GST Debate Intensifies: Government Rebuts WP's Promises

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit NewsOneSMADCSTDO now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

GST Debate Intensifies: Government Rebuts WP's Promises on Tax Relief

The ongoing debate surrounding the Goods and Services Tax (GST) has reached fever pitch, with the ruling government delivering a strong rebuttal to the opposition Workers' Party's (WP) recent promises of significant tax relief. The WP's proposals, unveiled last week, have sparked a flurry of public discussion, prompting the government to clarify its own stance and defend its current GST framework.

The core of the disagreement centers on the WP's pledge to substantially reduce the GST rate, currently at 7%, and to introduce targeted measures to alleviate the burden on lower-income households. The government, however, argues that such a drastic reduction would severely impact government revenue and jeopardize crucial social programs and infrastructure projects.

Government's Counter-Arguments:

The Finance Minister, in a press conference held earlier today, highlighted several key points in response to the WP's proposals:

-

Fiscal Sustainability: The Minister emphasized the importance of maintaining fiscal responsibility. A significant GST reduction, he argued, would create a substantial budget deficit, potentially forcing cuts to essential public services like healthcare and education. He stated that the current GST rate is carefully calibrated to balance the needs of the economy with the demands of social welfare programs.

-

Targeted Assistance vs. Broad-Based Cuts: The government defended its approach of providing targeted assistance to vulnerable groups through schemes like the GST Voucher scheme, arguing that this is a more efficient and equitable way to distribute relief than a blanket reduction in the GST rate. This allows the government to direct aid to those who need it most, instead of providing tax breaks to higher-income earners.

-

Economic Impact: The Minister warned that a sudden drop in GST revenue could negatively impact Singapore's economic stability, potentially hindering growth and investment. He stressed the need for a sustainable and responsible approach to fiscal policy.

WP's Response:

The WP has yet to formally respond to the government's rebuttal. However, party members have previously defended their proposals by emphasizing the need for greater equity and affordability for ordinary Singaporeans. They argue that the current GST framework disproportionately burdens lower-income families and that more substantial relief is necessary to address cost-of-living concerns.

Public Sentiment:

Public opinion remains divided on the issue. Online forums and social media platforms are buzzing with discussions, with citizens expressing a range of viewpoints on the merits and drawbacks of both the government's current policy and the WP's proposed changes. The debate underscores the complexities of balancing economic growth with social welfare in a high-cost-of-living environment.

Looking Ahead:

The debate is likely to continue to dominate the political landscape in the coming weeks. With general elections on the horizon, the GST issue will undoubtedly remain a central point of contention between the ruling party and the opposition. The public’s reaction to the ongoing arguments will play a significant role in shaping the future of Singapore's taxation system. Further analysis of the economic implications of both proposals is necessary to fully grasp the potential consequences of altering the current GST framework. This ongoing dialogue highlights the crucial importance of informed public discourse in shaping national policy.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on GST Debate Intensifies: Government Rebuts WP's Promises. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game Changing Homer Paul Goldschmidts 3 Run Shot

May 03, 2025

Game Changing Homer Paul Goldschmidts 3 Run Shot

May 03, 2025 -

Spotify Prepares For Apples New Rules With A Ready To Test App

May 03, 2025

Spotify Prepares For Apples New Rules With A Ready To Test App

May 03, 2025 -

Trumpisms Shadow Looms Large Before Election Day

May 03, 2025

Trumpisms Shadow Looms Large Before Election Day

May 03, 2025 -

Google Integrates Ads Into Ai Chatbot Interactions With Startups

May 03, 2025

Google Integrates Ads Into Ai Chatbot Interactions With Startups

May 03, 2025 -

Legal Win For Privacy Court Rules In Favor Of Vpn Executive Affirms No Log Commitment

May 03, 2025

Legal Win For Privacy Court Rules In Favor Of Vpn Executive Affirms No Log Commitment

May 03, 2025

Latest Posts

-

Dollar Payments Arrive On Telegram Ethena And Ton Power The New System

May 03, 2025

Dollar Payments Arrive On Telegram Ethena And Ton Power The New System

May 03, 2025 -

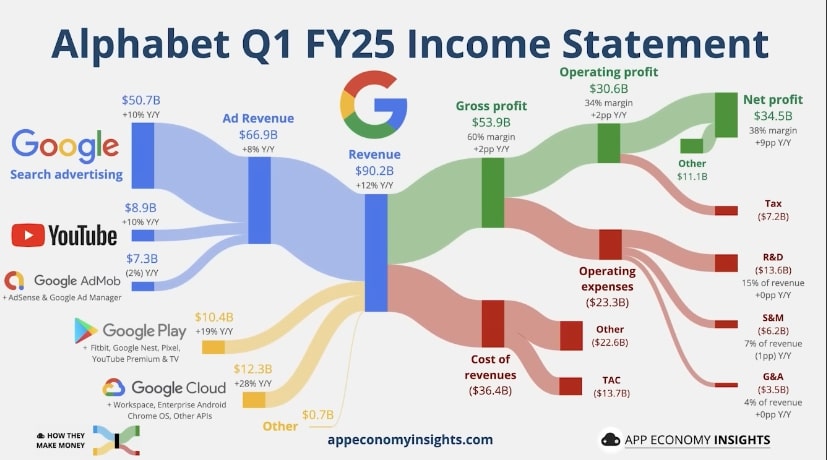

Examining Googles Financial Dominance Sustained Growth And Future Projections

May 03, 2025

Examining Googles Financial Dominance Sustained Growth And Future Projections

May 03, 2025 -

Updated College Softball Rankings Who Topped Week 12s Competition

May 03, 2025

Updated College Softball Rankings Who Topped Week 12s Competition

May 03, 2025 -

Bombshell Report Details Fettermans Marital Discord And Staffs Mental Health Doubts

May 03, 2025

Bombshell Report Details Fettermans Marital Discord And Staffs Mental Health Doubts

May 03, 2025 -

Disparities In Obesity Focusing On Minoritized Ethnic Populations

May 03, 2025

Disparities In Obesity Focusing On Minoritized Ethnic Populations

May 03, 2025