Franklin Templeton's Solana Spot ETF Filing: What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Franklin Templeton's Solana Spot ETF Filing: A Watershed Moment for Crypto Investors?

The crypto world is abuzz with the news of Franklin Templeton's recent filing for a Solana (SOL) spot exchange-traded fund (ETF). This move marks a significant step forward for the broader crypto ETF landscape and could potentially reshape the investment strategies of many. But what does this actually mean for investors, and should you be jumping on the Solana bandwagon? Let's delve into the details.

What is a Spot Solana ETF?

Unlike futures-based ETFs, which track derivatives contracts, a spot ETF directly invests in the underlying asset – in this case, Solana. This offers investors more direct exposure to Solana's price movements and eliminates the complexities and potential risks associated with futures contracts. The proposed Franklin Templeton ETF aims to provide investors with a convenient and regulated way to gain exposure to this prominent layer-1 blockchain.

Why is this Filing Significant?

This filing carries substantial weight for several reasons:

- Increased Institutional Interest: Franklin Templeton is a major player in the financial world, and their entry into the crypto ETF space signals growing institutional acceptance of digital assets. This legitimization can boost investor confidence and drive further adoption.

- Potential for Approval: While SEC approval is far from guaranteed, the filing itself demonstrates a growing trend towards approving spot crypto ETFs. Successful approval could pave the way for similar ETFs focused on other cryptocurrencies.

- Solana's Growing Ecosystem: Solana's robust and rapidly expanding ecosystem, encompassing NFTs, decentralized finance (DeFi), and decentralized applications (dApps), makes it an attractive target for institutional investment. An ETF offers a simplified entry point for investors seeking exposure to this vibrant market.

- Simplified Investment Access: Investing directly in Solana requires setting up cryptocurrency wallets and navigating the complexities of digital asset exchanges. An ETF streamlines this process, making it accessible to a broader range of investors.

Potential Risks and Considerations:

While the potential benefits are enticing, it's crucial to acknowledge the inherent risks:

- Regulatory Uncertainty: The regulatory landscape surrounding cryptocurrencies remains volatile. The SEC's decision on the ETF application will be crucial, and any negative outcome could impact the ETF's performance and investor sentiment.

- Volatility of Solana: Solana, like other cryptocurrencies, is known for its price volatility. Investors should be prepared for significant price swings and potential losses.

- Market Competition: The crypto ETF market is becoming increasingly competitive. Franklin Templeton will face competition from other established players vying for investor attention.

What Should Investors Do?

The Franklin Templeton Solana ETF filing presents a compelling opportunity, but investors should proceed with caution. Thorough research, understanding your own risk tolerance, and a diversified investment strategy are paramount. Consider consulting with a financial advisor before making any investment decisions. The approval of this ETF is not guaranteed, and the cryptocurrency market is inherently risky. Investors should only allocate capital they can afford to lose.

Conclusion:

Franklin Templeton's Solana spot ETF filing represents a pivotal moment in the evolution of crypto investment. While the future remains uncertain, the potential for broader institutional adoption and increased accessibility makes this a development worthy of close observation for all investors interested in the crypto market. Keep an eye on the SEC's decision and continue to monitor the evolving regulatory landscape as it shapes the future of crypto ETFs.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Franklin Templeton's Solana Spot ETF Filing: What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Where To Watch Nuggets Vs Warriors Live Stream And Tv Channel 3 17 25

Mar 18, 2025

Where To Watch Nuggets Vs Warriors Live Stream And Tv Channel 3 17 25

Mar 18, 2025 -

Is This Woman The Winner Of The Bachelor Analyzing Clues And Fan Theories

Mar 18, 2025

Is This Woman The Winner Of The Bachelor Analyzing Clues And Fan Theories

Mar 18, 2025 -

First T20 International New Zealand Secures Victory Against Pakistan In Christchurch

Mar 18, 2025

First T20 International New Zealand Secures Victory Against Pakistan In Christchurch

