Going-Concern Warning Sends Wolfspeed Shares Cratering: 26% Decline As Debt Talks Intensify

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Going-Concern Warning Sends Wolfspeed Shares Cratering: 26% Decline as Debt Talks Intensify

Wolfspeed's stock plummeted 26% on Thursday after the company issued a going-concern warning, raising serious doubts about its ability to remain in business without significant restructuring. This dramatic drop followed the announcement of intensified debt negotiations, highlighting the precarious financial position of the leading silicon carbide (SiC) semiconductor manufacturer.

The going-concern warning, included in the company's latest quarterly filing, sent shockwaves through the market. It's a stark declaration that unless Wolfspeed can successfully restructure its debt and secure additional funding, it faces the very real possibility of bankruptcy. This unexpected announcement wiped billions off the company's market capitalization, underscoring investor anxiety surrounding the company's future.

<h3>What Triggered the Crisis?</h3>

Wolfspeed's financial struggles stem from a combination of factors:

- High Capital Expenditures: The company has invested heavily in expanding its SiC production capacity, a necessary step to meet growing demand in the electric vehicle and renewable energy sectors. However, these substantial capital expenditures have strained its cash flow.

- Slow Revenue Growth: Despite the long-term potential of the SiC market, Wolfspeed's revenue growth has not kept pace with its ambitious expansion plans. This mismatch between investment and returns has exacerbated its financial difficulties.

- Rising Interest Rates: The current macroeconomic environment, characterized by rising interest rates, has made it more expensive for Wolfspeed to borrow money, further complicating its financial situation.

These challenges have led to the urgent need for debt restructuring negotiations. The company is reportedly in talks with its lenders to renegotiate its existing debt obligations and secure additional financing. The outcome of these negotiations will be crucial in determining Wolfspeed's long-term survival.

<h3>The Impact on the Semiconductor Industry</h3>

Wolfspeed's predicament has broader implications for the wider semiconductor industry. The company is a key player in the development and production of SiC semiconductors, crucial components for electric vehicles, renewable energy infrastructure, and other high-growth sectors. Any significant disruption to Wolfspeed's operations could impact the supply chain and potentially delay the adoption of these critical technologies.

Analysts are closely watching the situation, speculating on various outcomes, including potential mergers and acquisitions, further debt restructuring, or even bankruptcy. The uncertainty surrounding Wolfspeed's future is causing significant volatility in the semiconductor sector.

<h3>What Happens Next?</h3>

The coming weeks will be critical for Wolfspeed. The success of its debt negotiations will directly impact its future. Investors are anxiously awaiting further updates on the company's financial situation and the progress of its restructuring efforts. A failure to reach a favorable agreement could have devastating consequences, leading to job losses and significant disruption to the semiconductor supply chain. The company's ability to navigate this crisis will be a key test of its management's strategic capabilities and its long-term viability in the competitive semiconductor market. The situation underscores the inherent risks associated with rapid expansion in a capital-intensive industry. The Wolfspeed stock price will undoubtedly remain highly sensitive to any news regarding the debt negotiations and the company's financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Going-Concern Warning Sends Wolfspeed Shares Cratering: 26% Decline As Debt Talks Intensify. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Crucial Team Change Ahead Of Bombers Crucial Clash

May 11, 2025

Crucial Team Change Ahead Of Bombers Crucial Clash

May 11, 2025 -

Tom Cruises Mission Impossible 7 Breaks Records 11 000 Advance Tickets Sold

May 11, 2025

Tom Cruises Mission Impossible 7 Breaks Records 11 000 Advance Tickets Sold

May 11, 2025 -

Belal Muhammad Vs Jack Della Maddalena Ufc 287 Live Round By Round Recap

May 11, 2025

Belal Muhammad Vs Jack Della Maddalena Ufc 287 Live Round By Round Recap

May 11, 2025 -

Thunders Game 1 Dominance Further Fuel To The Alex Caruso Trade Controversy

May 11, 2025

Thunders Game 1 Dominance Further Fuel To The Alex Caruso Trade Controversy

May 11, 2025 -

Womens Tri Nation Odi Final India Wins Toss Chooses To Bat Against Sri Lanka

May 11, 2025

Womens Tri Nation Odi Final India Wins Toss Chooses To Bat Against Sri Lanka

May 11, 2025

Latest Posts

-

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025

Overseas Filipinos Embrace Internet Voting A Boost In Voter Turnout

May 12, 2025 -

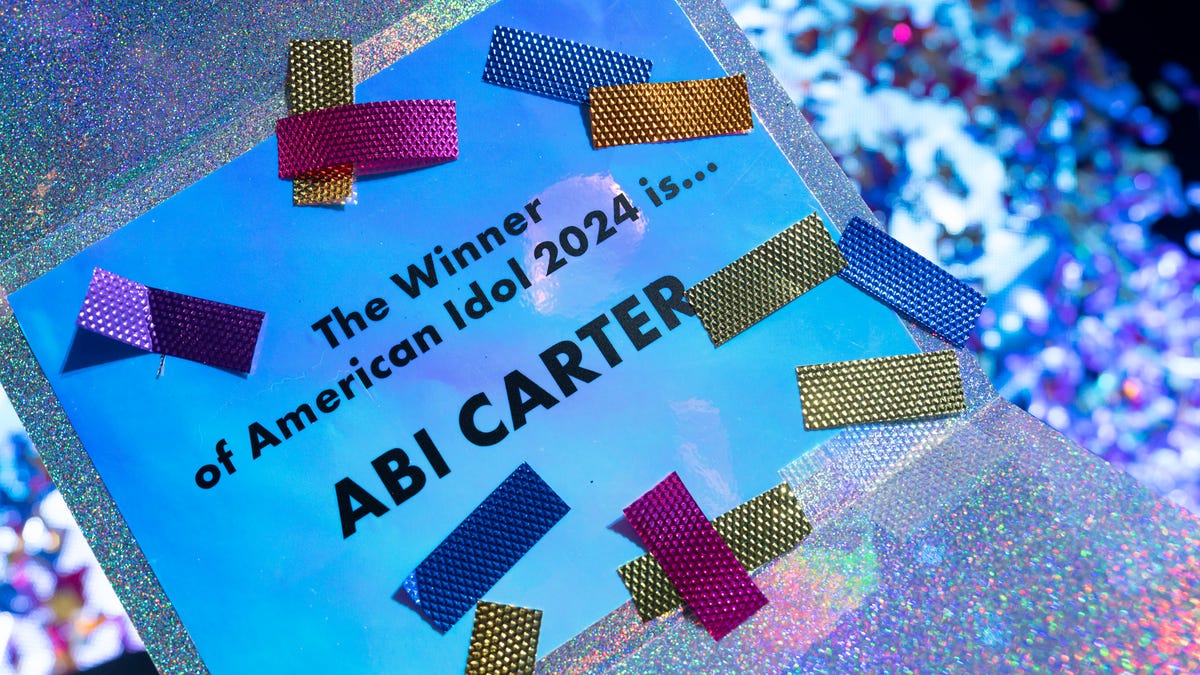

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025

American Idol 2024 Top 7 Performers When And Where To Watch

May 12, 2025 -

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025

Dylan Field On Ai Figmas Strategic Shift And Future Plans

May 12, 2025 -

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025

May 11 2025 Nba Game Oklahoma City Vs Denver Highlights And Analysis

May 12, 2025 -

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025

Nuggets Force Overtime Defeat Thunder In Game 3 To Take 2 1 Series Lead

May 12, 2025