GST Burden: Daily Payments Vs. Semi-Annual Refunds – RDU's Philemon's GE2025 Call For Reform

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GST Burden: Daily Payments vs. Semi-Annual Refunds – RDU's Philemon Calls for Urgent Reform Ahead of GE2025

The Goods and Services Tax (GST) system, while intended to streamline taxation, is facing increasing criticism for its impact on small and medium-sized enterprises (SMEs). A significant point of contention revolves around the burden of daily GST payments versus the lengthy wait for semi-annual refunds, a situation highlighted by RDU leader, Philemon, who is calling for urgent reform ahead of the 2025 General Elections (GE2025). His impassioned plea underscores the growing frustration felt by businesses struggling under the current system.

Philemon's call to action is gaining traction amidst a chorus of complaints from businesses nationwide. The current system, they argue, creates a significant cash flow problem, especially for smaller businesses with limited capital reserves. The daily payment structure demands immediate outlay, while the delayed refund process ties up vital working capital for months, hindering growth and potentially leading to business failures.

The Core Issue: Cash Flow Crunch for SMEs

The core issue, as highlighted by Philemon and numerous business owners, is the crippling effect of the current GST structure on cash flow. Imagine the scenario: a small retailer pays GST daily on their sales, yet waits six months or more to receive refunds for GST paid on their purchases. This creates a substantial financial strain, forcing many to resort to high-interest loans or deplete their savings just to stay afloat.

- Daily GST Payments: The immediate outflow of funds puts pressure on daily operations.

- Delayed Refunds: The lengthy wait for reimbursements ties up crucial working capital.

- High Interest Costs: Businesses often resort to borrowing, incurring significant interest expenses.

Philemon's Proposed Reforms for GE2025

Philemon's proposed reforms for the GST system, which he intends to champion in the lead-up to GE2025, center around addressing this cash flow imbalance. He advocates for:

- Faster Refund Processing: Streamlining the refund application and processing procedures to significantly reduce the waiting time. He suggests exploring digitalization and automation to expedite the process.

- More Frequent Refund Cycles: Moving from semi-annual refunds to quarterly, or even monthly, cycles to improve cash flow management for SMEs.

- Increased Transparency: Implementing a more transparent and accountable system for tracking refund applications and providing regular updates to businesses.

- Targeted Support for SMEs: Introducing specific measures to support SMEs, such as interest-free loans or tax breaks during the refund waiting period.

Impact on the Economy and GE2025

The GST system's impact extends beyond individual businesses, affecting the overall economic health of the nation. The current challenges faced by SMEs could stifle entrepreneurship and hinder economic growth. Philemon's campaign to reform the GST system is not just about addressing a specific tax issue; it's about creating a more equitable and supportive business environment, a key element that will undoubtedly play a significant role in the upcoming GE2025.

Conclusion: A Call for Action Before GE2025

RDU leader Philemon's call for GST reform is a timely reminder of the urgent need to address the challenges faced by SMEs. The current system's impact on cash flow is undeniably detrimental, and the proposed reforms offer a viable path towards a more sustainable and equitable tax system. The success of these reforms will not only benefit businesses but also contribute to a healthier and more prosperous economy in the run-up to and beyond GE2025. The coming months will be crucial in seeing whether this call for change gains the necessary momentum to effect real and lasting improvement.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GST Burden: Daily Payments Vs. Semi-Annual Refunds – RDU's Philemon's GE2025 Call For Reform. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Hamiltons Retirement Teased Full Statement And Steiners Perspective

Apr 28, 2025

Hamiltons Retirement Teased Full Statement And Steiners Perspective

Apr 28, 2025 -

Country Star Eric Church Opens Up About Emotional Toll Of Post Las Vegas Shooting Opry Show

Apr 28, 2025

Country Star Eric Church Opens Up About Emotional Toll Of Post Las Vegas Shooting Opry Show

