Gold Market Correction: Will Prices Recover Or Continue To Fall?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Market Correction: Will Prices Recover or Continue to Fall?

Gold's recent price dip has investors wondering: is this a temporary correction, or the start of a longer downturn? The precious metal, often seen as a safe haven asset, has experienced a noticeable pullback in recent weeks, leaving many wondering about the future direction of gold prices. This article delves into the factors influencing this market correction and explores potential scenarios for gold's price trajectory.

Understanding the Current Gold Market Correction

The gold market, like any other market, is subject to fluctuations. Several factors are contributing to the current correction:

-

Rising Interest Rates: Increased interest rates in major economies, like the United States, make non-yielding assets like gold less attractive compared to interest-bearing investments. Higher rates boost the dollar, further impacting gold's price, which is typically inversely related to the US dollar.

-

Strong US Dollar: The strengthening US dollar makes gold more expensive for holders of other currencies, dampening global demand. This is a significant factor impacting international gold investment.

-

Inflation Concerns Easing (Slightly): While inflation remains a concern, recent economic data suggests a potential slowing of price increases. This reduces the appeal of gold as an inflation hedge, a key driver of its price historically.

-

Geopolitical Uncertainty: While geopolitical risks remain a persistent factor, the current situation hasn't significantly escalated in recent weeks, reducing some of the safe-haven demand for gold.

Will Gold Prices Recover? Analyzing Potential Scenarios

Predicting the future of gold prices is challenging, but analyzing several scenarios can provide valuable insights:

Scenario 1: A Short-Term Correction: Many analysts believe the current downturn is a temporary correction within a broader upward trend. They point to long-term factors like ongoing inflation concerns, geopolitical instability, and increasing central bank gold purchases as supporting evidence for a future price rebound. This scenario suggests a potential recovery in the coming months.

Scenario 2: A More Prolonged Downturn: A more pessimistic view suggests the current correction could extend further. This scenario is fueled by the possibility of further interest rate hikes and a sustained strong US dollar. This would likely lead to lower gold prices for a more extended period.

Factors to Watch for Future Price Movement:

-

Federal Reserve Policy: The Federal Reserve's decisions regarding interest rates will significantly influence the dollar and, consequently, gold prices. Future rate hikes or pauses will be critical indicators.

-

Inflation Data: Further inflation data releases will provide clarity on the effectiveness of monetary policy and its impact on investor sentiment towards gold. Persistent or resurgent inflation could boost demand for gold.

-

Geopolitical Developments: Escalation of geopolitical tensions or unexpected events could reignite safe-haven demand, pushing gold prices higher.

-

Central Bank Activity: Continued gold purchases by central banks globally could provide significant support for prices.

Conclusion: Navigating the Uncertainty

The gold market is dynamic and unpredictable. While the current correction presents challenges, investors should approach the situation strategically. Careful consideration of the factors mentioned above, coupled with a long-term investment perspective, is crucial for navigating this uncertainty. It's important to consult with a financial advisor before making any investment decisions. The future price of gold depends on a complex interplay of economic and geopolitical factors, making it crucial to stay informed and adapt your strategy as needed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Market Correction: Will Prices Recover Or Continue To Fall?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Don Valley Parkway Southbound Closure Multiple Collisions Cause Traffic Chaos

