Gold Price Plunge: Long-Term Outlook Remains Uncertain

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Gold Price Plunge: Long-Term Outlook Remains Uncertain

Gold prices have taken a significant dive recently, leaving investors wondering about the future of this precious metal. The recent plunge has sparked considerable debate among analysts, with opinions diverging on whether this is a temporary correction or the start of a longer-term trend. Understanding the factors driving this volatility and the potential implications for investors is crucial.

What Caused the Gold Price Drop?

Several interconnected factors contributed to the recent gold price plunge. Firstly, the strengthening US dollar played a significant role. As the dollar gains strength against other currencies, gold, priced in dollars, becomes more expensive for international buyers, leading to reduced demand and lower prices. This is a classic inverse relationship often seen in the gold market.

Secondly, rising interest rates in the United States have impacted investor sentiment. Higher interest rates make bonds more attractive, diverting investment away from non-yielding assets like gold. This shift in investor preference towards higher-yielding alternatives directly impacts gold's appeal.

Furthermore, positive economic data in the US and globally has also contributed to the price decline. Stronger-than-expected economic growth often reduces the safe-haven demand for gold, which typically sees increased investment during times of economic uncertainty.

Analyzing the Long-Term Outlook: Experts Weigh In

The long-term outlook for gold remains a subject of considerable debate among market experts. While some analysts predict further price declines in the short-term, others remain bullish on gold's long-term prospects.

-

Bearish Predictions: Some analysts believe that the current trend will continue, citing persistent inflationary pressures and the Federal Reserve's commitment to interest rate hikes as major headwinds for gold prices. They argue that the current economic climate is less conducive to gold's traditional role as a safe haven.

-

Bullish Predictions: Conversely, other analysts highlight gold's enduring appeal as a hedge against inflation and geopolitical uncertainty. They point to the ongoing global economic instability and potential future crises as factors that could drive renewed demand for gold. The limited supply of gold, compared to fiat currencies, is also cited as a bullish factor in the long term.

Investment Strategies Amidst Uncertainty:

Navigating the current gold market requires a cautious and strategic approach. Investors should:

- Diversify their portfolios: Don't put all your eggs in one basket. Diversification across different asset classes is crucial to mitigate risk.

- Consider your risk tolerance: Gold is a volatile investment. Only invest an amount you are comfortable losing.

- Monitor market trends: Stay informed about macroeconomic factors that influence gold prices.

- Seek professional financial advice: Consult a financial advisor before making any significant investment decisions.

Conclusion:

The recent gold price plunge highlights the inherent volatility of this precious metal. While the short-term outlook remains uncertain, the long-term prospects for gold are a subject of ongoing debate among experts. Investors should carefully consider the various factors influencing gold prices and develop a well-informed investment strategy that aligns with their risk tolerance and long-term financial goals. The interplay between economic data, interest rates, and geopolitical events will continue to shape the future of gold investments. Staying informed and adapting your strategy as needed is key to navigating this dynamic market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Gold Price Plunge: Long-Term Outlook Remains Uncertain. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Another Ipl 2025 Fifty For Mitchell Marsh Joining The Ranks Of Kohli Warner And Gayle

Apr 08, 2025

Another Ipl 2025 Fifty For Mitchell Marsh Joining The Ranks Of Kohli Warner And Gayle

