GameStop's $6 Billion Balance Sheet And Bitcoin Investment: A Path To Future Growth?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GameStop's $6 Billion Balance Sheet and Bitcoin Investment: A Path to Future Growth?

GameStop, the video game retailer that once teetered on the brink of collapse, is making headlines again. This time, it's not about a Reddit-fueled stock surge, but a surprisingly robust balance sheet and a bold investment in Bitcoin. With over $6 billion in cash and liquid assets, the company is positioned to navigate economic uncertainty and potentially redefine its future in the evolving digital landscape. But is its Bitcoin investment a wise strategic move, or a risky gamble?

A Fortuitous Financial Position:

GameStop's recent financial reports reveal a remarkable turnaround. The company, once synonymous with struggling brick-and-mortar retail, now boasts a substantial cash reserve. This financial strength is largely attributed to a combination of factors: the unexpected success of its NFT marketplace, strategic cost-cutting measures, and shrewd management of its inventory. This massive cash pile has sparked intense speculation about GameStop's future plans. Many analysts believe this financial flexibility offers the company unprecedented opportunities for growth and expansion.

The Bitcoin Gamble: A Hedge or a Growth Strategy?

GameStop's investment in Bitcoin adds another layer of intrigue to its transformation. While the exact amount remains undisclosed, the investment signals a significant shift in the company's strategy, moving beyond traditional retail and embracing the volatile yet potentially lucrative world of cryptocurrencies. This move could be viewed in two primary ways:

- Hedging against inflation: In times of economic uncertainty, Bitcoin, often considered a hedge against inflation, can help preserve the value of GameStop's assets. This strategic move could protect the company's substantial cash reserves from potential erosion.

- Strategic diversification: The investment may also represent a more forward-looking approach. GameStop is clearly exploring opportunities beyond its core business, signaling an intention to become a more diversified and future-proof company. The cryptocurrency market, despite its volatility, presents significant growth potential.

Potential Benefits and Risks:

The benefits of GameStop's Bitcoin investment are potentially substantial, including:

- Increased brand relevance: By associating itself with a cutting-edge technology like Bitcoin, GameStop could attract a younger, tech-savvy customer base.

- New revenue streams: GameStop might explore ways to integrate Bitcoin into its existing operations, potentially offering cryptocurrency payment options or even developing cryptocurrency-based games and services.

- Enhanced investor confidence: The bold investment could boost investor confidence and potentially drive further stock appreciation.

However, the risks are equally significant:

- Market volatility: Bitcoin's price is notoriously volatile, and a significant downturn could negatively impact GameStop's investment.

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies is constantly evolving, and changes could negatively impact GameStop's holdings.

- Reputational risk: A poorly managed cryptocurrency investment could damage GameStop's reputation.

The Path Forward: A Long-Term Vision?

GameStop's $6 billion balance sheet and its foray into Bitcoin are not isolated events. They are part of a larger strategy aimed at transforming the company into a player in the evolving digital landscape. While the long-term success of this strategy remains to be seen, the company's bold moves demonstrate a willingness to adapt and innovate in a rapidly changing market. Only time will tell if this gamble pays off, but the company’s current financial strength certainly gives it a fighting chance. The upcoming quarters will be critical in determining the true impact of these strategic decisions on GameStop's long-term viability and growth. Analysts and investors alike will be watching closely.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GameStop's $6 Billion Balance Sheet And Bitcoin Investment: A Path To Future Growth?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Nhl Bench To Behind The Scenes Peter De Boers Hockey Journey

May 23, 2025

From Nhl Bench To Behind The Scenes Peter De Boers Hockey Journey

May 23, 2025 -

Jon Stewart Critiques Cnns Biden Biography A Missed Opportunity

May 23, 2025

Jon Stewart Critiques Cnns Biden Biography A Missed Opportunity

May 23, 2025 -

Trump Administration Accepts Luxury Jet From Qatar Details Inside

May 23, 2025

Trump Administration Accepts Luxury Jet From Qatar Details Inside

May 23, 2025 -

Td Bank Commits 1 Billion To Enhance Compliance Systems

May 23, 2025

Td Bank Commits 1 Billion To Enhance Compliance Systems

May 23, 2025 -

Thunder Vs Timberwolves Game 2 Final Score Recap And Key Highlights

May 23, 2025

Thunder Vs Timberwolves Game 2 Final Score Recap And Key Highlights

May 23, 2025

Latest Posts

-

Where Does Gillian Anderson Feel Most At Home Uk Or Usa

May 23, 2025

Where Does Gillian Anderson Feel Most At Home Uk Or Usa

May 23, 2025 -

Improved Maritime Domain Awareness The Coast Guards Plan For Integrated Surveillance

