Gold Market Analysis: Bulls And Bears Clash On Future Price Direction

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Market Analysis: Bulls and Bears Clash on Future Price Direction

Gold, the perennial safe haven asset, finds itself at a crossroads. Recent price fluctuations have ignited a fierce debate among market analysts, pitting bullish investors against their bearish counterparts. The question on everyone's mind: where will gold prices head next? This analysis delves into the conflicting predictions and explores the key factors driving this uncertainty.

The Bullish Case: Inflationary Pressures and Geopolitical Uncertainty

Bulls remain optimistic about gold's future, citing persistent inflationary pressures and ongoing geopolitical instability as primary drivers. The argument rests on several key pillars:

-

Inflationary Hedge: With inflation remaining stubbornly high in many parts of the world, gold, traditionally viewed as an inflation hedge, continues to attract investors seeking to protect their purchasing power. Rising interest rates, while initially dampening gold's appeal, may eventually lose their effectiveness if inflation remains elevated.

-

Geopolitical Risks: The ongoing war in Ukraine, escalating tensions in the Taiwan Strait, and broader geopolitical uncertainty fuel demand for safe haven assets like gold. Investors often flock to gold during times of market volatility and economic uncertainty as a store of value.

-

Weakening Dollar: A weakening US dollar, traditionally inversely correlated with gold prices, can boost demand for the precious metal, making it more attractive to international buyers.

The Bearish Counterpoint: Rising Interest Rates and Strong Dollar

However, bears counter these arguments, highlighting the impact of rising interest rates and a relatively strong US dollar. Their perspective emphasizes:

-

Opportunity Cost: Higher interest rates increase the opportunity cost of holding non-yielding assets like gold. Investors may prefer higher-yielding investments, reducing demand for gold.

-

Strong Dollar: A stronger dollar makes gold more expensive for international buyers, potentially dampening demand.

-

Technical Analysis: Some bearish analysts point to technical indicators suggesting a potential price correction or consolidation after recent price gains. They highlight resistance levels that could hinder further price appreciation.

Analyzing the Key Factors and Predicting the Future

The gold market's future direction depends on the interplay of these conflicting forces. Several key factors will influence the price trajectory:

-

Inflation Data: Future inflation reports will be crucial in determining the trajectory of gold prices. Persistently high inflation would likely support the bullish case.

-

Geopolitical Developments: Any escalation or de-escalation of geopolitical tensions will significantly impact investor sentiment and gold demand.

-

Federal Reserve Policy: The Federal Reserve's monetary policy decisions will play a vital role. Any shift towards a more dovish stance could potentially support gold prices.

-

US Dollar Movement: Fluctuations in the US dollar's value will continue to influence gold's price.

Conclusion: Navigating the Uncertainty

The current gold market presents a complex picture, with compelling arguments on both sides of the debate. While bullish investors highlight inflation and geopolitical risks, bearish investors emphasize rising interest rates and a strong dollar. The ultimate direction of gold prices will depend on the interplay of these factors and the unfolding of global economic and geopolitical events. Investors should carefully consider these competing perspectives and diversify their portfolios accordingly to manage risk. Closely monitoring key economic indicators and geopolitical developments is crucial for navigating this uncertain market environment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Market Analysis: Bulls And Bears Clash On Future Price Direction. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

