Global Markets React To Renewed India-Pakistan Border Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Markets React to Renewed India-Pakistan Border Tensions

Escalating tensions along the India-Pakistan border have sent ripples through global financial markets, sparking concerns about regional stability and potential disruptions to trade and investment. The recent surge in cross-border shelling and heightened military activity has reignited anxieties about a potential wider conflict, impacting investor sentiment and commodity prices.

The escalating situation follows months of relative calm and comes at a time when global markets are already grappling with numerous challenges, including rising inflation and geopolitical uncertainty. This renewed instability adds another layer of complexity, prompting investors to reassess their risk appetite.

<h3>Impact on Financial Markets</h3>

The immediate impact has been felt in several key areas:

-

Currency Markets: The Indian Rupee and Pakistani Rupee have both experienced significant volatility against major currencies like the US dollar. Uncertainty surrounding the future trajectory of the conflict has led to capital flight, weakening both currencies. This volatility poses challenges for businesses engaging in cross-border trade and investment between the two nations.

-

Stock Markets: Stock markets in both India and Pakistan experienced declines following the renewed border tensions. Investor sentiment turned cautious, with investors opting to move towards safer assets. Regional markets, particularly those with close economic ties to India and Pakistan, also saw some negative impact, reflecting a broader concern about regional stability.

-

Commodity Prices: Prices of certain commodities, particularly oil, have shown upward pressure as the conflict adds to existing global supply chain disruptions. Any significant escalation could lead to further price increases, impacting global inflation and economic growth.

<h3>Geopolitical Implications and Expert Analysis</h3>

The renewed border tensions raise concerns about the potential for a wider conflict, with significant implications for regional stability and global security. Experts warn that a protracted conflict could disrupt trade routes, hinder economic growth, and potentially lead to humanitarian crises.

"The escalation of tensions between India and Pakistan is a significant concern for global markets," says Dr. Anya Sharma, a leading geopolitical analyst at the Institute for International Studies. "The potential for a wider conflict poses a substantial risk, not only to the region but also to the global economy."

Many analysts are closely monitoring the situation, emphasizing the importance of diplomatic efforts to de-escalate tensions and prevent a further deterioration of the situation. The international community has called for restraint and a return to dialogue between the two nations.

<h3>Long-Term Economic Effects</h3>

The long-term economic consequences of sustained border tensions are potentially severe. Disruptions to trade, investment, and tourism could significantly impact economic growth in both countries. Furthermore, the potential for increased military spending could divert resources away from crucial social and economic development programs.

Looking Ahead: The situation remains fluid, and the coming days and weeks will be crucial in determining the trajectory of the conflict and its impact on global markets. Continued monitoring of the situation and the responses of key stakeholders are essential for investors and policymakers alike. The international community's role in fostering dialogue and promoting peaceful resolution will be paramount in mitigating the economic fallout of these renewed tensions. The need for stable regional relationships and predictable geopolitical landscapes is more crucial now than ever for global economic stability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Markets React To Renewed India-Pakistan Border Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

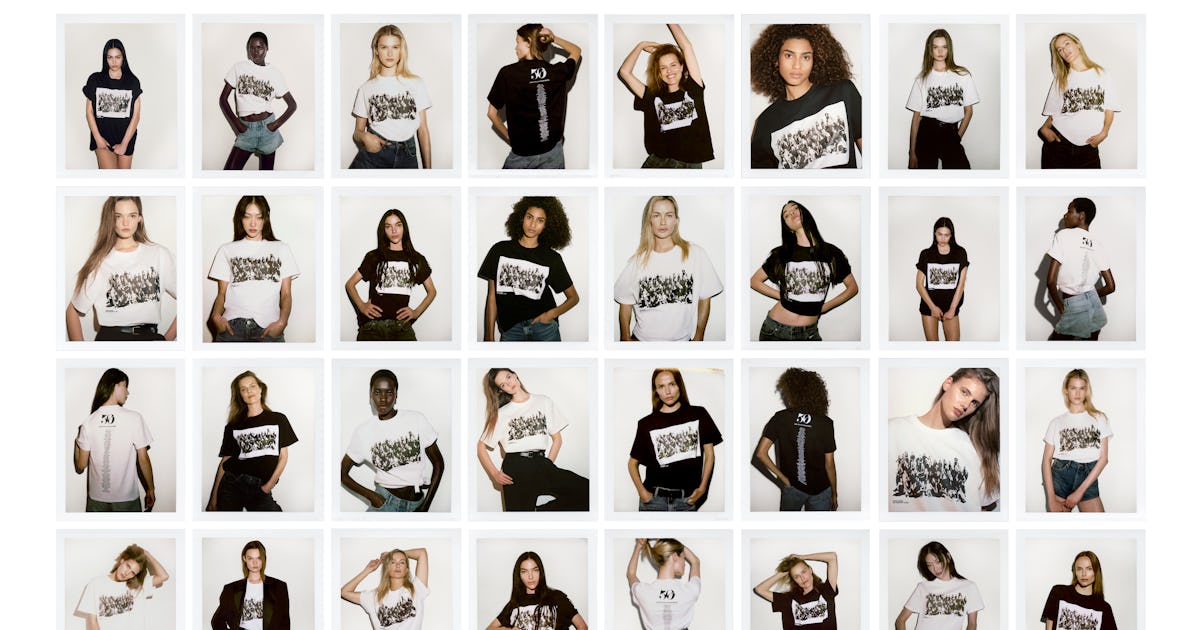

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025

Inclusion Redefined Zaras Groundbreaking Fashion Campaign

May 10, 2025 -

Figma Vs Adobe Word Press And Canva How Ai Levels The Playing Field

May 10, 2025

Figma Vs Adobe Word Press And Canva How Ai Levels The Playing Field

May 10, 2025 -

Astroworld Survivors Recount The Nights Horrors

May 10, 2025

Astroworld Survivors Recount The Nights Horrors

May 10, 2025 -

Thursdays Wordle Answer Nyt Game 1419 May 8th Hints

May 10, 2025

Thursdays Wordle Answer Nyt Game 1419 May 8th Hints

May 10, 2025 -

Singapores Ocbc Confirms 2025 Targets Despite Difficult Economic Climate

May 10, 2025

Singapores Ocbc Confirms 2025 Targets Despite Difficult Economic Climate

May 10, 2025

Latest Posts

-

Rio Grande Do Sul Enfrenta Crise Apos Fortes Chuvas Balanco De 75 Mortes E Deficit De Agua E Energia

May 10, 2025

Rio Grande Do Sul Enfrenta Crise Apos Fortes Chuvas Balanco De 75 Mortes E Deficit De Agua E Energia

May 10, 2025 -

Stacks Stx Breakout Layer 2 Tokens Price Increase And Market Implications

May 10, 2025

Stacks Stx Breakout Layer 2 Tokens Price Increase And Market Implications

May 10, 2025 -

Set For Life Lottery Results Winning Numbers For May 8th

May 10, 2025

Set For Life Lottery Results Winning Numbers For May 8th

May 10, 2025 -

Julie Fragar Wins 2023 Archibald Prize Live Updates And Reaction

May 10, 2025

Julie Fragar Wins 2023 Archibald Prize Live Updates And Reaction

May 10, 2025 -

Sleep Tokens Damocles Makes History Reaching The Pinnacle Of The Hot Hard Rock Songs Chart

May 10, 2025

Sleep Tokens Damocles Makes History Reaching The Pinnacle Of The Hot Hard Rock Songs Chart

May 10, 2025