Global Oil Market Drowns In Supply: OPEC+ Decision Impacts Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Oil Market Drowns in Supply: OPEC+ Decision Impacts Prices

The global oil market is grappling with a significant supply glut, sending shockwaves through prices and prompting concerns about the future of the energy sector. The recent decision by OPEC+ to maintain its current production levels, despite growing global economic uncertainties, has exacerbated this situation, leaving analysts scrambling to predict the market's trajectory. This move, while seemingly designed to support prices, has instead highlighted the complex interplay of geopolitical factors, economic forecasts, and shifting demand patterns impacting the oil industry.

OPEC+'s Production Freeze: A Double-Edged Sword?

The Organization of the Petroleum Exporting Countries and its allies (OPEC+), a powerful cartel controlling a significant portion of global oil production, recently opted to keep oil production unchanged. This decision, announced amidst ongoing concerns about a potential global recession and weakening demand, surprised many analysts who anticipated a production cut to bolster prices. The rationale behind the decision remains a subject of debate, with some suggesting the group is confident in the market's ability to rebalance itself, while others point to internal disagreements and differing national interests within the OPEC+ alliance.

Global Economic Slowdown: Dampening Demand

The global economy is facing headwinds, with several major economies experiencing slower-than-expected growth. This slowdown is directly impacting oil demand, as industrial activity and transportation sectors—major consumers of oil—reduce their consumption. The International Energy Agency (IEA) recently lowered its global oil demand forecast for 2023, citing these economic concerns as a primary driver. This reduced demand, coupled with the sustained production levels from OPEC+, is contributing to the current oversupply situation.

Impact on Oil Prices: A Rollercoaster Ride

The consequences of the OPEC+ decision and weakening global demand are already visible in the oil market. Crude oil prices have experienced significant volatility in recent weeks, with prices fluctuating wildly as traders grapple with the implications of the oversupply. This price instability creates uncertainty for oil-producing nations, energy companies, and consumers alike. The long-term impact on prices remains uncertain, depending on future developments in global economic growth and geopolitical events.

Looking Ahead: Uncertainty Reigns

The future of the global oil market remains shrouded in uncertainty. While the current supply glut is putting downward pressure on prices, several factors could influence the market's trajectory. These include:

- Geopolitical instability: Ongoing conflicts and tensions in various parts of the world can disrupt oil supplies and trigger price spikes.

- Unexpected demand surges: A faster-than-anticipated global economic recovery could lead to a sudden increase in oil demand, potentially tightening the market.

- OPEC+'s future decisions: Any future changes in OPEC+'s production strategy could significantly impact oil prices.

Conclusion: Navigating the Turbulent Waters of the Oil Market

The global oil market is currently navigating turbulent waters, characterized by an oversupply of crude oil, weakening global demand, and the ongoing impact of the OPEC+'s production strategy. While the short-term outlook remains uncertain, the long-term implications for the energy sector and the global economy are significant. Careful monitoring of economic indicators, geopolitical events, and OPEC+'s future actions is crucial for navigating this complex and dynamic market. The coming months will be critical in determining the direction of oil prices and the broader impact on the global energy landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Oil Market Drowns In Supply: OPEC+ Decision Impacts Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stop Wasting Time A Practical Guide To I Phones Screen Time Feature