Mar 18, 2025 -

Google Assistants Phone App To Be Discontinued Gemini Is The Successor

Mar 18, 2025

Google Assistants Phone App To Be Discontinued Gemini Is The Successor

Mar 18, 2025 -

Solana Spot Etf Race Heats Up Franklin Templeton Joins The Fray With Sec Filing

Mar 18, 2025

Solana Spot Etf Race Heats Up Franklin Templeton Joins The Fray With Sec Filing

Mar 18, 2025

Latest Posts

-

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025

Martinellis High Stakes Arsenals Crucial Champions League Battle Against Psg

Apr 30, 2025 -

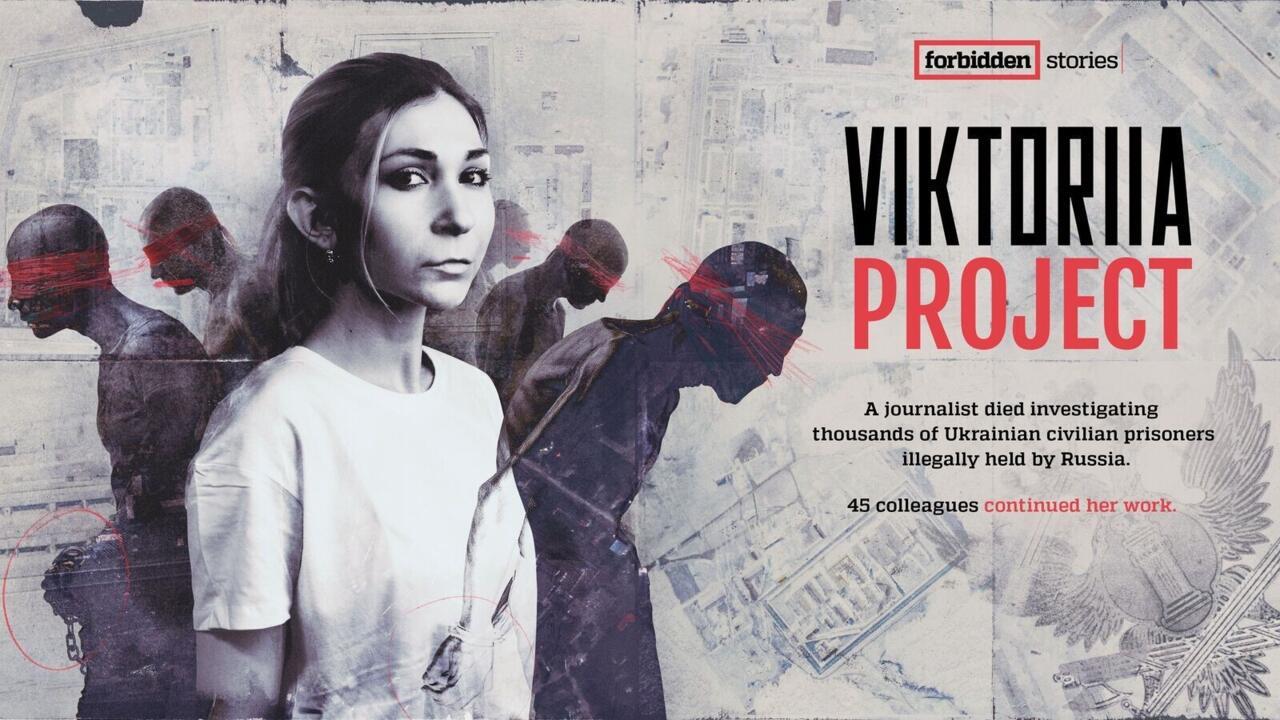

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025

Forbidden Stories The Perilous Search For A Missing Journalist In Ukraine

Apr 30, 2025 -

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025

The Epic Games Store On Mobile A Retrospective And Future Outlook

Apr 30, 2025 -

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025

Are Ai Powered Web3 Projects Secure Exploring The Risks Of Key Access

Apr 30, 2025 -

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025

Cochise County Stronghold Fire 3 000 Acres Burned Investigation Begins

Apr 30, 2025