From Black Monday To The Pandemic: Examining The US Stock Market's Most Devastating Crashes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

From Black Monday to the Pandemic: Examining the US Stock Market's Most Devastating Crashes

The US stock market, a behemoth of global finance, has witnessed periods of breathtaking growth and equally terrifying collapses. While volatility is inherent to the system, certain crashes stand out as particularly devastating, shaping economic policy and leaving lasting scars on investor confidence. From the infamous Black Monday to the COVID-19 pandemic-induced plunge, let's examine some of the most significant market crashes in US history.

Black Monday (October 19, 1987): The Day the Market Plunged

Black Monday remains etched in the memory of market veterans. On this single day, the Dow Jones Industrial Average plummeted a staggering 22.6%, the largest one-day percentage drop in history. While the exact causes are still debated, a confluence of factors – including program trading, rising interest rates, and concerns about the US trade deficit – contributed to the panic selling. The crash highlighted the vulnerability of the market to rapid, unforeseen events and the need for improved regulatory oversight. This event serves as a crucial reminder of the inherent risks in stock market investment.

The Dot-Com Bubble Burst (2000-2002): The Tech Wreck

The late 1990s witnessed an unprecedented surge in technology stocks, fueled by the burgeoning internet industry. However, this rapid growth was unsustainable, and the subsequent burst of the dot-com bubble resulted in a significant market correction. Many internet companies, overvalued and lacking profitability, collapsed, wiping out billions of dollars in investor wealth. The Nasdaq Composite Index, a key indicator of the tech sector's performance, lost over 78% of its value from its peak in March 2000 to its low in October 2002. This crash underscored the dangers of speculative investing and the importance of fundamental analysis.

The Global Financial Crisis (2008-2009): The Subprime Mortgage Meltdown

The 2008 financial crisis, triggered by the subprime mortgage crisis, stands as one of the most severe economic downturns in modern history. The widespread defaults on subprime mortgages led to a collapse in the housing market and a credit crunch that rippled through the global financial system. Major investment banks failed, and the Dow Jones Industrial Average experienced its worst year since 1931. Government intervention, including massive bailouts and quantitative easing, was crucial in preventing a complete collapse of the financial system. The GFC exposed systemic risks within the financial industry and prompted significant regulatory reforms.

The COVID-19 Pandemic Crash (2020): Unprecedented Uncertainty

The COVID-19 pandemic sent shockwaves through the global economy, triggering the fastest and steepest market decline since the Great Depression. Lockdowns, supply chain disruptions, and widespread economic uncertainty fueled a massive sell-off in March 2020. The speed and severity of the decline were unprecedented, with the Dow Jones Industrial Average experiencing its worst week since 1931. However, unlike previous crashes, the market's recovery was surprisingly swift, driven by unprecedented government stimulus and the rapid development of COVID-19 vaccines. This event highlighted the market's adaptability and the significant impact of government intervention during times of crisis.

Lessons Learned and Future Outlook:

Analyzing these devastating market crashes reveals several crucial lessons:

- Diversification: Spreading investments across different asset classes reduces risk.

- Risk Management: Understanding and managing risk is crucial for long-term success.

- Long-Term Perspective: Market fluctuations are inevitable; a long-term perspective is essential.

- Regulatory Oversight: Strong regulatory frameworks are vital for market stability.

While predicting the future is impossible, understanding past market crashes provides invaluable insights into potential risks and opportunities. By learning from history, investors can better navigate future market volatility and make more informed investment decisions. The US stock market's resilience, demonstrated through its recovery from these significant downturns, underscores its enduring role in driving economic growth, though the potential for future shocks remains a constant consideration.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on From Black Monday To The Pandemic: Examining The US Stock Market's Most Devastating Crashes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

