Generate $3,100 Annual Dividends: $18,000 Portfolio With 3 High-Yield Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Generate $3,100 Annual Dividends: $18,000 Portfolio with 3 High-Yield Stocks

Dreaming of passive income? Imagine generating $3,100 in annual dividends from a relatively modest $18,000 portfolio. It sounds too good to be true, but with careful stock selection and a focus on high-yield dividend stocks, it's entirely achievable. This article reveals a potential strategy using three carefully chosen stocks to help you build a reliable dividend income stream.

Disclaimer: Investing in the stock market always involves risk. Dividend payments are not guaranteed, and stock prices can fluctuate. The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.

Unlocking Passive Income: The Power of High-Yield Dividend Stocks

High-yield dividend stocks offer the potential for regular income streams alongside capital appreciation. By strategically investing in companies with a history of consistent dividend payouts, you can create a portfolio that generates passive income year after year. This strategy is particularly attractive for investors seeking supplemental income or those looking to build a long-term passive income stream.

Three High-Yield Stocks to Consider for Your $18,000 Portfolio

This example portfolio focuses on diversification across sectors, minimizing risk while maximizing potential dividend yield. Remember, past performance is not indicative of future results. Thorough due diligence is crucial before any investment.

-

Real Estate Investment Trust (REIT): REITs often offer high dividend yields due to their requirement to distribute a significant portion of their income to shareholders. A well-established REIT with a proven track record of dividend payments can be a cornerstone of a high-yield portfolio. Example: (Note: Specific stock recommendations are omitted due to the disclaimer. Research and select a REIT fitting your risk tolerance and investment goals.)

-

Energy Sector Stock: The energy sector can be volatile, but companies with stable operations and strong cash flow often reward investors with attractive dividends. Consider established energy companies with a history of consistent dividend payments. Example: (Note: Specific stock recommendations are omitted due to the disclaimer. Research and select an energy stock fitting your risk tolerance and investment goals.)

-

Consumer Staples Company: Companies providing essential goods and services often demonstrate resilience during economic downturns, making them attractive for dividend income. These typically have stable earnings, leading to more reliable dividend payouts. Example: (Note: Specific stock recommendations are omitted due to the disclaimer. Research and select a consumer staples company fitting your risk tolerance and investment goals.)

Building Your $18,000 Portfolio for $3,100 in Annual Dividends

To achieve an annual dividend income of approximately $3,100 from an $18,000 portfolio, you'll need an average dividend yield of around 17.2%. This can be achieved by strategically allocating your investment across the three selected stocks. For example, you could allocate roughly equal amounts to each stock (approximately $6,000 per stock), assuming each offers a yield near or exceeding the average. However, precise allocation will depend on the specific yield of each chosen stock at the time of investment.

Important Considerations:

- Dividend Growth: While focusing on high current yields, consider the potential for dividend growth over time. Companies with a history of increasing dividends can enhance your passive income stream.

- Risk Management: Diversification is key. Spreading your investment across different sectors reduces overall portfolio risk.

- Tax Implications: Remember that dividend income is taxable. Factor tax implications into your overall investment strategy.

- Regular Monitoring: Regularly review your portfolio's performance and make adjustments as needed. Market conditions and company performance can impact your dividend income.

Conclusion:

Generating $3,100 in annual dividends from an $18,000 portfolio is achievable with careful planning and investment in high-yield dividend stocks. This strategy requires thorough research, risk assessment, and a long-term perspective. Remember to consult with a financial advisor before making any investment decisions to tailor a strategy best suited to your individual financial goals and risk tolerance. This article offers a potential framework; individual results may vary.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Generate $3,100 Annual Dividends: $18,000 Portfolio With 3 High-Yield Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Who Is Stars Name S Fiancee Exploring Her Family And Financial Success

May 13, 2025

Who Is Stars Name S Fiancee Exploring Her Family And Financial Success

May 13, 2025 -

Australian Filipinos Cast Online Votes Crucial Midterm Elections For The Philippines

May 13, 2025

Australian Filipinos Cast Online Votes Crucial Midterm Elections For The Philippines

