From Fossil Fuels To Crypto: Oil And Gas Firms' Strategic Shift To Bitcoin Mining

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

From Fossil Fuels to Crypto: Oil and Gas Firms' Strategic Shift to Bitcoin Mining

The energy industry is undergoing a seismic shift, and it's not just about renewables. Major oil and gas companies are increasingly turning their attention to a seemingly disparate sector: Bitcoin mining. This strategic move, driven by a confluence of factors, is reshaping the landscape of both the energy and cryptocurrency worlds. But is this a sustainable, environmentally responsible path, or a risky gamble?

The Allure of Bitcoin Mining for Energy Giants:

Several key factors are motivating oil and gas companies to invest heavily in Bitcoin mining. Firstly, stranded energy assets – gas flares, excess electricity from oil production sites – present a significant opportunity. Instead of wasting this energy, companies can leverage it to power Bitcoin mining operations, generating revenue from a previously unprofitable resource. This approach allows for increased profitability and reduces the environmental impact of flaring, a significant source of greenhouse gas emissions.

Secondly, the price volatility of Bitcoin presents a compelling investment case. While the cryptocurrency market is notoriously volatile, successful mining operations can yield substantial profits, potentially offsetting losses in traditional energy markets and diversifying their revenue streams. Companies see this as a hedge against fluctuating oil and gas prices.

Thirdly, Bitcoin mining provides a new avenue for technological innovation and expertise. The technical expertise required for efficient and large-scale mining operations aligns with the existing skillsets within oil and gas companies, enabling a relatively smooth transition into this new market.

Environmental Concerns and the Path to Sustainability:

While the utilization of stranded energy is a positive aspect, the environmental impact of Bitcoin mining remains a significant concern. The energy-intensive nature of the process, particularly when relying on fossil fuels, directly contradicts the global push towards decarbonization. However, many companies are actively exploring ways to mitigate this:

- Investing in renewable energy sources: Several firms are pairing their mining operations with renewable energy projects, aiming for carbon-neutral or even carbon-negative mining. This approach addresses the environmental concerns while still utilizing their existing infrastructure.

- Improving mining efficiency: Technological advancements in mining hardware and software are continually improving the energy efficiency of the process, reducing the overall environmental footprint.

- Transparency and data reporting: Increasingly, companies are committing to transparent reporting on their energy consumption and carbon emissions, fostering accountability and driving improvements in sustainability.

Challenges and Future Outlook:

Despite the potential benefits, oil and gas companies face challenges in their transition to Bitcoin mining. Regulatory uncertainty surrounding cryptocurrency mining varies significantly across jurisdictions, impacting investment decisions and operational feasibility. Furthermore, competition from established Bitcoin mining companies and the inherent volatility of the cryptocurrency market pose considerable risks.

However, the long-term outlook suggests a continued shift towards Bitcoin mining within the energy sector. The potential for revenue generation from stranded assets, coupled with technological advancements and a growing awareness of environmental responsibility, is likely to drive further investment and innovation in this space. The success of this transition will largely depend on the industry's ability to address environmental concerns and navigate the complexities of the cryptocurrency market. The future will tell whether this strategic shift represents a sustainable and profitable path for oil and gas firms, or a fleeting experiment in a highly volatile market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on From Fossil Fuels To Crypto: Oil And Gas Firms' Strategic Shift To Bitcoin Mining. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

1930s Gothic Horror Michael B Jordan In Ryan Cooglers Sinners

Apr 24, 2025

1930s Gothic Horror Michael B Jordan In Ryan Cooglers Sinners

Apr 24, 2025 -

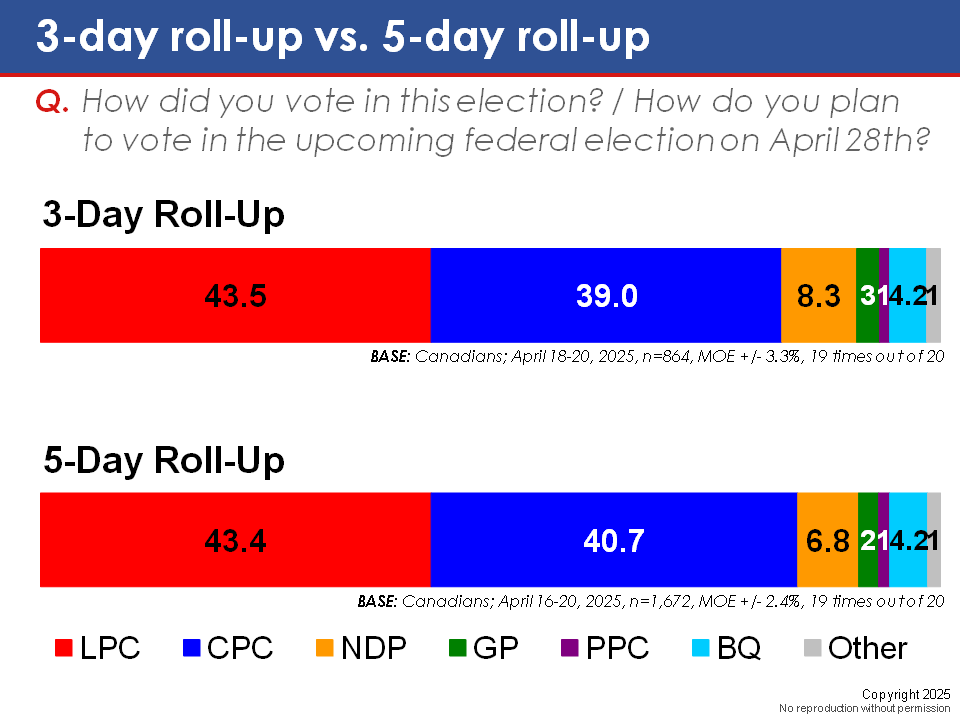

Political Rollercoaster One Night Lead For Conservatives Then Liberal Recovery

Apr 24, 2025

Political Rollercoaster One Night Lead For Conservatives Then Liberal Recovery

Apr 24, 2025 -

Early Stanley Cup Playoffs Show Significant Home Ice Advantage

Apr 24, 2025

Early Stanley Cup Playoffs Show Significant Home Ice Advantage

Apr 24, 2025 -

Thunderbolts First Reactions Highlight Pughs Powerful Performance And Gritty Tone

Apr 24, 2025

Thunderbolts First Reactions Highlight Pughs Powerful Performance And Gritty Tone

Apr 24, 2025 -

Trump On Powell No Intention Of Removing Federal Reserve Chair

Apr 24, 2025

Trump On Powell No Intention Of Removing Federal Reserve Chair

Apr 24, 2025