Global Oil Prices Jump On OPEC+ Production Cut Decision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Global Oil Prices Surge Following OPEC+ Production Cut Announcement

Global oil prices experienced a significant jump on Sunday after the OPEC+ alliance, comprising the Organization of the Petroleum Exporting Countries (OPEC) and its allies, announced a surprise production cut of 1.16 million barrels per day (bpd). This unexpected move sent shockwaves through the energy markets, leaving analysts scrambling to assess the implications for consumers and the global economy. The decision, effective in May, represents a significant tightening of global oil supply and marks a bold gamble by OPEC+ to bolster prices.

OPEC+'s Strategic Gamble: A Bold Move with Uncertain Consequences

The production cut, amounting to roughly 1% of global oil supply, is the biggest since the COVID-19 pandemic. While OPEC+ cited the need to stabilize the market and support prices as the rationale, the timing and magnitude of the cut have raised eyebrows. Many analysts believe the decision reflects a desire to counteract the impact of Western sanctions on Russian oil and to boost member states' revenues amidst global economic uncertainty. This strategic maneuver, however, carries considerable risk.

Impact on Global Oil Markets: Immediate Price Increases and Long-Term Uncertainty

The immediate impact was a sharp increase in oil prices. Benchmark Brent crude futures surged over 6%, while West Texas Intermediate (WTI) crude futures climbed by a similar margin. This price spike is expected to translate to higher gasoline prices at the pump for consumers worldwide. The long-term consequences are less clear. Some analysts predict that the cut could exacerbate existing inflationary pressures, potentially slowing down global economic growth. Others argue that the tighter supply could incentivize increased investment in renewable energy sources, accelerating the transition away from fossil fuels.

Geopolitical Implications: A Shifting Global Energy Landscape

The OPEC+ decision carries significant geopolitical implications. The move could be interpreted as a challenge to Western efforts to limit Russia's oil revenues. It also highlights the continuing influence of OPEC+ on the global energy market and underscores the need for greater energy diversification. The decision further complicates the already complex dynamics of global energy security, potentially increasing tensions between oil-producing nations and consuming countries.

What's Next? Analyzing Potential Scenarios and Market Volatility

The coming weeks and months will be crucial in determining the full impact of this decision. The market's reaction will depend on several factors, including the effectiveness of the production cut in boosting prices, the response of other oil-producing nations, and the overall trajectory of the global economy. Increased market volatility is expected, potentially leading to further price fluctuations.

- Higher Energy Costs: Consumers should prepare for increased gasoline and heating oil prices.

- Inflationary Pressures: The price hike could contribute to already elevated inflation rates globally.

- Geopolitical Tensions: The decision could exacerbate existing tensions between oil-producing and consuming nations.

- Renewable Energy Investment: The price increase could spur greater investment in renewable energy alternatives.

Conclusion: Navigating the Uncertainties of the Global Oil Market

The OPEC+ production cut represents a significant turning point in the global oil market. While aiming to stabilize prices and boost member revenues, the decision introduces considerable uncertainty and potential risks to the global economy. The coming months will be crucial in understanding the long-term ramifications of this bold strategic move. Monitoring global oil markets closely and adapting to fluctuating prices will be crucial for businesses and consumers alike. The ongoing situation necessitates a proactive approach to energy security and the acceleration of the global transition towards sustainable energy sources.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Global Oil Prices Jump On OPEC+ Production Cut Decision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Reshuffle Looms Albanese To Axe Two Ministers

