Gen Z's Financial Leap: Ramit Sethi's Strategies For Early Wealth Building

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gen Z's Financial Leap: Ramit Sethi's Strategies for Early Wealth Building

Gen Z is entering the workforce with a laser focus on financial independence, a stark contrast to previous generations. Fueled by a desire for early retirement and a healthy dose of financial literacy gleaned from social media, this generation is actively seeking strategies to build wealth early. Ramit Sethi, a renowned personal finance expert, offers a unique approach that resonates powerfully with this ambitious demographic. His strategies, focusing on mindful spending, aggressive saving, and strategic investing, are helping Gen Z achieve financial freedom faster than ever before.

Understanding Gen Z's Financial Landscape:

Gen Z faces unique challenges in the current economic climate. High student loan debt, rising inflation, and a volatile job market create significant hurdles. However, this generation also possesses advantages: a strong digital literacy, access to diverse financial resources, and a willingness to embrace unconventional approaches to wealth building. This blend of challenges and opportunities makes Ramit Sethi's tailored strategies particularly relevant.

Ramit Sethi's Winning Formula for Gen Z:

Sethi's philosophy isn't about extreme frugality; it's about conscious spending and strategic allocation of resources. His approach, detailed in his books and online courses, boils down to these key principles:

1. Mindful Spending, Not Deprivation:

Sethi advocates for identifying your "essential" and "non-essential" spending. He encourages deliberate choices, not sacrifices. This means allocating funds towards experiences and purchases that bring true value and joy, while eliminating unnecessary expenses. This isn't about deprivation; it's about conscious consumption.

- Track your spending: Utilize budgeting apps and spreadsheets to monitor your cash flow and identify areas for improvement.

- Prioritize experiences: Invest in experiences that create lasting memories, rather than accumulating material possessions.

- Negotiate bills: Don't be afraid to negotiate lower rates on services like internet and insurance.

2. Aggressive Saving and Investing:

Sethi stresses the importance of saving aggressively, even with seemingly limited resources. He emphasizes the power of compounding returns through early and consistent investing. Gen Z can leverage this by:

- Automate savings: Set up automatic transfers to a savings or investment account each month.

- Maximize employer matching: Take full advantage of any employer-sponsored retirement plans and their matching contributions.

- Invest in index funds: Diversify investments through low-cost index funds to minimize risk and maximize long-term growth.

3. Side Hustles and Income Diversification:

Sethi recognizes the value of multiple income streams. Gen Z's entrepreneurial spirit and digital fluency are perfectly suited to generating additional income through:

- Freelancing: Leverage skills in writing, graphic design, or web development to offer services online.

- Online courses & tutorials: Share expertise and knowledge by creating and selling online courses.

- Investing in rental properties (long-term): A more traditional method of generating passive income, requiring more capital but providing potentially higher returns.

4. Building a Strong Financial Foundation:

Sethi’s strategies go beyond quick wins; they focus on building a solid financial foundation for long-term success. This includes:

- Paying down high-interest debt: Prioritize paying off high-interest debt like credit cards to reduce financial burden.

- Building credit: Establishing good credit is crucial for future financial opportunities such as mortgages and loans.

- Continuous learning: Stay updated on financial trends and strategies through books, courses, and reputable financial resources.

Conclusion:

Ramit Sethi's approach offers a practical and achievable path to financial freedom for Gen Z. By embracing mindful spending, aggressive saving, strategic investing, and income diversification, this generation can overcome financial challenges and build a secure financial future. It's not about deprivation; it's about conscious choices that lead to lasting financial well-being. The key is to start now, learn consistently, and actively work towards achieving your financial goals.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gen Z's Financial Leap: Ramit Sethi's Strategies For Early Wealth Building. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