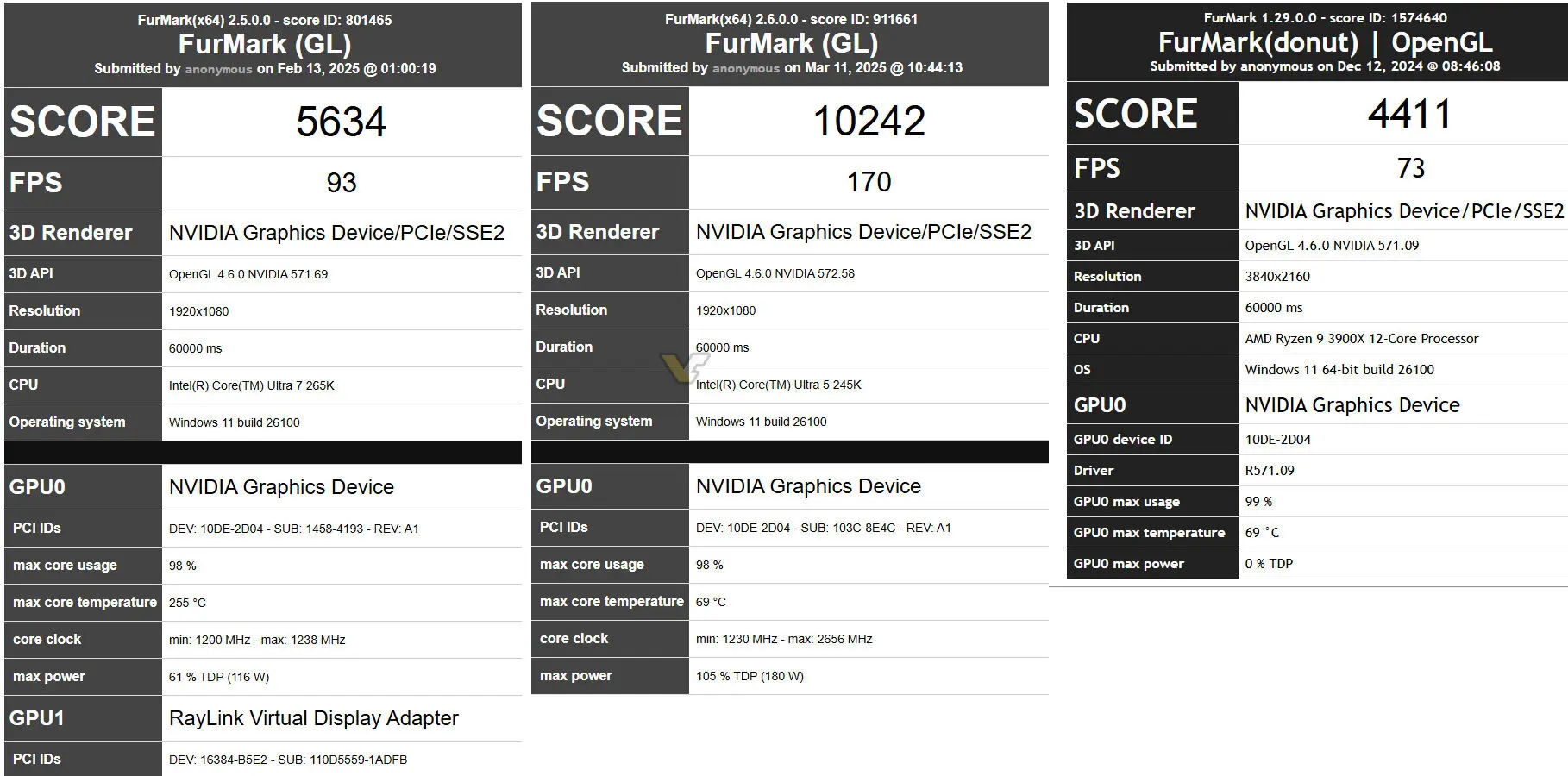

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025

Fur Mark Database Leaks Nvidia Rtx 5060 Ti Performance At 180 W Tdp

Apr 07, 2025 -

Economic Uncertainty Treasurer Signals Potential Rate Cuts Dutton Sounds Alarm

Apr 07, 2025

Economic Uncertainty Treasurer Signals Potential Rate Cuts Dutton Sounds Alarm

Apr 07, 2025 -

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025

Compartilhamento De Imoveis Como Investir Em Cotas De Casas De Praia E Campo

Apr 07, 2025 -

The Shifting Sands Of The Data Center Arms Aggressive Push Against X86

Apr 07, 2025

The Shifting Sands Of The Data Center Arms Aggressive Push Against X86

Apr 07, 2025 -

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025

When You Cant Win Take A Point Diabys Tactical Analysis Of The Al Ittihad Al Ahli Clash

Apr 07, 2025