Global Oil Prices Jump Despite Unexpected OPEC Production Cuts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Oil Prices Surge Following Surprise OPEC+ Production Cuts

Global oil prices jumped significantly on Wednesday following an unexpected announcement from OPEC+ to slash oil production by a further 1.16 million barrels per day (bpd). This move, effective from May, sent shockwaves through the energy markets, with benchmark Brent crude surging above $86 a barrel and West Texas Intermediate (WTI) climbing past $82. The decision comes as a surprise to many analysts who predicted the cartel would maintain its existing production levels.

This dramatic price increase has significant implications for global economies, particularly those heavily reliant on imported oil. The ripple effects will be felt across various sectors, impacting everything from transportation and manufacturing to consumer prices. Let's delve deeper into the factors contributing to this unexpected surge.

OPEC+'s Strategic Gambit: A Deeper Dive

The OPEC+ decision, a coalition of the Organization of the Petroleum Exporting Countries (OPEC) and allied producers like Russia, was ostensibly made to support oil prices and stabilize the market. However, analysts are divided on the true motivations behind this move. Some suggest it's a response to concerns about weakening global demand, while others believe it's a strategic maneuver to increase OPEC+'s market share and leverage.

- Weakening Demand Concerns: Concerns persist about slowing economic growth in several major economies, potentially leading to decreased oil consumption. OPEC+ may be preemptively addressing this threat by reducing supply to maintain price levels.

- Geopolitical Instability: The ongoing conflict in Ukraine and related geopolitical uncertainties continue to cast a shadow over the global energy market. OPEC+ might be seeking to mitigate the impact of these volatile factors.

- Market Share Dominance: By strategically reducing production, OPEC+ could potentially increase its control over global oil prices and solidify its position as a dominant player in the energy market.

Impact on Global Economy and Consumers

The price surge will undoubtedly impact consumers worldwide. Higher oil prices often translate to increased gasoline prices at the pump, potentially exacerbating existing inflationary pressures. This could lead to reduced consumer spending and slower economic growth. Industries reliant on oil, such as transportation and manufacturing, will also feel the pinch, potentially affecting production costs and supply chains.

Here's what we can expect:

- Higher Gas Prices: Prepare for a potential increase at the gas pump in the coming weeks and months.

- Increased Inflationary Pressures: Higher energy costs will contribute to overall inflation, impacting consumer purchasing power.

- Supply Chain Disruptions: Businesses may face increased costs for transportation and logistics, potentially leading to supply chain bottlenecks.

- Economic Slowdown: The combination of higher prices and reduced consumer spending could contribute to a slowdown in global economic growth.

What Lies Ahead for Oil Prices?

Predicting future oil prices is notoriously difficult, given the complex interplay of geopolitical events, economic indicators, and OPEC+'s strategic decisions. However, analysts generally agree that the recent price jump is likely to persist in the short term. The extent and duration of the price increase will depend on various factors, including global demand, geopolitical developments, and any further actions taken by OPEC+. Close monitoring of these factors will be crucial in understanding the evolving landscape of the global oil market. The coming weeks will be critical in determining the long-term trajectory of oil prices and their impact on the global economy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Oil Prices Jump Despite Unexpected OPEC Production Cuts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

