Global Oil Market Oversaturated: OPEC+ Production Hike Triggers Price Crash

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Oil Market Oversaturated: OPEC+ Production Hike Triggers Price Crash

The global oil market is reeling from a dramatic price crash, triggered by a surprise decision from OPEC+ to significantly increase its oil production. This move has sent shockwaves through the energy sector, leaving analysts scrambling to assess the long-term implications for producers, consumers, and the global economy. Crude oil prices plummeted to their lowest point in months, raising concerns about potential instability and further economic uncertainty.

OPEC+'s Bold Move and its Immediate Impact

The Organization of the Petroleum Exporting Countries and its allies (OPEC+) announced a substantial increase in oil production quotas, exceeding market expectations by a considerable margin. This unexpected hike flooded the market with crude oil, overwhelming existing demand and creating a significant supply glut. The immediate consequence was a sharp and swift decline in oil prices, impacting both benchmark Brent and WTI crude. Many analysts had predicted a more gradual increase, leading to widespread surprise and subsequent market volatility.

Factors Contributing to the Oversupply

Several factors beyond OPEC+'s decision contributed to the current oil market oversaturation. These include:

- Slower-than-expected global economic growth: Concerns about a potential global recession have dampened demand for oil, contributing to the existing surplus.

- Increased efficiency in oil consumption: Technological advancements and a global push for energy efficiency have led to a reduction in overall oil demand.

- The rise of renewable energy sources: The increasing adoption of solar, wind, and other renewable energy sources is gradually reducing the reliance on fossil fuels, including oil.

- Strategic oil reserves releases: Governments around the world have released oil from their strategic reserves in an attempt to stabilize prices, further adding to the supply glut.

Implications for the Energy Sector and Global Economy

The current oversupply has significant implications for the energy sector and the broader global economy:

- Lower oil prices for consumers: While beneficial in the short term for consumers, persistently low oil prices can hurt oil-producing nations' economies, impacting their budgets and investment capacities.

- Challenges for oil producers: Oil companies are facing reduced revenues and profit margins, potentially leading to job losses and reduced investment in exploration and production.

- Geopolitical instability: The price crash could exacerbate geopolitical tensions, especially in oil-producing regions heavily reliant on oil revenues.

- Uncertainty in investment decisions: The volatile oil market creates uncertainty for investors, making it difficult to predict future returns and impacting investment decisions in the energy sector.

Looking Ahead: Market Predictions and Uncertainty

Predicting the future trajectory of oil prices remains challenging. Analysts are divided on whether the current oversupply is temporary or marks a longer-term shift in the global oil market. Some believe that demand will eventually catch up with supply, leading to a price recovery. Others warn that the oversupply could persist for an extended period, potentially leading to further price declines. The impact of geopolitical events, economic growth, and the ongoing energy transition will all play crucial roles in shaping the future of the global oil market. The coming months will be critical in determining the long-term consequences of this significant market shift and the strategies oil producers and consumers will adopt to navigate the uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Oil Market Oversaturated: OPEC+ Production Hike Triggers Price Crash. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

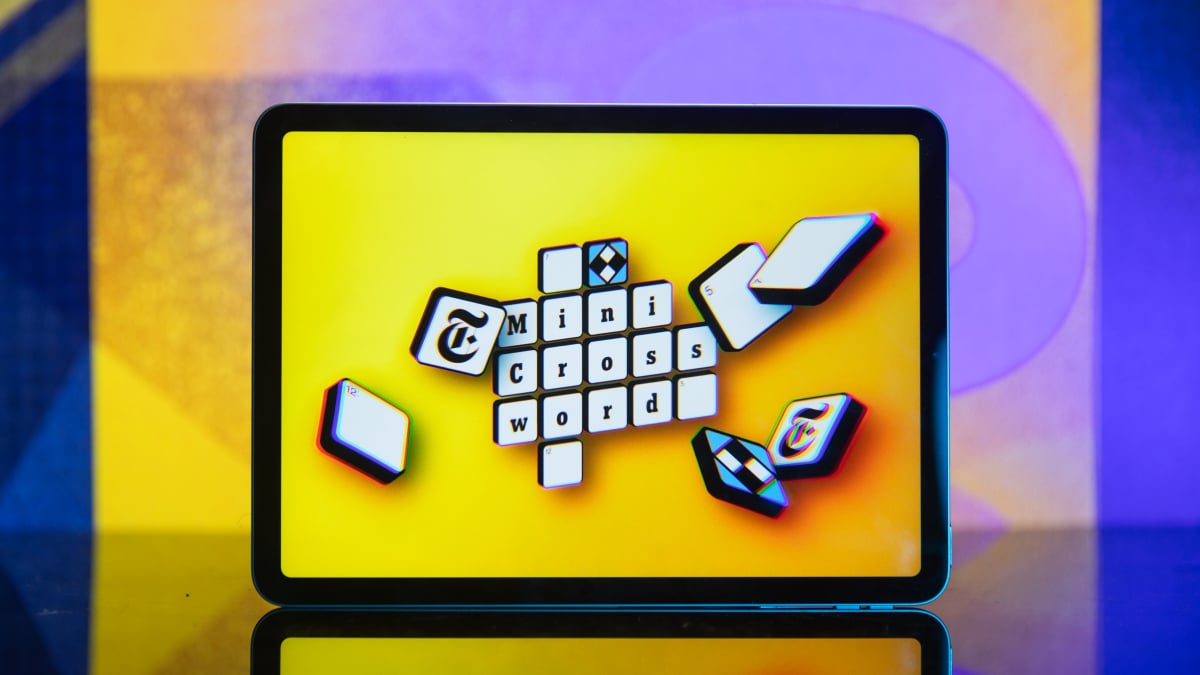

Solve The Nyt Mini Crossword May 6 2025 Hints And Answers

May 07, 2025

Solve The Nyt Mini Crossword May 6 2025 Hints And Answers

May 07, 2025 -

Jrue Holiday Injury Update Will He Play In Celtics First Round Matchup

May 07, 2025

Jrue Holiday Injury Update Will He Play In Celtics First Round Matchup

May 07, 2025 -

Beckham Praises Lamine Yamal After Barcelona Match

May 07, 2025

Beckham Praises Lamine Yamal After Barcelona Match

May 07, 2025 -

Rockets Game 7 Loss Lessons Learned And Path Forward

May 07, 2025

Rockets Game 7 Loss Lessons Learned And Path Forward

May 07, 2025 -

Exploring The Haute Scene Final Archive Entries

May 07, 2025

Exploring The Haute Scene Final Archive Entries

May 07, 2025

Latest Posts

-

Is Fart Coins Bounce A Sign Of A Bullish Trend Analyzing Key Support

May 07, 2025

Is Fart Coins Bounce A Sign Of A Bullish Trend Analyzing Key Support

May 07, 2025 -

Di Mens Lacrosse Stats Ranking The All Time Leading Goal Scorers

May 07, 2025

Di Mens Lacrosse Stats Ranking The All Time Leading Goal Scorers

May 07, 2025 -

First Look The Standout Apple Watch Band For Pride 2025

May 07, 2025

First Look The Standout Apple Watch Band For Pride 2025

May 07, 2025 -

Minnesota Timberwolves Soar After Julius Randles Injury Revelation

May 07, 2025

Minnesota Timberwolves Soar After Julius Randles Injury Revelation

May 07, 2025 -

Indias Military Action In Pakistan Administered Kashmir A Detailed Analysis

May 07, 2025

Indias Military Action In Pakistan Administered Kashmir A Detailed Analysis

May 07, 2025