Generate $3,100 In Dividends Annually: A $54,000 Investment Plan Using 3 Proven Stocks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Generate $3,100 in Dividends Annually: A $54,000 Investment Plan Using 3 Proven Stocks

Dreaming of passive income? Tired of the 9-to-5 grind and longing for financial freedom? A well-structured dividend investment portfolio can be your ticket to a more comfortable future. This article outlines a strategy to generate a healthy $3,100 in annual dividends with a $54,000 investment, focusing on three established, dividend-paying stocks known for their reliability and growth potential. This isn't a get-rich-quick scheme; it's a long-term strategy requiring careful consideration and research.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Understanding Dividend Investing

Before diving into the specifics, let's clarify what dividend investing entails. Dividend stocks are shares of companies that regularly distribute a portion of their profits to shareholders. This passive income stream can supplement your existing income and contribute significantly to your long-term financial goals. However, it's crucial to remember that dividends are not guaranteed and can be affected by various factors, including company performance and economic conditions.

The $54,000 Dividend Portfolio: A 3-Stock Strategy

This strategy focuses on diversification across sectors to mitigate risk while maximizing dividend yield. We'll allocate our $54,000 investment as follows:

-

$18,000 in Johnson & Johnson (JNJ): A healthcare giant known for its consistent dividend payouts and strong brand reputation. JNJ offers stability and is often considered a defensive stock, meaning its value tends to hold up relatively well during economic downturns. Their history of dividend increases is a major draw for income investors.

-

$18,000 in Coca-Cola (KO): A consumer staples company with a global presence and a long history of dividend payments. KO benefits from its resilient brand and the consistent demand for its products, making it a reliable addition to a dividend portfolio.

-

$18,000 in Realty Income (O): A real estate investment trust (REIT) specializing in single-tenant commercial properties. REITs are known for their high dividend yields, and Realty Income boasts a substantial track record of dividend growth. This adds diversification beyond consumer staples and healthcare.

Projected Annual Dividend Income

Based on current dividend yields (always check the most up-to-date information before investing), this portfolio could generate approximately $3,100 in annual dividends. This projection is subject to change based on fluctuating dividend payouts and stock prices. It's crucial to regularly monitor your portfolio and adjust your strategy as needed.

Important Considerations

- Risk Tolerance: Before investing, assess your risk tolerance. Dividend investing, while generally considered less volatile than growth investing, still carries inherent risks.

- Dividend Reinvestment: Consider reinvesting your dividends to accelerate your growth. This strategy, known as DRIP (Dividend Reinvestment Plan), allows you to buy more shares, increasing your future dividend income.

- Tax Implications: Dividends are taxable income. Understand the tax implications before investing to accurately plan for your financial future.

- Diversification Beyond this Portfolio: While this 3-stock strategy offers a starting point, diversifying further across more stocks and asset classes is advisable for long-term stability.

Conclusion: Building Your Path to Passive Income

This $54,000 dividend investment plan offers a potential path to generating significant passive income. By focusing on established, dividend-paying companies like Johnson & Johnson, Coca-Cola, and Realty Income, you can build a foundation for long-term financial security. Remember to conduct thorough research, understand the inherent risks, and seek professional advice before making any investment decisions. Your financial journey towards a more comfortable future starts with informed decisions and a well-structured strategy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Generate $3,100 In Dividends Annually: A $54,000 Investment Plan Using 3 Proven Stocks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nyt Wordle May 11th Game 1422 Answer And Helpful Hints

May 12, 2025

Nyt Wordle May 11th Game 1422 Answer And Helpful Hints

May 12, 2025 -

Fallout In Brisbane Labor Party Expels Member In Unprecedented Step

May 12, 2025

Fallout In Brisbane Labor Party Expels Member In Unprecedented Step

May 12, 2025 -

Dicas Para Encontrar A Cota De Casa Ideal Praia Ou Campo Qual A Melhor Opcao

May 12, 2025

Dicas Para Encontrar A Cota De Casa Ideal Praia Ou Campo Qual A Melhor Opcao

May 12, 2025 -

Godzilla Vs Kong 2 Title And Potential Storylines Explored

May 12, 2025

Godzilla Vs Kong 2 Title And Potential Storylines Explored

May 12, 2025 -

Ufc 315 Preliminary Fights Full Results And Analysis Of Muhammad Vs Della Maddalena

May 12, 2025

Ufc 315 Preliminary Fights Full Results And Analysis Of Muhammad Vs Della Maddalena

May 12, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

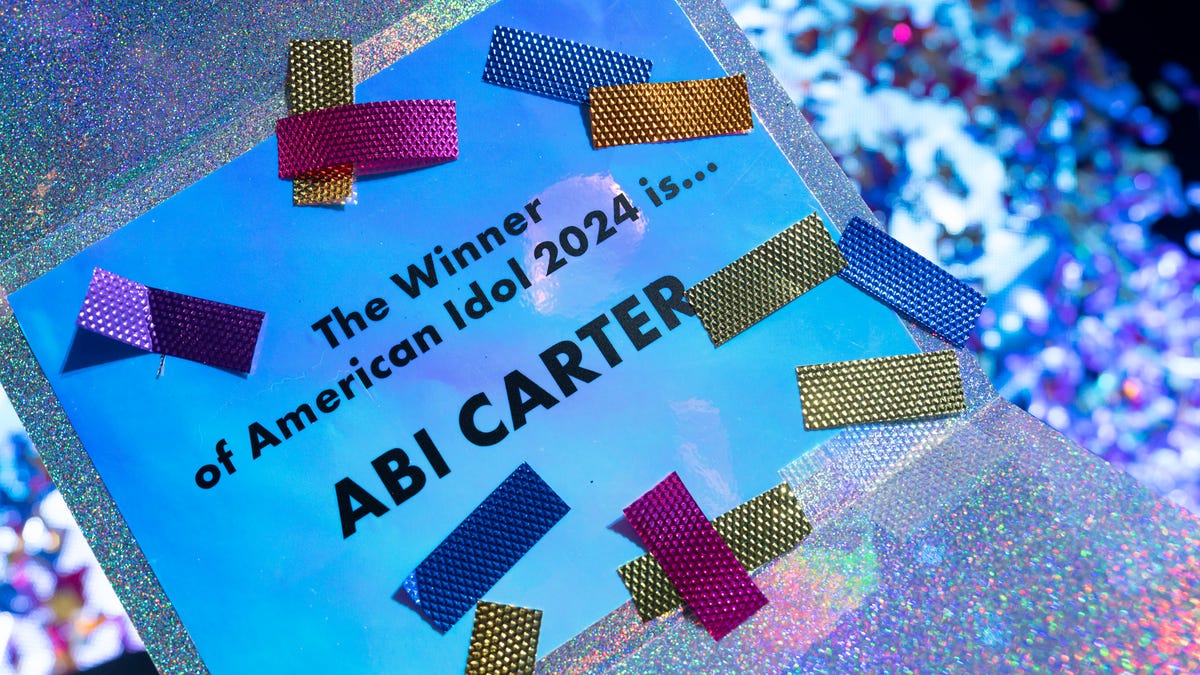

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025