Global Market Vulnerability: The Expanding Reach Of Crypto Exchange Attacks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Market Vulnerability: The Expanding Reach of Crypto Exchange Attacks

The cryptocurrency market, despite its decentralized ethos, is increasingly vulnerable to sophisticated attacks targeting exchanges. These breaches, escalating in frequency and impact, pose a significant threat to global financial stability and investor confidence. The expanding reach of these attacks necessitates a deeper understanding of the vulnerabilities and the urgent need for robust security measures.

The Rising Tide of Crypto Exchange Hacks:

The past few years have witnessed a dramatic increase in the number and scale of attacks on cryptocurrency exchanges. From minor exploits targeting smaller platforms to multi-million dollar heists from major players, the threat landscape is constantly evolving. These attacks aren't just impacting individual investors; they are eroding trust in the entire crypto ecosystem and raising concerns about regulatory oversight.

Methods Employed by Attackers:

Cybercriminals utilize a range of tactics to compromise exchange security, including:

- Phishing and Social Engineering: These attacks manipulate users into revealing their login credentials or private keys. Sophisticated phishing campaigns can mimic legitimate exchange communications, making them difficult to detect.

- Exploiting Software Vulnerabilities: Weaknesses in an exchange's software or its underlying infrastructure can be exploited to gain unauthorized access. Regular security audits and prompt patching are crucial to mitigating this risk.

- Denial-of-Service (DoS) Attacks: These attacks overwhelm an exchange's servers, rendering them inaccessible and disrupting trading activities. While not directly resulting in theft, DoS attacks can cause significant financial losses and reputational damage.

- Insider Threats: Malicious insiders with privileged access can compromise security measures and facilitate theft. Robust background checks and internal controls are essential to mitigate this risk.

- Advanced Persistent Threats (APTs): State-sponsored or highly organized criminal groups deploy sophisticated techniques to breach security, often remaining undetected for extended periods.

The Impact Beyond Financial Losses:

The consequences of crypto exchange attacks extend beyond the immediate financial losses. The breaches:

- Erode Investor Confidence: Successful attacks undermine trust in the security and reliability of cryptocurrency exchanges, potentially deterring new investment and driving existing investors away.

- Damage Reputation: Exchanges targeted by attacks suffer reputational damage, impacting their ability to attract users and maintain a competitive edge.

- Fuel Regulatory Scrutiny: The increasing frequency and severity of attacks are likely to fuel stricter regulatory oversight, potentially hindering innovation and growth within the industry.

- Increase Insurance Costs: Exchanges are increasingly relying on cyber insurance to mitigate the risk of losses from attacks, driving up costs and impacting profitability.

Mitigating the Risk: A Multi-pronged Approach:

Addressing the vulnerability of crypto exchanges requires a multi-faceted approach:

- Enhanced Security Measures: Exchanges need to invest heavily in advanced security technologies, including multi-factor authentication (MFA), robust intrusion detection systems, and regular security audits.

- User Education: Educating users about phishing scams, safe password management practices, and the importance of using secure wallets is critical.

- Regulatory Collaboration: International cooperation and standardized regulations are needed to create a more secure and transparent cryptocurrency market.

- Industry Collaboration: Sharing information about security threats and best practices among exchanges can help the entire industry improve its defenses.

The future of the cryptocurrency market hinges on the ability of exchanges to effectively address these vulnerabilities. Ignoring the growing threat of attacks is not an option; proactive and comprehensive security measures are essential to protecting investors, maintaining market stability, and ensuring the long-term viability of the cryptocurrency ecosystem.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Market Vulnerability: The Expanding Reach Of Crypto Exchange Attacks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wordle April 26th 1407 Clues Answer And Gameplay Help