Apr 28, 2025 -

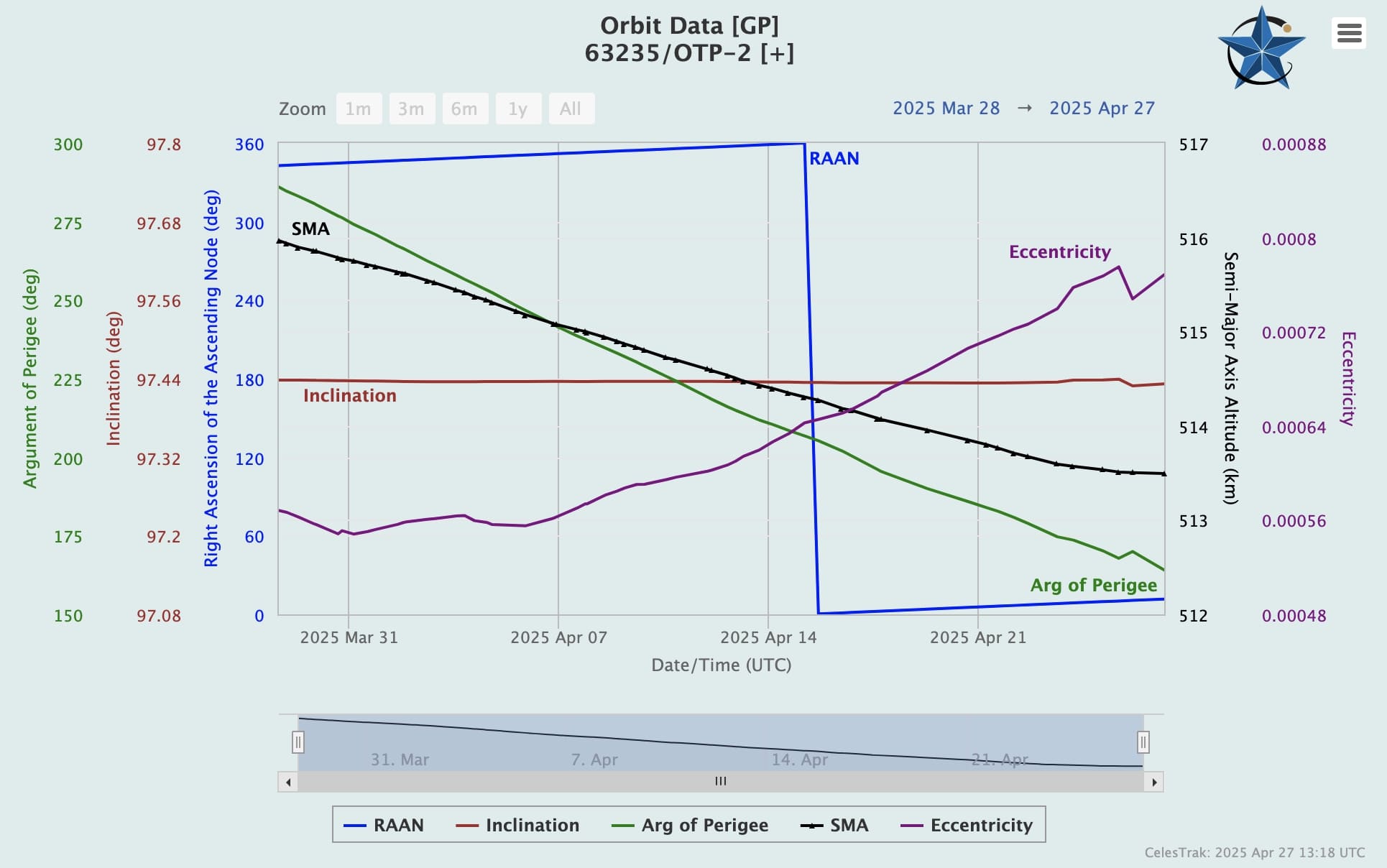

Otp 2 Propellantless Drive Continued Success And Reduced Orbital Degradation

Apr 28, 2025

Otp 2 Propellantless Drive Continued Success And Reduced Orbital Degradation

Apr 28, 2025 -

Will Bitcoin Thrive Or Crash In 2025 Analyzing The Numbers

Apr 28, 2025

Will Bitcoin Thrive Or Crash In 2025 Analyzing The Numbers

Apr 28, 2025 -

Brenda Blethyn Bids Farewell To Vera The End Of An Era

Apr 28, 2025

Brenda Blethyn Bids Farewell To Vera The End Of An Era

Apr 28, 2025

Latest Posts

-

Downtown Ottawa Shooting Rideau Centre Evacuated Lockdown In Effect

Apr 29, 2025

Downtown Ottawa Shooting Rideau Centre Evacuated Lockdown In Effect

Apr 29, 2025 -

Madden Nfl 26 Release Date Leak Sparks Fan Excitement And Speculation

Apr 29, 2025

Madden Nfl 26 Release Date Leak Sparks Fan Excitement And Speculation

Apr 29, 2025 -

From Champion To Challenger Madrid Open Players Meltdown

Apr 29, 2025

From Champion To Challenger Madrid Open Players Meltdown

Apr 29, 2025 -

Tough Conditions And Tosses Cost Pietersens Team Against Rcb

Apr 29, 2025

Tough Conditions And Tosses Cost Pietersens Team Against Rcb

Apr 29, 2025 -

Michigan Residents Face Potential 574 Million Dte Energy Rate Increase

Apr 29, 2025

Michigan Residents Face Potential 574 Million Dte Energy Rate Increase

Apr 29, 2025