May 13, 2025 -

Teslas Dojo Chip And 4680 Battery Revolutionizing Electric Vehicle Production

May 13, 2025

Teslas Dojo Chip And 4680 Battery Revolutionizing Electric Vehicle Production

May 13, 2025 -

Australian Cricket In Mourning Remembering Bob Cowpers Legacy

May 13, 2025

Australian Cricket In Mourning Remembering Bob Cowpers Legacy

May 13, 2025 -

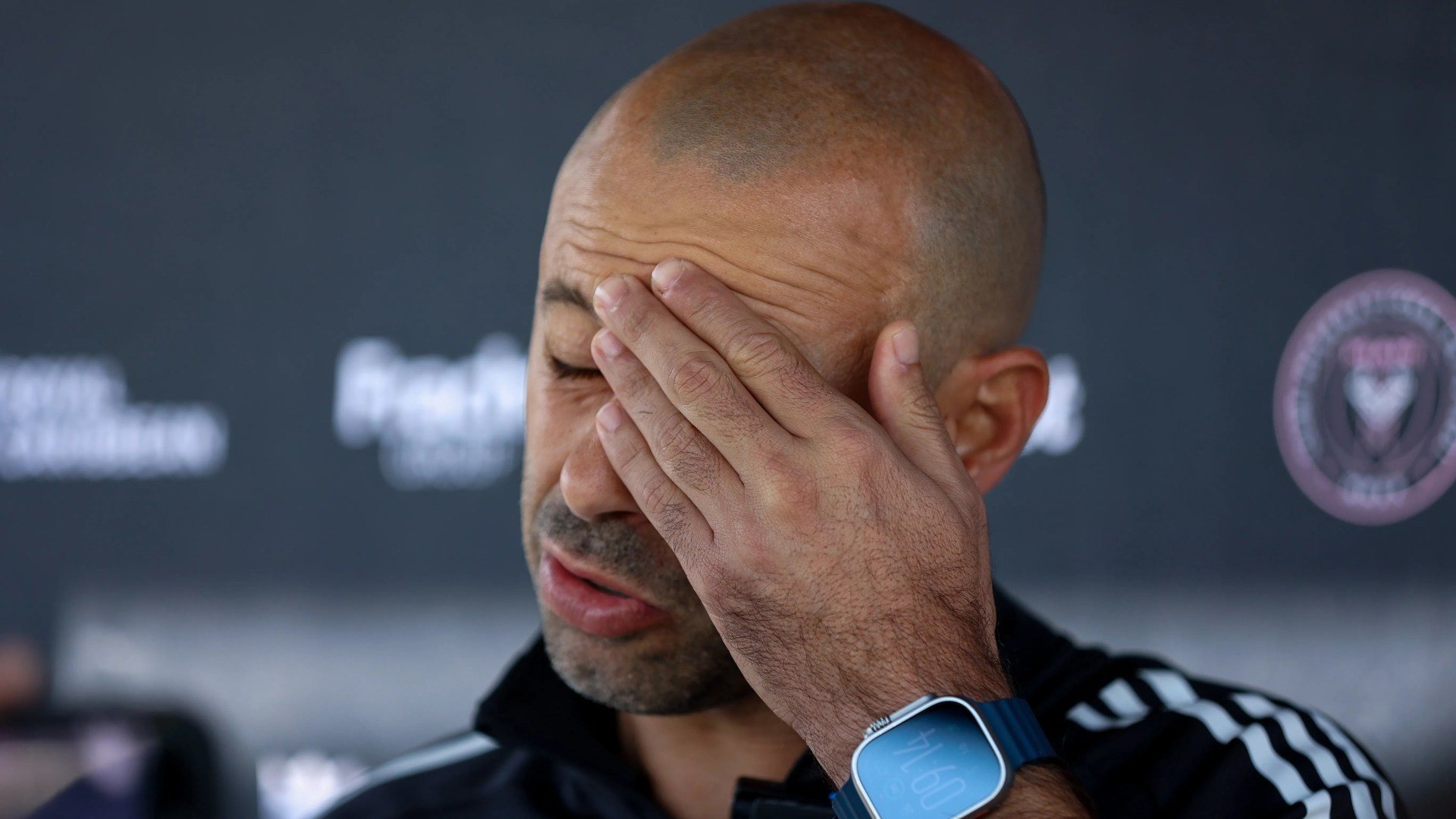

Messis Crushing Mls Loss Beckham Under Fire Mascheranos Job On The Line

May 13, 2025

Messis Crushing Mls Loss Beckham Under Fire Mascheranos Job On The Line

May 13, 2025

Latest Posts

-

Fallout In Queensland Labor Mps Expulsion Sparks Controversy

May 13, 2025

Fallout In Queensland Labor Mps Expulsion Sparks Controversy

May 13, 2025 -

Breaking News Virat Kohlis Retirement Confirmed The Full Story

May 13, 2025

Breaking News Virat Kohlis Retirement Confirmed The Full Story

May 13, 2025 -

Stars Name S Fiancee A Look Into Her Family Fortune And Life

May 13, 2025

Stars Name S Fiancee A Look Into Her Family Fortune And Life

May 13, 2025 -

Virat Kohli Announces Test Retirement A Legacy Defined

May 13, 2025

Virat Kohli Announces Test Retirement A Legacy Defined

May 13, 2025 -

Reuniao Anual Berkshire Hathaway 2024 Cobertura Ao Vivo E Exclusiva Da Info Money

May 13, 2025

Reuniao Anual Berkshire Hathaway 2024 Cobertura Ao Vivo E Exclusiva Da Info Money

May 13, 2025