Former Director's S$7 Million Embezzlement: China Property Development Scheme Unravels

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Former Director's S$7 Million Embezzlement: China Property Development Scheme Unravels

A shocking embezzlement scandal has rocked the Singaporean business world, unraveling a seemingly lucrative China property development scheme and leaving investors reeling. The arrest of former director, [Name Redacted pending legal proceedings], on charges of embezzling S$7 million has sent shockwaves through the industry, raising serious questions about oversight and transparency in overseas investments.

The scheme, initially touted as a high-return investment opportunity in a rapidly developing Chinese city, [City Name Redacted], promised substantial profits to investors. Marketing materials highlighted the booming real estate market and projected impressive returns on investment within a short timeframe. However, recent investigations have revealed a different story.

The Unraveling of the Scheme: A Web of Deceit

The alleged embezzlement came to light after a series of discrepancies were reported by concerned investors. These discrepancies, initially dismissed as minor administrative errors, quickly escalated into a full-blown investigation, revealing a sophisticated web of fraudulent transactions. According to official statements, [Name Redacted] allegedly diverted funds intended for land acquisition and construction into personal accounts.

Key findings of the investigation include:

- Missing funds: Approximately S$7 million in investor funds cannot be accounted for.

- Fabricated documents: Investigators uncovered evidence of forged contracts and manipulated financial records.

- Shell companies: The investigation uncovered a network of shell companies allegedly used to launder the embezzled funds.

This case highlights the significant risks associated with overseas investments, particularly in less regulated markets. The ease with which [Name Redacted] allegedly concealed the fraudulent activities underscores the importance of rigorous due diligence and robust investor protection measures.

Implications for the Future of Overseas Investments

The scandal serves as a stark warning to potential investors. The seemingly promising returns on offer often mask substantial risks, especially when dealing with opaque business structures or unfamiliar jurisdictions. Experts recommend investors undertake thorough background checks on companies and individuals involved in overseas ventures. They also advise seeking independent legal and financial advice before committing significant funds.

Investors should consider the following preventative measures:

- Thorough due diligence: Independently verify the legitimacy of the investment opportunity and the credibility of the individuals and companies involved.

- Transparent financial reporting: Demand clear and regular financial reporting from the investment manager.

- Legal and financial advice: Seek professional counsel to assess the risks associated with the investment.

- Diversification: Avoid putting all your eggs in one basket by diversifying your investment portfolio.

The investigation into [Name Redacted]'s alleged embezzlement is ongoing, with further charges expected. The case is likely to set a significant legal precedent, impacting future regulations concerning overseas investments and highlighting the need for stricter oversight and accountability in the industry. The collapse of this China property development scheme serves as a cautionary tale, emphasizing the critical importance of investor vigilance and careful due diligence in the face of attractive, yet potentially risky, investment opportunities. The ultimate impact on investors remains to be seen, but the repercussions are likely to be felt for some time to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Former Director's S$7 Million Embezzlement: China Property Development Scheme Unravels. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Football Legends Share Economy Flight Ferdinand Bale And Hoddle In Bilbao