May 06, 2025

Stop Wasting Time A Practical Guide To I Phones Screen Time Feature

May 06, 2025 -

May 6 2025 Nba Game Nuggets Vs Thunder Live Scores And Highlights From Espn Au

May 06, 2025

May 6 2025 Nba Game Nuggets Vs Thunder Live Scores And Highlights From Espn Au

May 06, 2025 -

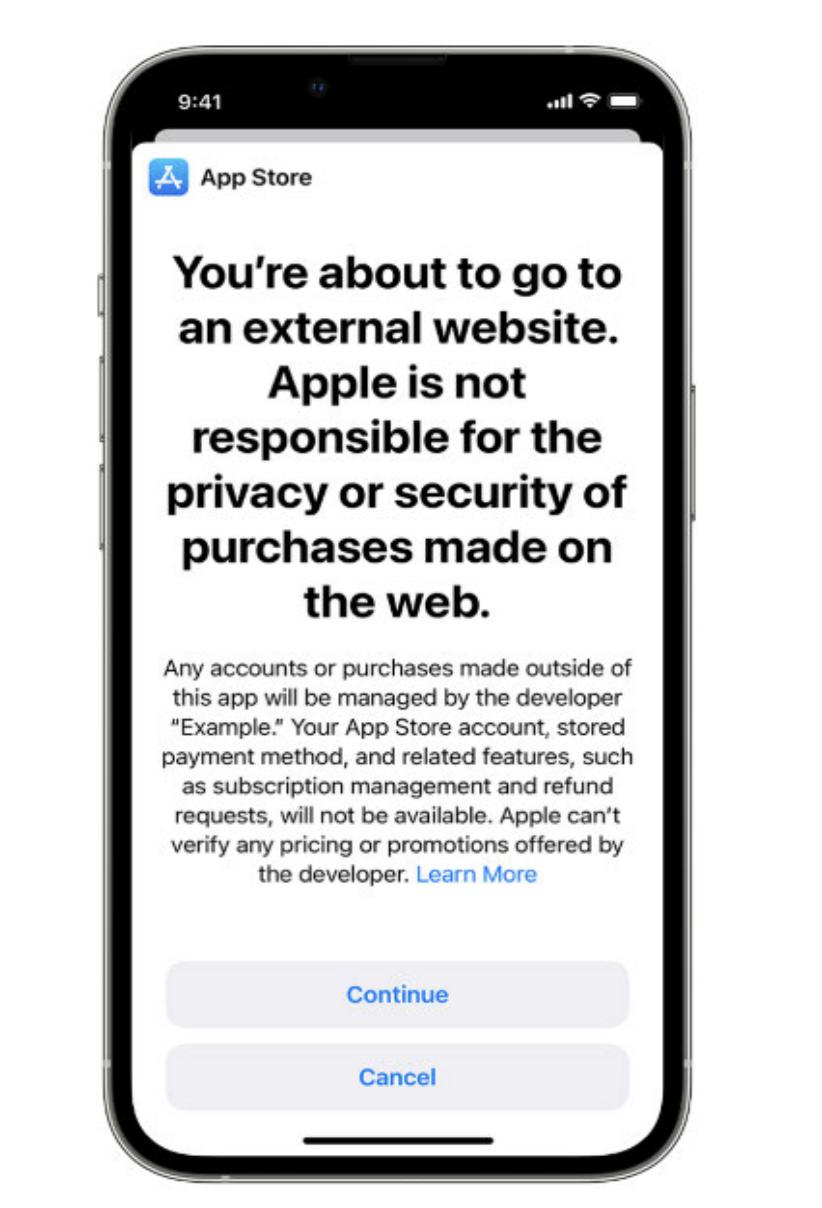

Is Apples Monopoly Over Analyzing The Impact Of Recent Legal Decisions

May 06, 2025

Is Apples Monopoly Over Analyzing The Impact Of Recent Legal Decisions

May 06, 2025 -

Senate Power Shift Pocock And Lambie Face Sidelining

May 06, 2025

Senate Power Shift Pocock And Lambie Face Sidelining

May 06, 2025 -

Persistent Issues Plague The Oklahoma City Thunder

May 06, 2025

Persistent Issues Plague The Oklahoma City Thunder

May 06, 2025

Latest Posts

-

Black Sea Conflict Ukrainian Navy Drone Successfully Targets Russian Su 30

May 06, 2025

Black Sea Conflict Ukrainian Navy Drone Successfully Targets Russian Su 30

May 06, 2025 -

Usmca And Beyond Carneys Efforts To Prevent A Canada U S Trade War

May 06, 2025

Usmca And Beyond Carneys Efforts To Prevent A Canada U S Trade War

May 06, 2025 -

Emotional Fallout Hill Opens Up About His Difficult Detroit Lions Exit

May 06, 2025

Emotional Fallout Hill Opens Up About His Difficult Detroit Lions Exit

May 06, 2025 -

Jalen Williams E T Tribute Okc Thunder Sideline Reporter Nick Gallo Honored

May 06, 2025

Jalen Williams E T Tribute Okc Thunder Sideline Reporter Nick Gallo Honored

May 06, 2025 -

Pnc Park Fall Survivor Makes First Steps A Story Of Resilience

May 06, 2025

Pnc Park Fall Survivor Makes First Steps A Story Of Resilience

May 06, 2025