No Camera Bump Oppo Find X8 Ultras Design Innovation Explained

Apr 10, 2025

No Camera Bump Oppo Find X8 Ultras Design Innovation Explained

Apr 10, 2025 -

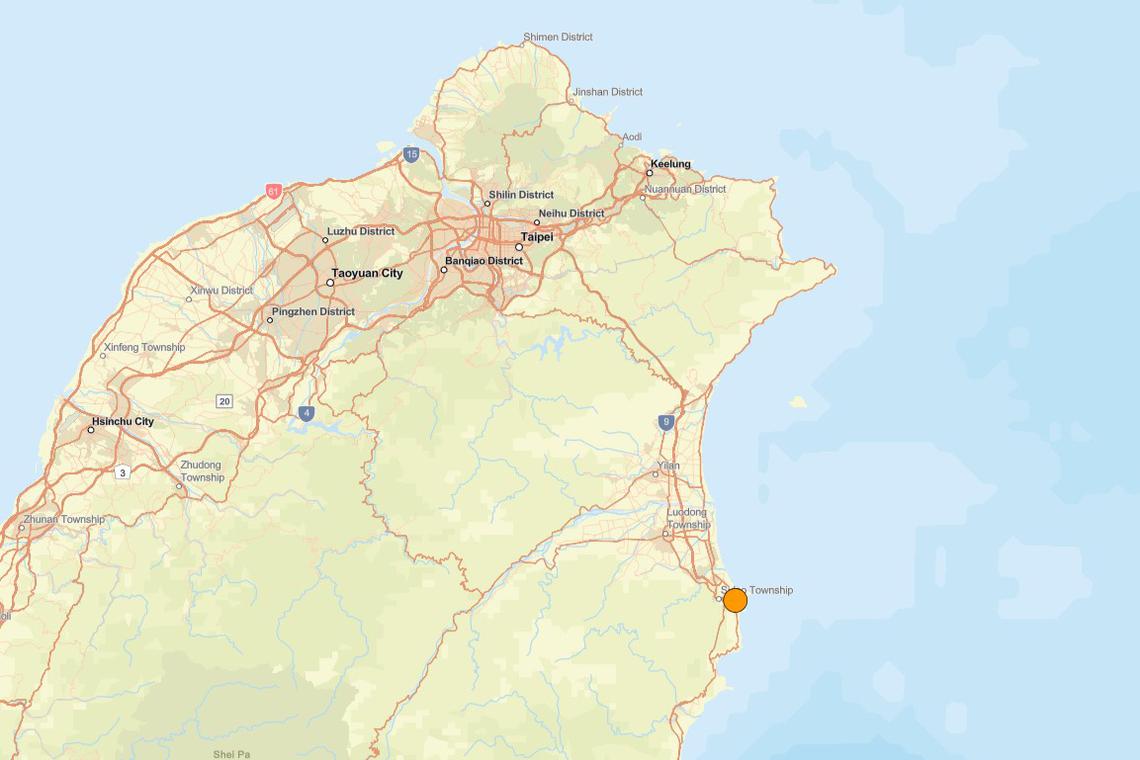

No Casualties Reported After 5 8 Earthquake Jolts Taiwan

Apr 10, 2025

No Casualties Reported After 5 8 Earthquake Jolts Taiwan

Apr 10, 2025 -

Manchester United Goalkeeping Crisis Matics Onana Assessment Sparks Debate

Apr 10, 2025

Manchester United Goalkeeping Crisis Matics Onana Assessment Sparks Debate

Apr 10, 2025 -

Pekhart W Chelsea Czy To Wlasciwy Wybor

Apr 10, 2025

Pekhart W Chelsea Czy To Wlasciwy Wybor

Apr 10, 2025 -

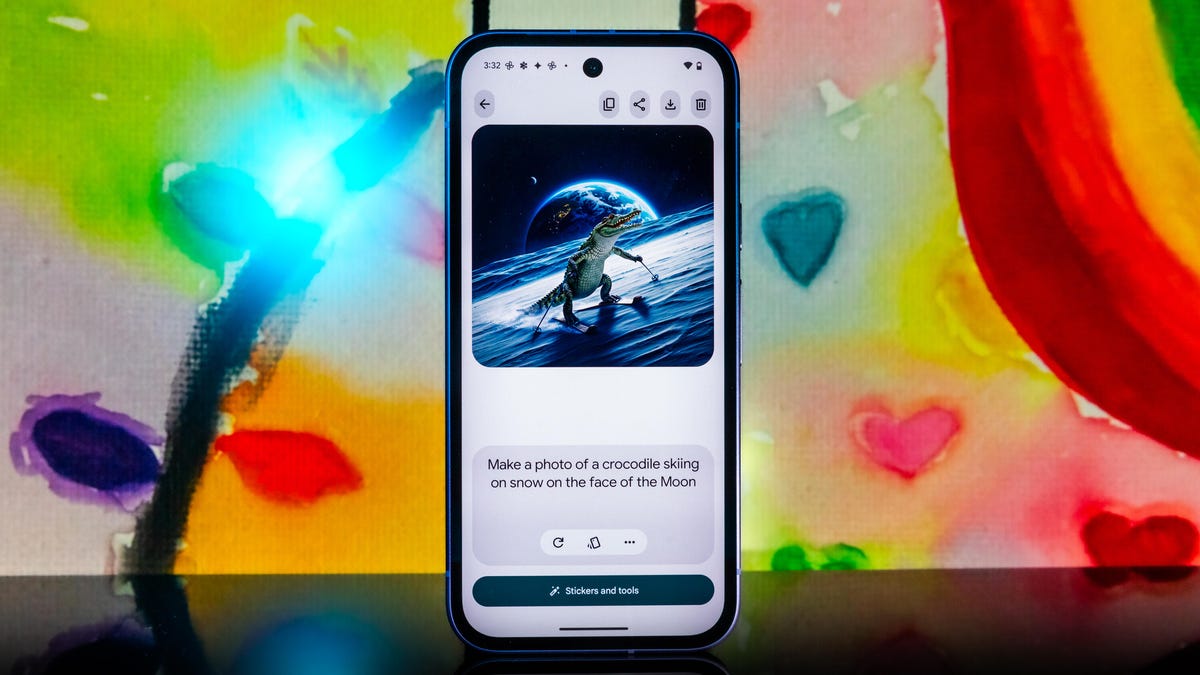

Google Pixel 9a Review Performance Camera And Overall Value

Apr 10, 2025

Google Pixel 9a Review Performance Camera And Overall Value

Apr 10, 2025