New George Pickens Trade Rumors Could The Steelers Star Be Moved

May 07, 2025

New George Pickens Trade Rumors Could The Steelers Star Be Moved

May 07, 2025 -

Amazons Off Campus Adaptation Seven New Cast Members Announced

May 07, 2025

Amazons Off Campus Adaptation Seven New Cast Members Announced

May 07, 2025 -

Reliability Check Hostinger And Site Ground Head To Head Web Hosting Comparison

May 07, 2025

Reliability Check Hostinger And Site Ground Head To Head Web Hosting Comparison

May 07, 2025 -

Laura And Jason Kenny Welcome Baby Girl Overcoming Fertility Challenges

May 07, 2025

Laura And Jason Kenny Welcome Baby Girl Overcoming Fertility Challenges

May 07, 2025 -

Nba Playoffs Shai Gilgeous Alexanders Thunder Take On Denver Nuggets

May 07, 2025

Nba Playoffs Shai Gilgeous Alexanders Thunder Take On Denver Nuggets

May 07, 2025

Latest Posts

-

Get Your 200 Summer Cost Of Living Payment Update

May 08, 2025

Get Your 200 Summer Cost Of Living Payment Update

May 08, 2025 -

Cadillac Celestiq Bespoke Electric Vehicle First Drive Impression

May 08, 2025

Cadillac Celestiq Bespoke Electric Vehicle First Drive Impression

May 08, 2025 -

Fanny Qui A Brille Sur Le Tapis Rouge De La Premiere

May 08, 2025

Fanny Qui A Brille Sur Le Tapis Rouge De La Premiere

May 08, 2025 -

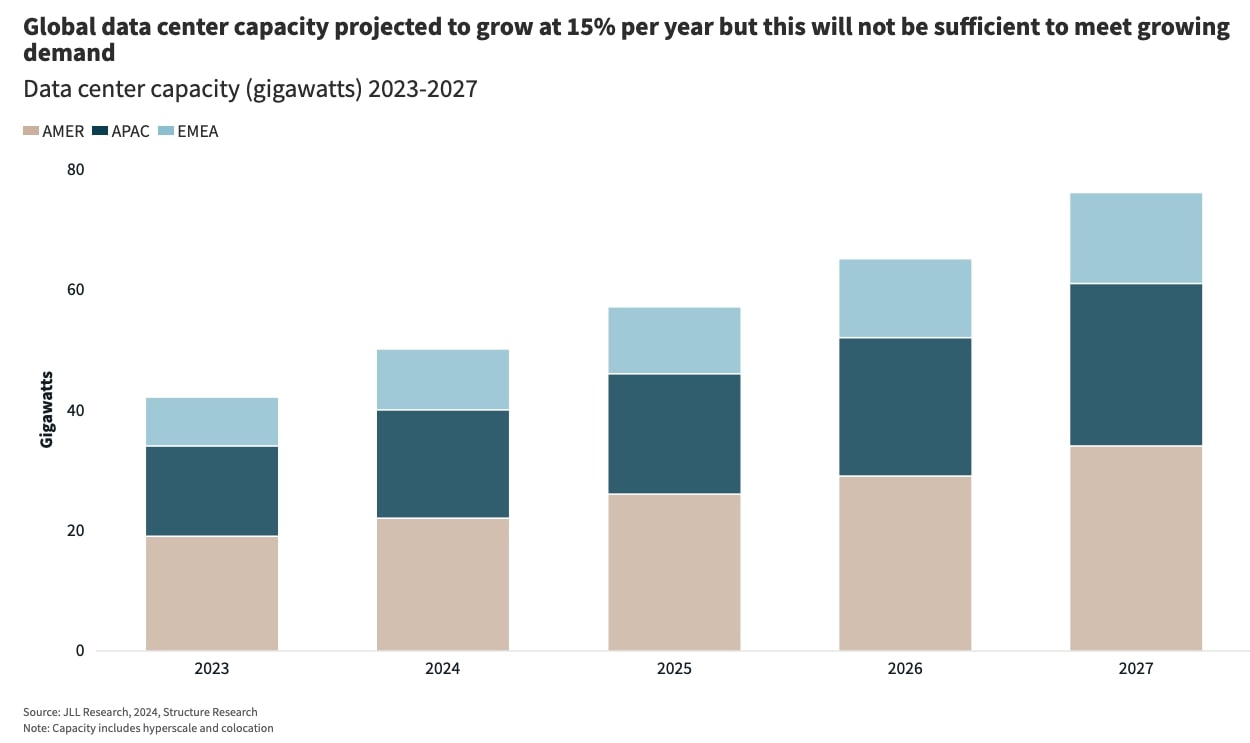

Navigating The Shifting Landscape Global Ai Data Center Market Trends

May 08, 2025

Navigating The Shifting Landscape Global Ai Data Center Market Trends

May 08, 2025 -

Amd Epyc 4005 Mini Pc A New Player In Large Scale Us Deployments

May 08, 2025

Amd Epyc 4005 Mini Pc A New Player In Large Scale Us Deployments

May 08, 2025