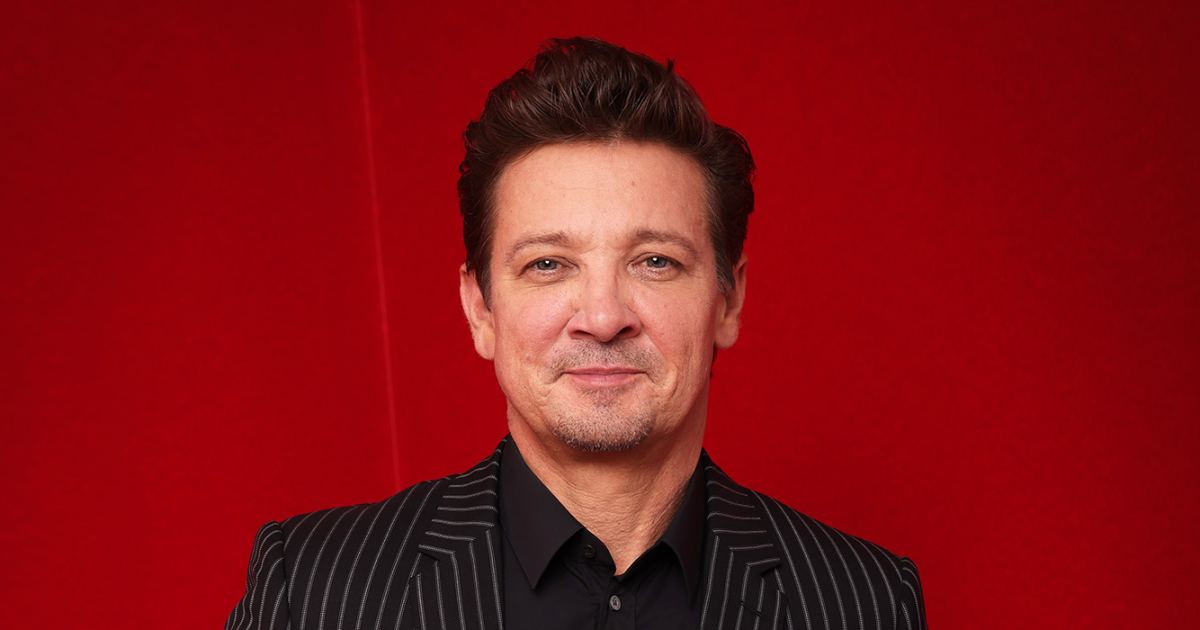

Jeremy Renners Near Fatal Snowplow Accident A Fight For Survival

Apr 29, 2025

Jeremy Renners Near Fatal Snowplow Accident A Fight For Survival

Apr 29, 2025 -

Workers Partys Ge 2025 Strategy Focusing On Punggol Grc And Gan Kim Yong

Apr 29, 2025

Workers Partys Ge 2025 Strategy Focusing On Punggol Grc And Gan Kim Yong

Apr 29, 2025 -

Unusual Radio 2 Welcome Scott Mills Gift To Ellie Taylor

Apr 29, 2025

Unusual Radio 2 Welcome Scott Mills Gift To Ellie Taylor

Apr 29, 2025 -

Expect Breakthroughs Criminal Ips Threat Intelligence At Rsac 2025

Apr 29, 2025

Expect Breakthroughs Criminal Ips Threat Intelligence At Rsac 2025

Apr 29, 2025 -

Iberian Peninsula Travel Nightmare Power Failure Causes Mass Delays

Apr 29, 2025

Iberian Peninsula Travel Nightmare Power Failure Causes Mass Delays

Apr 29, 2025

Latest Posts

-

I Died Jeremy Renner Details Grueling Recovery From Snowplow Incident

Apr 30, 2025

I Died Jeremy Renner Details Grueling Recovery From Snowplow Incident

Apr 30, 2025 -

Severe Weather Possible Calgary Faces Cloudy Windy Conditions And Thunderstorm Risk On Tuesday

Apr 30, 2025

Severe Weather Possible Calgary Faces Cloudy Windy Conditions And Thunderstorm Risk On Tuesday

Apr 30, 2025 -

Thunderbolts Post Credits Scene Leak And Critic Reactions Following Premiere

Apr 30, 2025

Thunderbolts Post Credits Scene Leak And Critic Reactions Following Premiere

Apr 30, 2025 -

Everything We Know About Madden Nfl 26 Release Editions And Bonuses

Apr 30, 2025

Everything We Know About Madden Nfl 26 Release Editions And Bonuses

Apr 30, 2025 -

Cardano Price Alert Ada Battles Key Support 1 Breakout In Sight

Apr 30, 2025

Cardano Price Alert Ada Battles Key Support 1 Breakout In Sight

Apr 30, 2025