Global Market Instability: The Link To Crypto Exchange Security Breaches

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Market Instability: The Link to Crypto Exchange Security Breaches

The recent turmoil in global financial markets has shone a harsh spotlight on the security vulnerabilities within the cryptocurrency exchange ecosystem. While seemingly disparate, the interconnectedness of global finance and the volatile nature of digital assets reveal a concerning correlation: market instability often exacerbates the risk of crypto exchange security breaches, leading to significant financial losses and eroded user trust.

The Perfect Storm: Market Volatility and Cybercrime

The current economic climate, characterized by high inflation, rising interest rates, and geopolitical uncertainty, creates a fertile ground for cybercriminals. When traditional markets experience volatility, investors often seek alternative assets, including cryptocurrencies. This increased activity on exchanges, coupled with potentially stretched security budgets amidst economic downturn, creates an exploitable window of opportunity for malicious actors.

Increased Targets, Diminished Resources?

During periods of market instability, cryptocurrency exchanges become increasingly attractive targets. The higher trading volumes translate to larger sums of digital assets held on exchanges, making them prime targets for sophisticated hacking attempts. Simultaneously, the economic downturn can impact the resources allocated to security by exchanges, potentially leaving them more vulnerable. This creates a dangerous feedback loop: increased value attracts attackers, while resource constraints hinder robust security measures.

Types of Breaches and Their Impact

Several types of security breaches plague crypto exchanges, each with devastating consequences:

- Hacking: Direct attacks on exchange servers to steal user funds represent the most significant threat. High-profile hacks have resulted in the loss of millions, even billions, of dollars in cryptocurrency.

- Insider Threats: Employees with access to sensitive data can exploit vulnerabilities for personal gain, leading to significant financial losses and reputational damage for the exchange.

- Phishing and Social Engineering: These attacks target users directly, tricking them into revealing their login credentials or private keys, providing attackers with direct access to their funds.

- Smart Contract Exploits: Vulnerabilities in smart contracts used by DeFi platforms integrated with exchanges can be exploited, leading to significant losses for users and the exchange itself.

The Ripple Effect: Beyond Financial Loss

The consequences of security breaches extend far beyond the immediate financial losses. They severely damage the reputation of affected exchanges, eroding user trust and potentially leading to regulatory scrutiny. This loss of confidence can further destabilize the cryptocurrency market, creating a negative feedback loop.

Mitigating the Risks: A Multi-pronged Approach

Addressing the issue requires a multi-faceted approach:

- Enhanced Security Measures: Exchanges must invest heavily in robust security infrastructure, including multi-factor authentication, cold storage solutions, and regular security audits.

- Regulatory Oversight: Stronger regulatory frameworks are needed to ensure exchanges maintain adequate security standards and are held accountable for breaches.

- User Education: Educating users about best practices for online security, including phishing awareness and secure password management, is crucial in preventing user-initiated breaches.

- Insurance and Risk Management: Implementing insurance policies and robust risk management strategies can help mitigate the financial impact of security breaches.

Conclusion: A Shared Responsibility

The link between global market instability and crypto exchange security breaches is undeniable. Mitigating this risk requires a collaborative effort from exchanges, regulators, and users. By prioritizing security, promoting transparency, and fostering a culture of responsibility, the cryptocurrency ecosystem can build greater resilience against the threats posed by both market volatility and cybercrime. The future of crypto depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Market Instability: The Link To Crypto Exchange Security Breaches. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

From Twickenham To The World Cup Englands Women Rugby Players Year Of Peaks

Apr 27, 2025

From Twickenham To The World Cup Englands Women Rugby Players Year Of Peaks

Apr 27, 2025 -

574 Million Dte Rate Hike Second Largest In History Sparking Public Outcry

Apr 27, 2025

574 Million Dte Rate Hike Second Largest In History Sparking Public Outcry

Apr 27, 2025 -

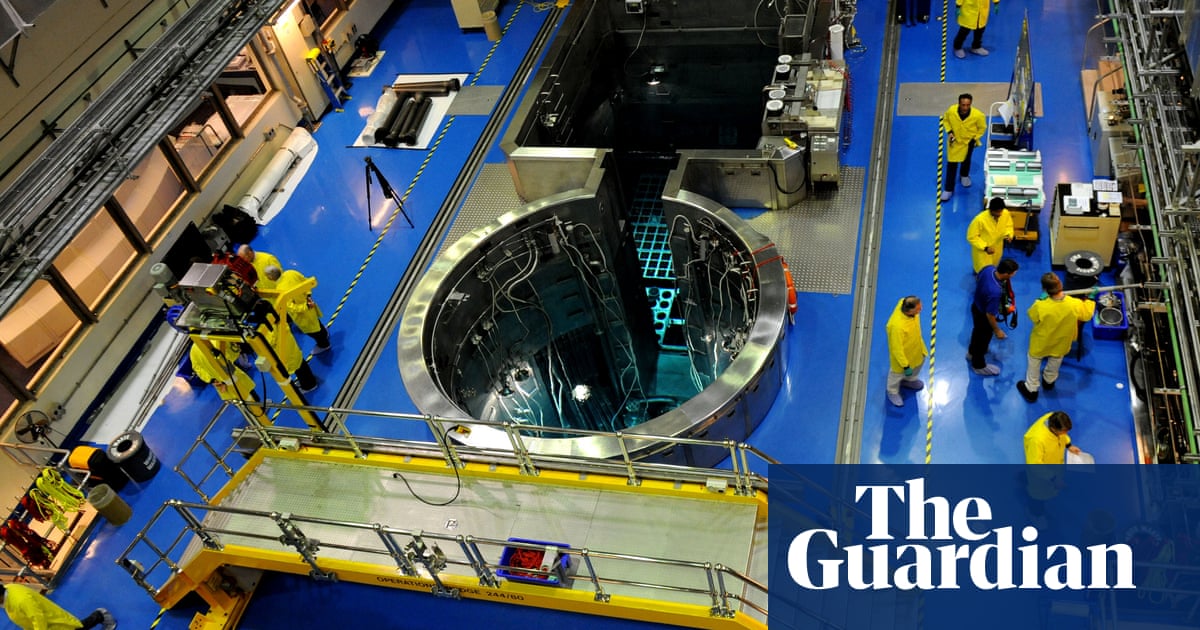

Majority Of Australians Oppose Nearby Nuclear Power Station New Survey Data

Apr 27, 2025

Majority Of Australians Oppose Nearby Nuclear Power Station New Survey Data

Apr 27, 2025 -

Inter Milan Roma Star Studded Lineup Predicted Featuring Brazilian Italian And German Talent

Apr 27, 2025

Inter Milan Roma Star Studded Lineup Predicted Featuring Brazilian Italian And German Talent

Apr 27, 2025 -

Tras El Despido De Potter Un Argentino Sera El Nuevo Dt Del Chelsea

Apr 27, 2025

Tras El Despido De Potter Un Argentino Sera El Nuevo Dt Del Chelsea

Apr 27, 2025