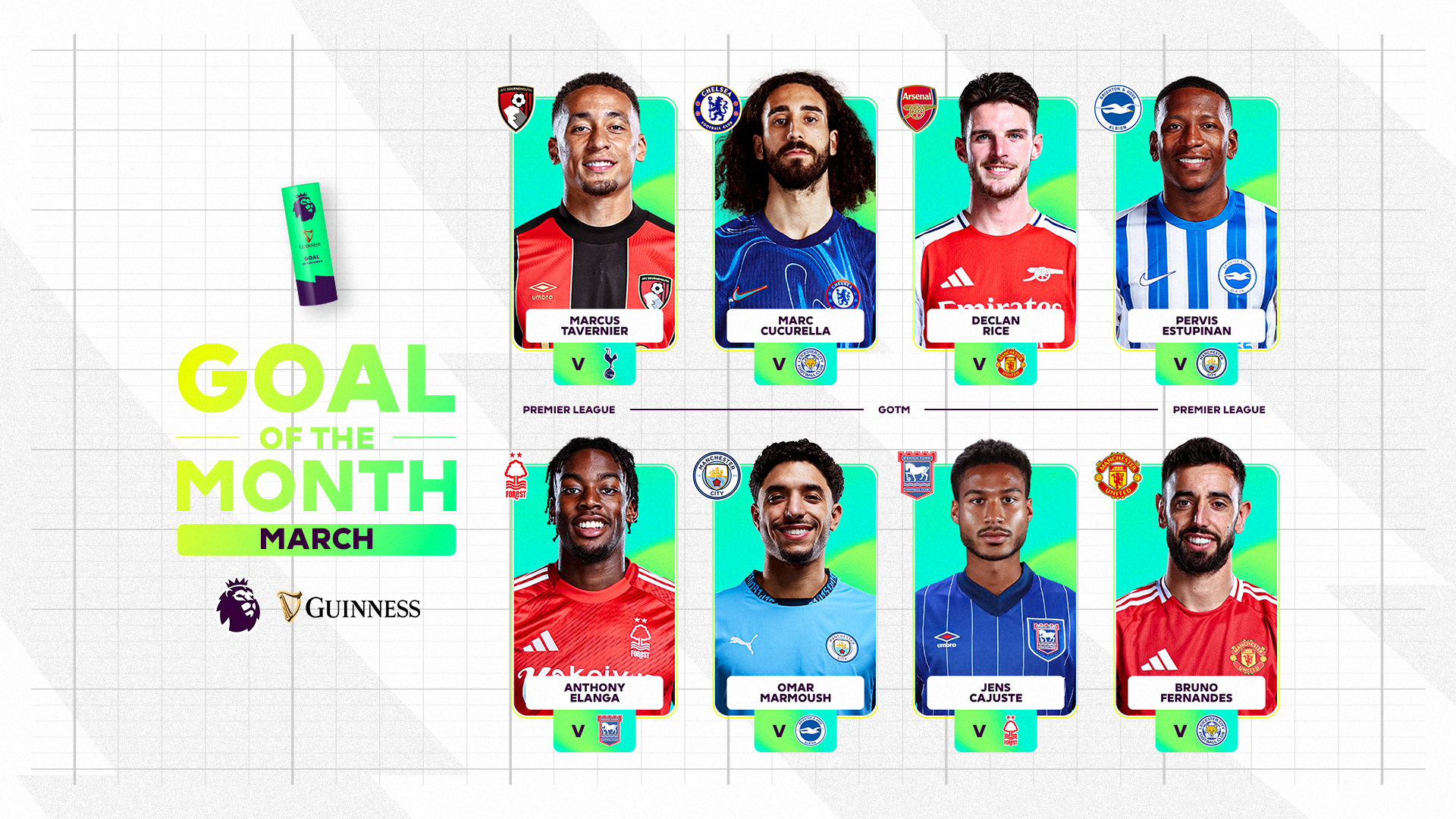

Marchs Guinness Goal Of The Month Vote Now For Your Favorite

Mar 30, 2025

Marchs Guinness Goal Of The Month Vote Now For Your Favorite

Mar 30, 2025 -

Piroe Highlights Leeds Transformation A More Dangerous Prospect

Mar 30, 2025

Piroe Highlights Leeds Transformation A More Dangerous Prospect

Mar 30, 2025 -

Elon Musks Future With Trumps Doge Initiative Recent Statements Analyzed

Mar 30, 2025

Elon Musks Future With Trumps Doge Initiative Recent Statements Analyzed

Mar 30, 2025 -

Erklaerung Weshalb Der Fc Bayern Heute Mit Trauerflor Spielt

Mar 30, 2025

Erklaerung Weshalb Der Fc Bayern Heute Mit Trauerflor Spielt

Mar 30, 2025