Apr 08, 2025 -

Investor Worry Netflix Stock Takes A Hit Due To New Tariffs

Apr 08, 2025

Investor Worry Netflix Stock Takes A Hit Due To New Tariffs

Apr 08, 2025 -

Incorrect Software Pricing Microsoft Issues Public Apology

Apr 08, 2025

Incorrect Software Pricing Microsoft Issues Public Apology

Apr 08, 2025 -

China Ties Singapore Tycoon Robert Ng And Family Face New Political Designation

Apr 08, 2025

China Ties Singapore Tycoon Robert Ng And Family Face New Political Designation

Apr 08, 2025 -

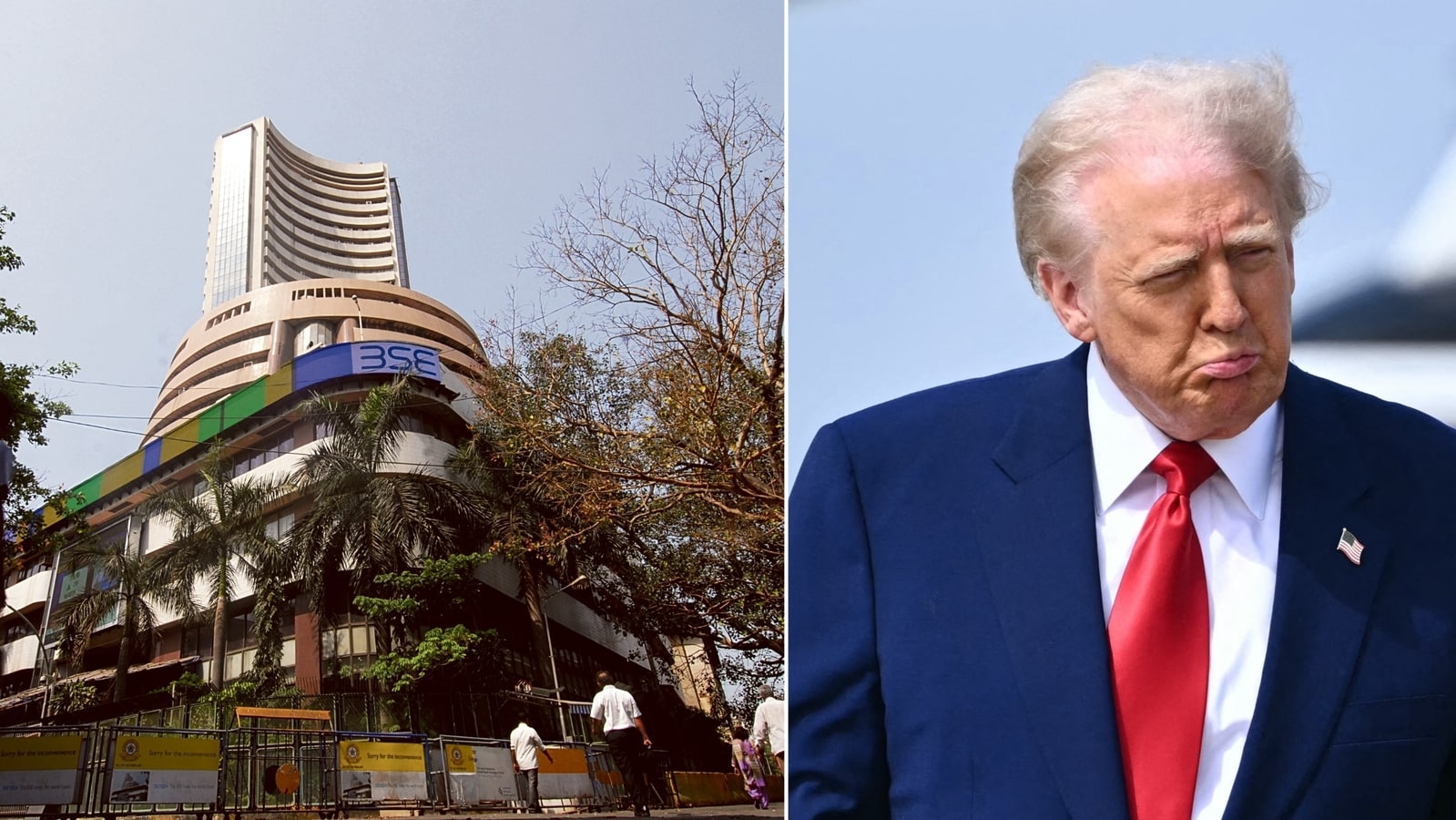

Indian Stock Market Downturn Deep Dive Into The Sensex And Niftys Recent Drop

Apr 08, 2025

Indian Stock Market Downturn Deep Dive Into The Sensex And Niftys Recent Drop

Apr 08, 2025