May 08, 2025

Reshuffle Looms Albanese To Axe Two Ministers

May 08, 2025 -

Ikea And Sonos Collaboration Officially Ends Future Of Symfonisk Speakers

May 08, 2025

Ikea And Sonos Collaboration Officially Ends Future Of Symfonisk Speakers

May 08, 2025 -

Inflacao Ipca Copom E O Cenario Industrial Brasileiro

May 08, 2025

Inflacao Ipca Copom E O Cenario Industrial Brasileiro

May 08, 2025 -

Back Pain Solution Bryant Selects Aggressive Treatment

May 08, 2025

Back Pain Solution Bryant Selects Aggressive Treatment

May 08, 2025 -

Hyeseong Kim Recalls Joyful Encounter With Ohtani After Dodgers Game

May 08, 2025

Hyeseong Kim Recalls Joyful Encounter With Ohtani After Dodgers Game

May 08, 2025

Latest Posts

-

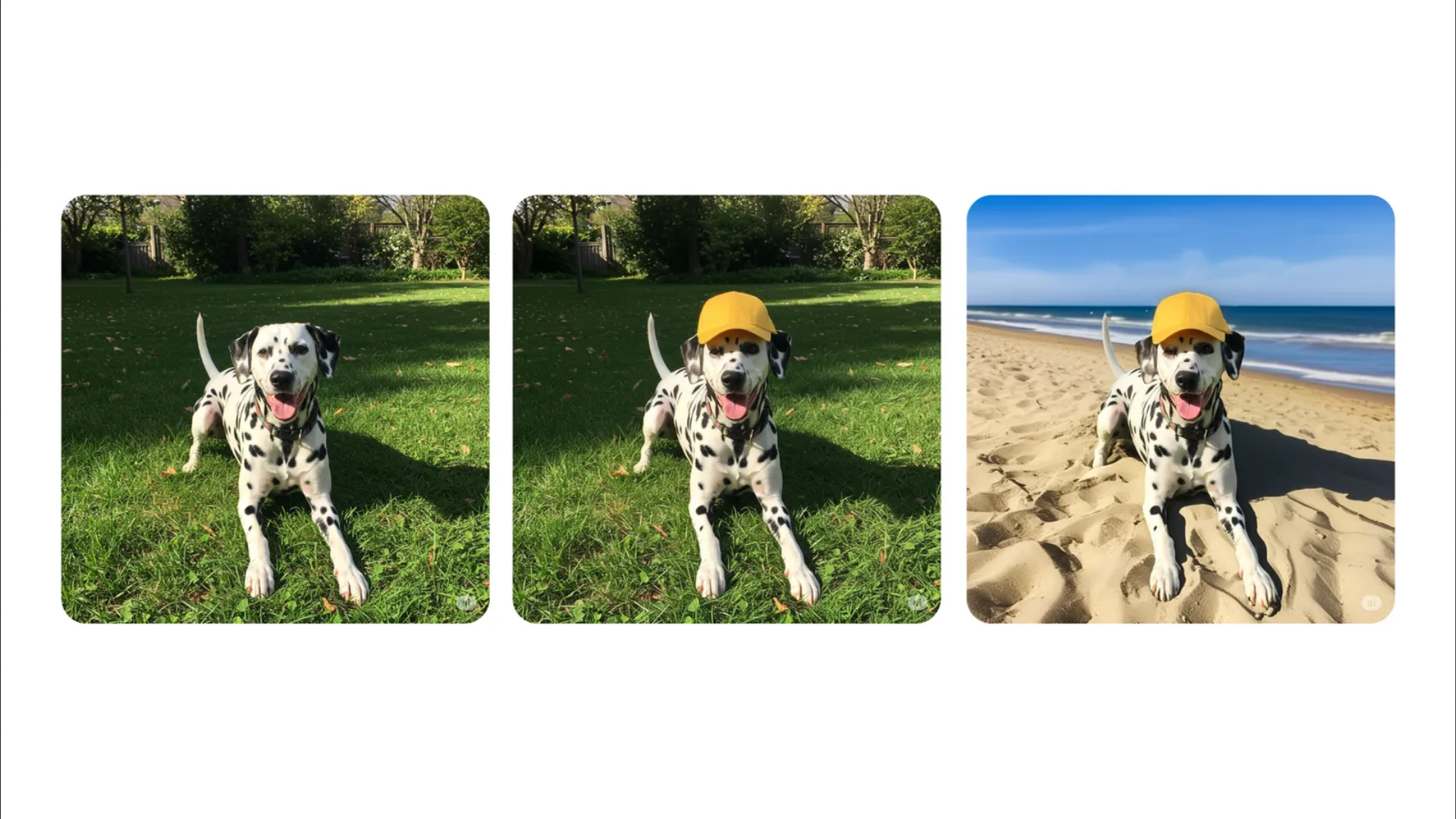

Enhanced Productivity Image Editing Now Available Directly In Gemini

May 08, 2025

Enhanced Productivity Image Editing Now Available Directly In Gemini

May 08, 2025 -

Four Years To A Million Times Better Ai Exploring The Potential Of Ai Agents

May 08, 2025

Four Years To A Million Times Better Ai Exploring The Potential Of Ai Agents

May 08, 2025 -

Playoff Preview Berubes Confidence Despite Panthers Favoritism

May 08, 2025

Playoff Preview Berubes Confidence Despite Panthers Favoritism

May 08, 2025 -

Higher Allowance Reserves Dont Derail Dbss Strong Q1 Profit Performance

May 08, 2025

Higher Allowance Reserves Dont Derail Dbss Strong Q1 Profit Performance

May 08, 2025 -

Albanese Government Faces Reshuffle Two Ministers Potentially Axed

May 08, 2025

Albanese Government Faces Reshuffle Two Ministers Potentially Axed

May 08, 2025