May 23, 2025

Improved Maritime Domain Awareness The Coast Guards Plan For Integrated Surveillance

May 23, 2025 -

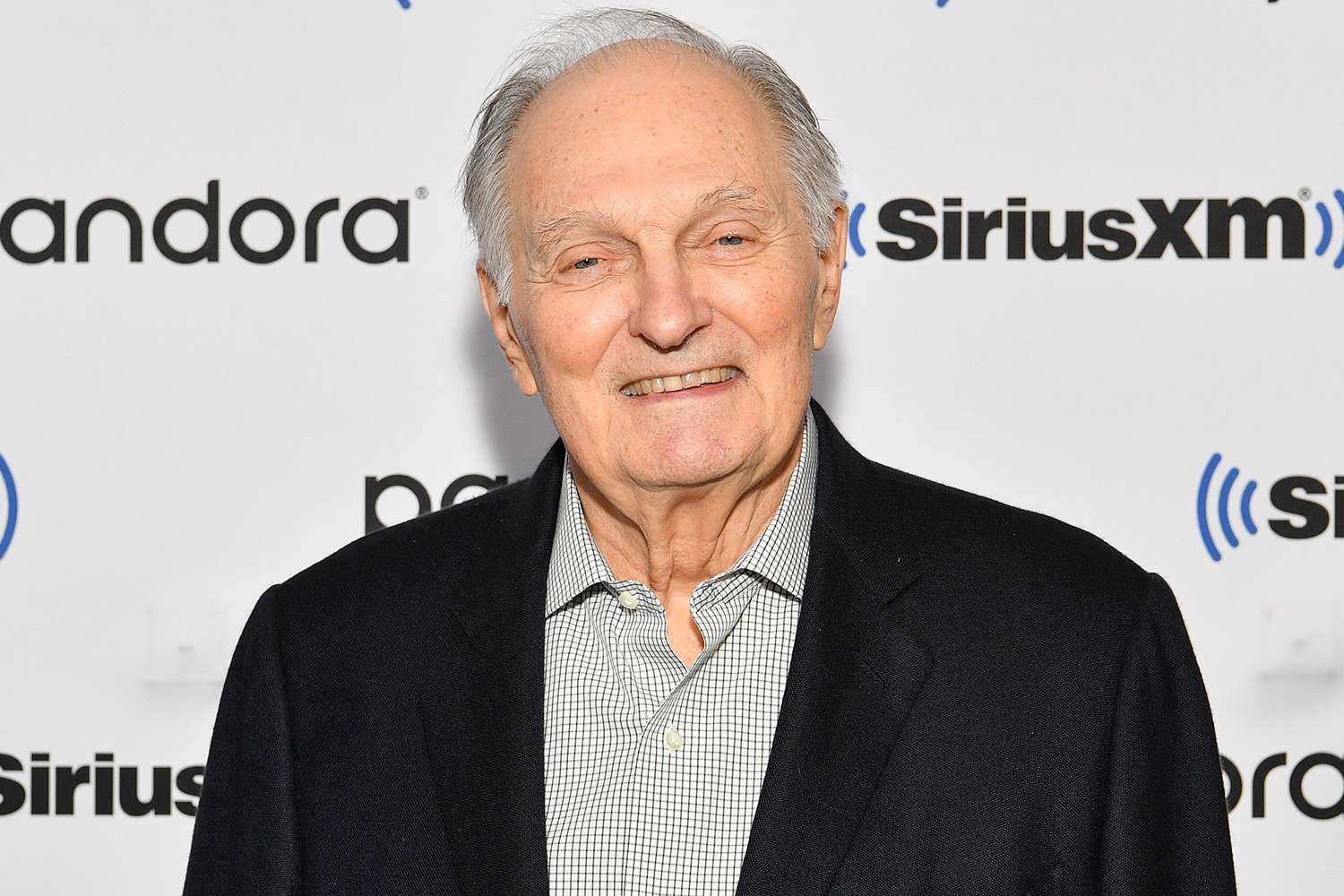

Alan Aldas Parkinsons Journey Challenges Humor And A Full Time Fight

May 23, 2025

Alan Aldas Parkinsons Journey Challenges Humor And A Full Time Fight

May 23, 2025 -

Major Energy Provider Announces 50 Off Energy For 7 Million Customers

May 23, 2025

Major Energy Provider Announces 50 Off Energy For 7 Million Customers

May 23, 2025 -

Ye Apologizes For Antisemitic Remarks After Face Time Call With Children

May 23, 2025

Ye Apologizes For Antisemitic Remarks After Face Time Call With Children

May 23, 2025