May 21, 2025

Football Legends Share Economy Flight Ferdinand Bale And Hoddle In Bilbao

May 21, 2025 -

Dedication And Strategy How Jarvis Achieved Success In The Gaming World

May 21, 2025

Dedication And Strategy How Jarvis Achieved Success In The Gaming World

May 21, 2025 -

Bitcoin Price Surge Investors Abandon Safe Havens For Crypto

May 21, 2025

Bitcoin Price Surge Investors Abandon Safe Havens For Crypto

May 21, 2025 -

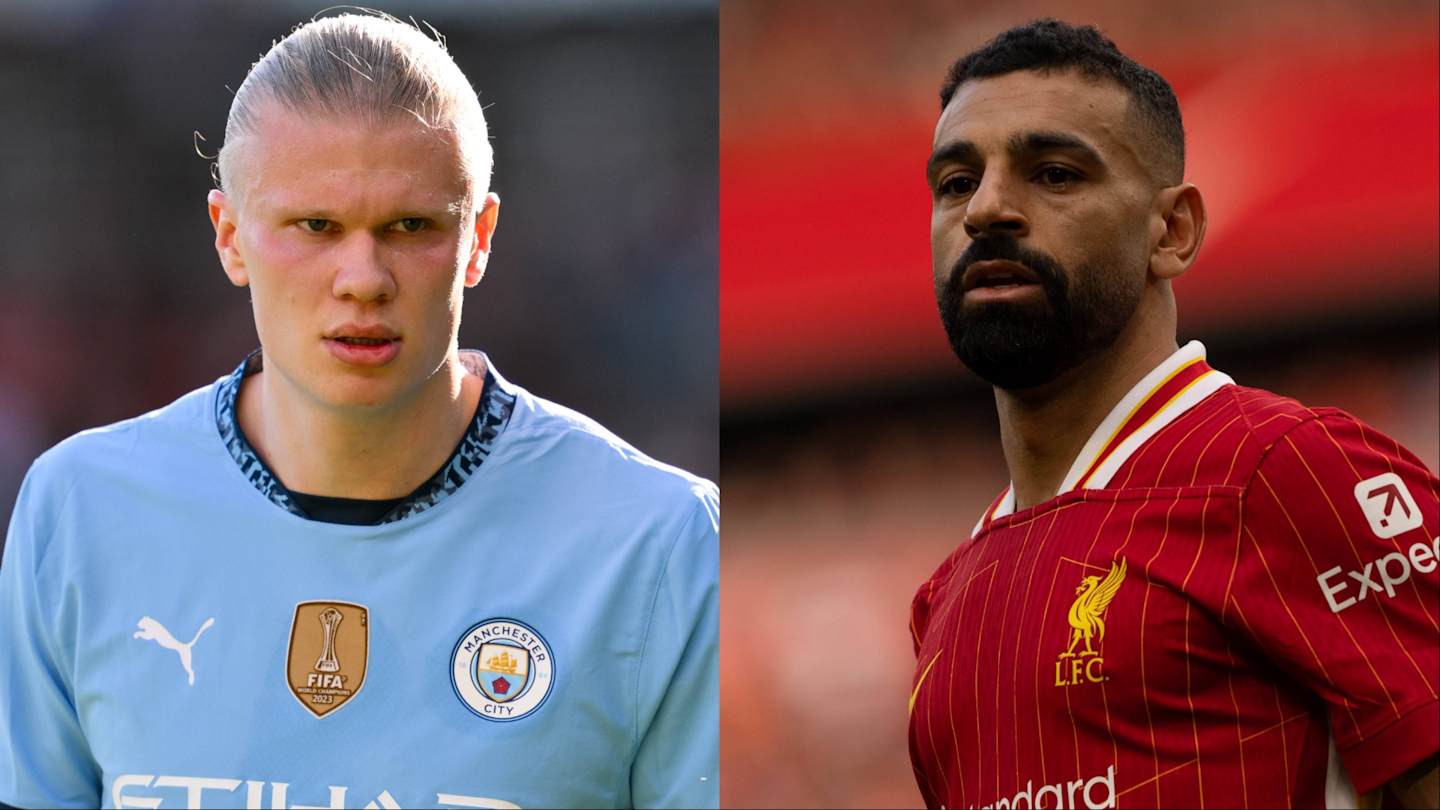

Tracking The Premier League Golden Boot Latest Scores And Predictions

May 21, 2025

Tracking The Premier League Golden Boot Latest Scores And Predictions

May 21, 2025 -

Analysis How Trumps Appointment Of Fbi Leaders Backfired On Maga Media

May 21, 2025

Analysis How Trumps Appointment Of Fbi Leaders Backfired On Maga Media

May 21, 2025