Apr 28, 2025

Wordle April 26th 1407 Clues Answer And Gameplay Help

Apr 28, 2025 -

Unforeseen Outcome Canadas Election Delivers A Shock Result

Apr 28, 2025

Unforeseen Outcome Canadas Election Delivers A Shock Result

Apr 28, 2025 -

Armenia Strengthens Border Security Increased Border Guard Presence Announced

Apr 28, 2025

Armenia Strengthens Border Security Increased Border Guard Presence Announced

Apr 28, 2025 -

Premier League And Fa Cup Odds Jones Knows 6 1 Treble And Liverpool Predictions

Apr 28, 2025

Premier League And Fa Cup Odds Jones Knows 6 1 Treble And Liverpool Predictions

Apr 28, 2025 -

Review Clair Obscur Expedition 33 Does It Deliver On Its Promise

Apr 28, 2025

Review Clair Obscur Expedition 33 Does It Deliver On Its Promise

Apr 28, 2025

Latest Posts

-

The Epic Games Store Mobile Launch A Critical Evaluation

Apr 29, 2025

The Epic Games Store Mobile Launch A Critical Evaluation

Apr 29, 2025 -

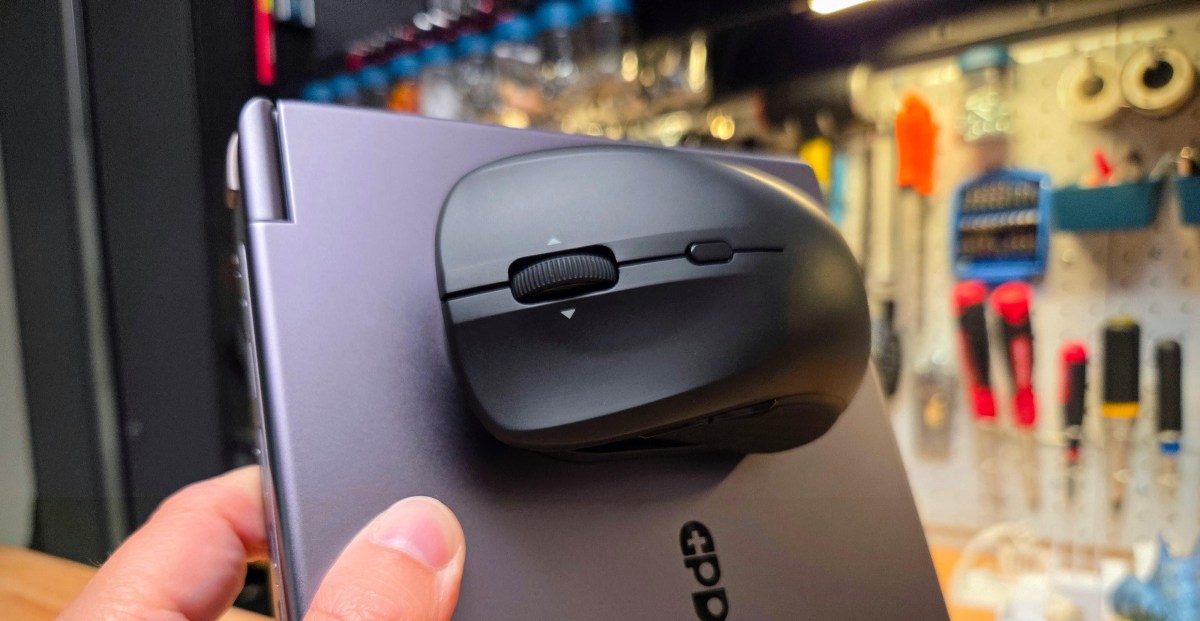

My Experience With A Magnetic Mouse And Its Unique Folding Usb C Cable

Apr 29, 2025

My Experience With A Magnetic Mouse And Its Unique Folding Usb C Cable

Apr 29, 2025 -

Greves Do Setor Publico Um Impacto Economico Desastroso No Brasil

Apr 29, 2025

Greves Do Setor Publico Um Impacto Economico Desastroso No Brasil

Apr 29, 2025 -

Qantas International Flight Sale 499 Deals Available Now

Apr 29, 2025

Qantas International Flight Sale 499 Deals Available Now

Apr 29, 2025 -

Stream The 2025 World Snooker Championship Ronnie O Sullivan Judd Trump And Key Matches Live

Apr 29, 2025

Stream The 2025 World Snooker Championship Ronnie O Sullivan Judd Trump And Key Matches Live

Apr 29, 2025