Apr 08, 2025

Don Valley Parkway Southbound Closure Multiple Collisions Cause Traffic Chaos

Apr 08, 2025 -

Houston Rockets 106 96 Win A Strong Statement Against Golden State

Apr 08, 2025

Houston Rockets 106 96 Win A Strong Statement Against Golden State

Apr 08, 2025 -

Rockets Upset Warriors Curry Held To Career Low 3 Points

Apr 08, 2025

Rockets Upset Warriors Curry Held To Career Low 3 Points

Apr 08, 2025 -

Lawrence Wong Slams Trumps Tariffs Questioning Us Singapore Friendship

Apr 08, 2025

Lawrence Wong Slams Trumps Tariffs Questioning Us Singapore Friendship

Apr 08, 2025 -

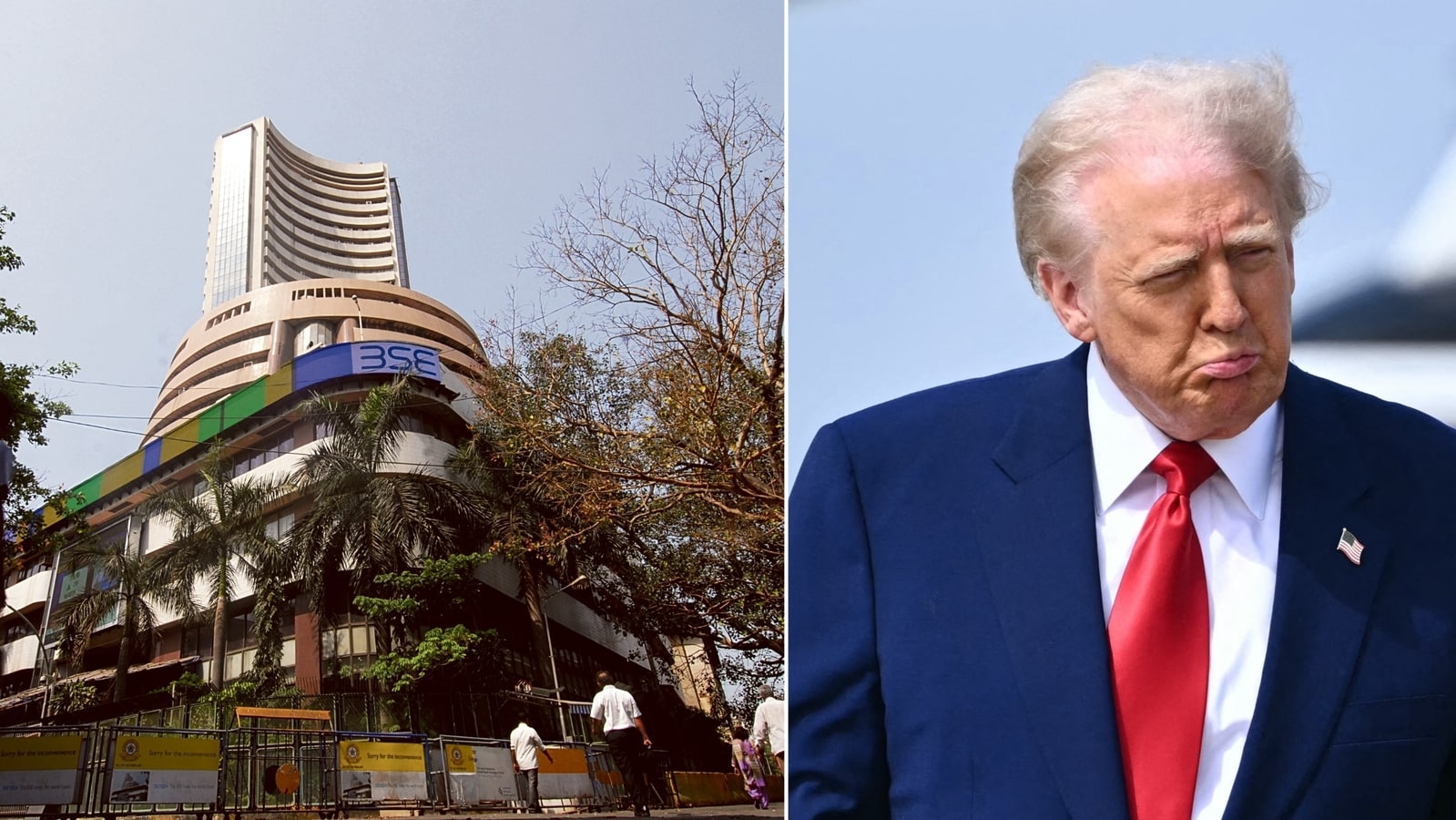

Indian Stock Market Downturn Deep Dive Into The Sensex And Niftys Recent Drop

Apr 08, 2025

Indian Stock Market Downturn Deep Dive Into The Sensex And Niftys Recent Drop

Apr 08, 2025